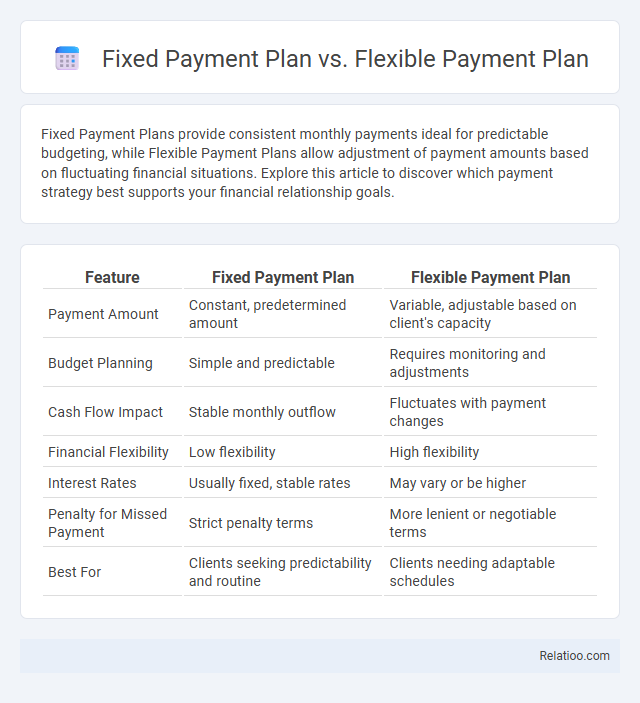

Fixed Payment Plans provide consistent monthly payments ideal for predictable budgeting, while Flexible Payment Plans allow adjustment of payment amounts based on fluctuating financial situations. Explore this article to discover which payment strategy best supports your financial relationship goals.

Table of Comparison

| Feature | Fixed Payment Plan | Flexible Payment Plan |

|---|---|---|

| Payment Amount | Constant, predetermined amount | Variable, adjustable based on client's capacity |

| Budget Planning | Simple and predictable | Requires monitoring and adjustments |

| Cash Flow Impact | Stable monthly outflow | Fluctuates with payment changes |

| Financial Flexibility | Low flexibility | High flexibility |

| Interest Rates | Usually fixed, stable rates | May vary or be higher |

| Penalty for Missed Payment | Strict penalty terms | More lenient or negotiable terms |

| Best For | Clients seeking predictability and routine | Clients needing adaptable schedules |

Introduction to Payment Plans

Payment plans are structured agreements that allow customers to pay off a balance over time, easing financial burden. Fixed payment plans require consistent, predetermined installments, providing predictability and budgeting ease. Flexible payment plans offer variable amounts or schedules, accommodating fluctuating income, while general payment plans encompass both types, tailored to meet diverse financial needs.

What is a Fixed Payment Plan?

A Fixed Payment Plan requires You to make consistent, predetermined payments over a specified period, ensuring predictable monthly costs and easier budgeting. Unlike Flexible Payment Plans that allow variable amounts or payment dates, Fixed Payment Plans maintain stability in your financial commitments. This predictability helps manage your expenses without surprises while adhering to the agreed payment schedule.

What is a Flexible Payment Plan?

A Flexible Payment Plan allows customers to adjust payment amounts and schedules based on their financial situation, offering greater adaptability compared to Fixed Payment Plans, which require consistent, predetermined payments. Unlike generic Payment Plans that may vary widely, Flexible Payment Plans provide tailored options such as variable installment amounts, payment deferrals, or extended terms, enhancing affordability and cash flow management. This approach benefits individuals or businesses facing fluctuating income or unexpected expenses by reducing financial strain and improving repayment success.

Key Differences Between Fixed and Flexible Payment Plans

Fixed payment plans require You to pay a set amount on predetermined dates, ensuring predictable budgeting and consistent cash flow management. Flexible payment plans allow adjustment of payment amounts or schedules based on Your financial situation, offering adaptability and relief during fluctuating income periods. The key difference lies in fixed plans providing stability, while flexible plans emphasize customization to meet varying payment capacities.

Pros and Cons of Fixed Payment Plans

Fixed Payment Plans offer predictable monthly payments, making budgeting easier by eliminating surprises in your financial commitments. However, their inflexibility can be a downside if your income fluctuates, as you must stick to the fixed amount regardless of your financial situation. Your best choice depends on how stable your income is and your need for financial consistency versus adaptability.

Pros and Cons of Flexible Payment Plans

Flexible Payment Plans offer the advantage of adjustable monthly installments that adapt to Your financial situation, making budgeting easier during fluctuating income periods. However, the variability may result in higher overall interest costs and less predictable total repayment timelines. Unlike Fixed Payment Plans that provide stability and Payment Plans with set terms, flexible options prioritize adaptability at the potential expense of long-term financial certainty.

Suitability: Who Should Choose Fixed Payment Plans?

Fixed Payment Plans suit individuals with predictable incomes who prefer consistent monthly payments for easier budgeting and financial stability. You benefit from fixed rates and scheduled payments, making this plan ideal for those avoiding interest rate fluctuations or unexpected cost increases. Flexible Payment Plans better fit those with variable incomes eager to adjust payments based on cash flow, while general Payment Plans offer middle-ground options for diverse financial situations.

Suitability: Who Should Choose Flexible Payment Plans?

Flexible payment plans are ideal for individuals with irregular income streams, such as freelancers or seasonal workers, who need adaptable repayment schedules to match fluctuating cash flow. Unlike fixed payment plans that require consistent monthly amounts, flexible plans allow customization in payment frequency and amounts, providing financial relief during lean periods. Your best choice depends on your income stability and preference for predictable budgeting versus payment adaptability.

Cost Implications and Budgeting Considerations

A Fixed Payment Plan offers consistent monthly payments, making budgeting straightforward and predictable, while a Flexible Payment Plan allows adjustments based on your financial situation, potentially minimizing immediate costs but requiring vigilant management to avoid higher long-term expenses. The standard Payment Plan balances these approaches, providing structured payments with some room for flexibility, which can influence your overall cost depending on interest rates and fees. Understanding these differences helps you choose a plan that aligns with your financial goals and budget constraints effectively.

Conclusion: Choosing the Right Payment Plan for Your Needs

Selecting the appropriate payment plan depends on your financial stability and spending habits. Fixed payment plans offer predictable monthly amounts, ideal for consistent budgeting, while flexible payment plans provide adaptability for fluctuating incomes or unexpected expenses. Evaluating your cash flow and financial goals ensures the chosen payment plan aligns with your needs and prevents unnecessary debt.

Infographic: Fixed Payment Plan vs Flexible Payment Plan

relatioo.com

relatioo.com