Debit cards withdraw money directly from your bank account, offering immediate payment without accumulating debt. Credit cards allow borrowing up to a set limit with interest charges on unpaid balances; learn more about their key differences and benefits in this article.

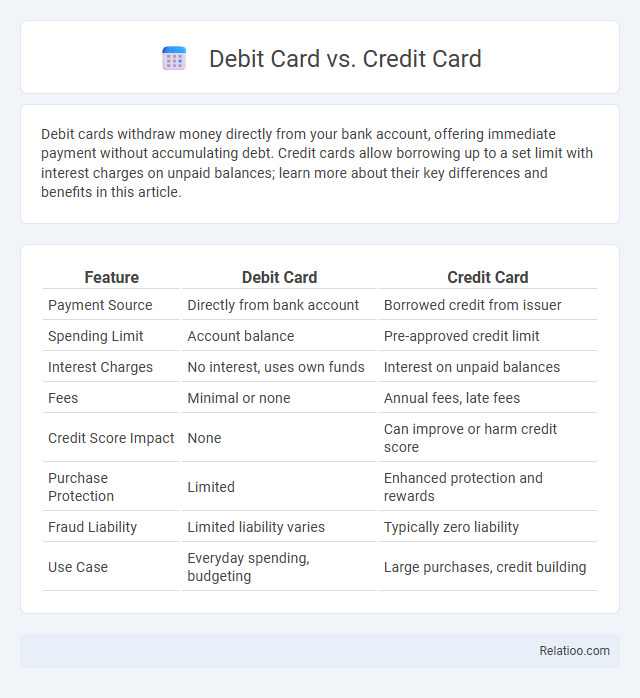

Table of Comparison

| Feature | Debit Card | Credit Card |

|---|---|---|

| Payment Source | Directly from bank account | Borrowed credit from issuer |

| Spending Limit | Account balance | Pre-approved credit limit |

| Interest Charges | No interest, uses own funds | Interest on unpaid balances |

| Fees | Minimal or none | Annual fees, late fees |

| Credit Score Impact | None | Can improve or harm credit score |

| Purchase Protection | Limited | Enhanced protection and rewards |

| Fraud Liability | Limited liability varies | Typically zero liability |

| Use Case | Everyday spending, budgeting | Large purchases, credit building |

Introduction to Debit and Credit Cards

Debit cards allow direct access to funds in a checking account, enabling instant payments without incurring debt. Credit cards offer a revolving line of credit with monthly billing statements, providing opportunities for building credit history and earning rewards. Household accounts streamline expense tracking and shared budgeting but lack the immediate transaction and credit features found in debit and credit cards.

How Debit Cards Work

Debit cards directly access funds from Your linked bank account, allowing immediate payment for purchases without borrowing money. Unlike credit cards, which provide a credit line to be repaid later, debit cards require sufficient account balance to complete transactions. Household accounts typically track shared expenses and payments among family members without direct fund access, making debit cards more practical for instant financial management.

How Credit Cards Work

Credit cards allow you to borrow money from the card issuer up to a predetermined credit limit, enabling purchases without immediate cash payment. When you use a credit card, each transaction creates a balance that you can pay off in full or over time with interest charges applied on unpaid amounts. Unlike debit cards that withdraw funds directly from your bank account or household accounts typically used for tracking shared expenses, credit cards offer flexibility and the opportunity to build your credit history.

Key Differences Between Debit and Credit Cards

Debit cards deduct funds directly from a linked checking account for purchases, providing immediate payment without incurring debt, while credit cards allow users to borrow up to a preset credit limit, requiring monthly repayments with potential interest charges. Key differences include the impact on credit score, as credit card usage and timely payments contribute to credit history, whereas debit card usage does not affect credit ratings. Household accounts typically involve shared expenses management within a family or group but do not function as individual payment methods like debit or credit cards.

Pros and Cons of Debit Cards

Debit cards offer immediate access to funds by directly debiting the linked bank account, reducing the risk of accumulating debt. They provide enhanced budgeting control and fewer fees compared to credit cards but lack benefits like credit building and fraud protection. Limited acceptance in some online and international transactions can be a drawback compared to credit cards and household accounts.

Pros and Cons of Credit Cards

Credit cards offer the advantage of building your credit score and providing a grace period on purchases, but they come with the risk of high-interest rates and potential debt accumulation if not managed carefully. Unlike debit cards, which limit spending to available funds, credit cards allow borrowing up to a preset limit, making them useful for emergencies and large purchases. Household accounts help manage shared expenses but lack the credit-building benefits and purchase protections that credit cards provide.

Security Features Comparison

Debit cards offer direct access to your bank account with PIN protection and fraud monitoring, but may expose you to higher liability if compromised. Credit cards provide enhanced security through zero liability policies, advanced encryption, and real-time transaction alerts to safeguard your purchases. Household accounts typically restrict spending to authorized members and track expenses collectively, but may lack individual fraud protection features found in debit and credit cards.

Impact on Credit Score

Using a credit card responsibly by making timely payments and maintaining a low credit utilization ratio positively impacts your credit score by demonstrating creditworthiness. Debit card usage does not affect credit scores directly because it draws funds from existing bank balances without involving credit. Household accounts, often linked to shared expenses but not involving borrowing, generally do not influence credit scores unless they incorporate credit features or result in unpaid debts reported to credit bureaus.

Choosing the Right Card for Your Lifestyle

Selecting the right payment method depends on your spending habits and financial goals. Debit cards provide direct access to funds without interest charges, ideal for budgeting and avoiding debt. Credit cards offer rewards and build credit history but require disciplined repayment to prevent high-interest debt, while household accounts can simplify shared expenses and manage family budgets efficiently.

Frequently Asked Questions (FAQs)

Debit cards deduct funds directly from a linked bank account for immediate payment, while credit cards offer a line of credit with monthly billing and interest charges on outstanding balances. Household accounts allow multiple users to share expenses and manage budgets collectively, often linked to banking services or financial apps for tracking. Common FAQs include questions about fees, interest rates, payment deadlines, overdraft protection, and how each option affects credit scores.

Infographic: Debit Card vs Credit Card

relatioo.com

relatioo.com