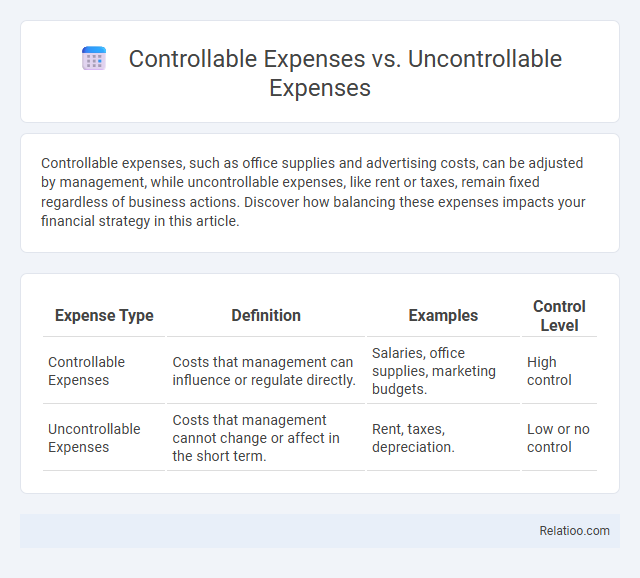

Controllable expenses, such as office supplies and advertising costs, can be adjusted by management, while uncontrollable expenses, like rent or taxes, remain fixed regardless of business actions. Discover how balancing these expenses impacts your financial strategy in this article.

Table of Comparison

| Expense Type | Definition | Examples | Control Level |

|---|---|---|---|

| Controllable Expenses | Costs that management can influence or regulate directly. | Salaries, office supplies, marketing budgets. | High control |

| Uncontrollable Expenses | Costs that management cannot change or affect in the short term. | Rent, taxes, depreciation. | Low or no control |

Understanding Controllable vs Uncontrollable Expenses

Controllable expenses refer to costs that you can influence or adjust, such as office supplies, utilities, and employee overtime. Uncontrollable expenses include fixed costs like rent, insurance, and taxes, which remain constant regardless of business decisions. Understanding controllable versus uncontrollable expenses allows your business to optimize budget management and make informed financial decisions.

Key Differences Between Controllable and Uncontrollable Expenses

Controllable expenses are costs that management can influence or regulate, such as advertising or office supplies, while uncontrollable expenses are fixed costs outside direct management control, like rent or property taxes. The key difference lies in the degree of decision-making power over these expenses; controllable expenses allow for adjustments based on operational needs, whereas uncontrollable expenses remain constant regardless of management actions. Understanding this distinction aids in effective budgeting, cost control, and financial planning processes.

Examples of Controllable Expenses

Controllable expenses are costs that you can influence or adjust, such as office supplies, marketing budgets, and employee salaries within your department. Uncontrollable expenses include fixed costs like rent, insurance premiums, and property taxes, which typically remain constant regardless of business decisions. Understanding the difference between these expenses helps you manage your budget effectively and optimize your company's financial performance.

Examples of Uncontrollable Expenses

Uncontrollable expenses are costs that cannot be easily altered or influenced by your decisions, such as rent, taxes, and insurance premiums. These differ from controllable expenses like utilities or office supplies, which you can reduce or manage more directly. Understanding the distinction between controllable and uncontrollable expenses helps you plan your budget more effectively and prioritize financial decisions.

Why Distinguishing Expense Types Matters

Distinguishing between controllable and uncontrollable expenses matters because it allows you to effectively manage your budget by focusing efforts on costs you can influence. Controllable expenses, such as marketing or office supplies, can be adjusted or minimized to improve financial performance, while uncontrollable expenses, like rent or taxes, require strategic planning to accommodate their fixed nature. Understanding these expense types enhances financial decision-making and supports more accurate forecasting and cost control.

Strategies to Manage Controllable Expenses

Controllable expenses include costs like marketing, salaries, and office supplies that management can adjust based on operational decisions, whereas uncontrollable expenses, such as rent or insurance premiums, remain fixed in the short term. Effective strategies to manage controllable expenses involve implementing budgeting controls, regular expense tracking, and negotiating supplier contracts to reduce variable costs. Employing data analytics for spending patterns and investing in employee training to enhance efficiency further optimize resource allocation and maximize profitability.

How to Forecast Uncontrollable Expenses

Uncontrollable expenses, such as rent, taxes, and insurance, are fixed costs that cannot be altered by management decisions, unlike controllable expenses that vary with operational activities. To forecast uncontrollable expenses effectively, analyze historical data trends, review contractual obligations, and factor in regulatory changes that impact these fixed costs. Your budgeting process should incorporate these projections to ensure accurate financial planning and avoid unexpected shortfalls.

Impact of Expense Types on Budgeting

Controllable expenses, such as office supplies and marketing costs, allow managers flexibility to adjust spending and optimize budget allocation, directly influencing financial performance. Uncontrollable expenses like rent and insurance are fixed costs that restrict budget adaptability, requiring careful forecasting to avoid overspending. Understanding the distinction between controllable and uncontrollable expenses is critical for effective budgeting, enabling organizations to prioritize cost control and maintain financial stability.

Mistakes to Avoid When Classifying Expenses

Misclassifying controllable and uncontrollable expenses can lead to inaccurate budgeting and financial analysis, affecting your business decisions. Avoid the common mistake of treating uncontrollable expenses, like rent or taxes, as controllable, which may create unrealistic expectations for cost reductions. Ensure clear differentiation by categorizing controllable expenses, such as marketing and supplies, separately to maintain precise cost control and operational efficiency.

Best Practices for Expense Control and Planning

Controllable expenses, such as office supplies and marketing costs, can be adjusted based on your budget and strategic priorities, while uncontrollable expenses like rent and insurance remain fixed regardless of operational changes. Best practices for expense control involve regularly reviewing controllable expenses to identify cost-saving opportunities and implementing strict approval processes for discretionary spending. Effective expense planning requires forecasting both controllable and uncontrollable costs, enabling you to allocate resources efficiently and maintain financial stability.

Infographic: Controllable Expenses vs Uncontrollable Expenses

relatioo.com

relatioo.com