Allowance for Receivables represents an estimated amount of uncollectible accounts deducted from total receivables, while Provision for Receivables is the expense recognized to create that allowance, reflecting expected credit losses. Explore this article to understand how these accounting concepts impact financial reporting and credit risk management.

Table of Comparison

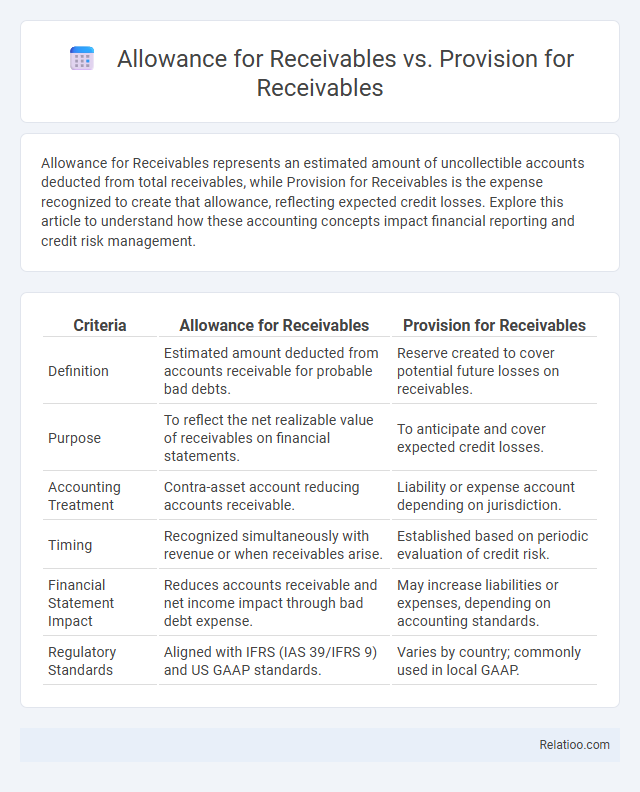

| Criteria | Allowance for Receivables | Provision for Receivables |

|---|---|---|

| Definition | Estimated amount deducted from accounts receivable for probable bad debts. | Reserve created to cover potential future losses on receivables. |

| Purpose | To reflect the net realizable value of receivables on financial statements. | To anticipate and cover expected credit losses. |

| Accounting Treatment | Contra-asset account reducing accounts receivable. | Liability or expense account depending on jurisdiction. |

| Timing | Recognized simultaneously with revenue or when receivables arise. | Established based on periodic evaluation of credit risk. |

| Financial Statement Impact | Reduces accounts receivable and net income impact through bad debt expense. | May increase liabilities or expenses, depending on accounting standards. |

| Regulatory Standards | Aligned with IFRS (IAS 39/IFRS 9) and US GAAP standards. | Varies by country; commonly used in local GAAP. |

Introduction to Receivables Management

Allowance for Receivables and Provision for Receivables are accounting terms used interchangeably to represent estimated losses from uncollectible accounts receivable, essential for accurate financial reporting. The Allowance for Receivables is a contra-asset account that reduces total accounts receivable to reflect expected credit losses, based on historical data and credit risk assessment. Effective receivables management involves consistently updating this allowance to ensure realistic valuation of assets and maintain liquidity by minimizing bad debt impact.

What is Allowance for Receivables?

Allowance for Receivables is an accounting estimate of uncollectible accounts receivable, representing the amount expected to be lost due to customer defaults. Unlike Provision for Receivables, which is a broader term encompassing all estimated losses on receivables, the Allowance specifically adjusts net receivables to reflect realistic collectible amounts. Understanding your Allowance for Receivables ensures accurate financial statements and effective credit risk management.

Definition of Provision for Receivables

Provision for receivables is a financial accounting term referring to an estimated amount set aside by a company to cover potential losses from uncollectible accounts receivable. It serves as a contra-asset account that reduces the total receivables reported on the balance sheet, reflecting more accurate net realizable value. Your understanding of how allowance for receivables and provision for receivables differ is crucial for accurate financial reporting and risk management.

Key Differences Between Allowance and Provision

Allowance for Receivables reflects an estimated amount deducted from accounts receivable to cover potential bad debts, while Provision for Receivables is a broader liability account set aside to cover expected losses on receivables. The key difference is that an allowance is a contra-asset account reducing the receivables balance directly on the balance sheet, whereas a provision is recorded as an expense or liability reflecting anticipated risk. Understanding this distinction helps you accurately manage and report credit risk in financial statements.

Purpose and Importance in Financial Reporting

Allowance for Receivables, Provision for Receivables, and Allowance represent estimated amounts set aside to cover potential losses from uncollectible accounts, ensuring accurate financial reporting. The purpose of these accounts is to present a realistic value of receivables on the balance sheet by anticipating credit risk and bad debt. Their importance lies in enhancing the reliability and transparency of financial statements, aiding stakeholders in assessing the true financial health and credit risk of a company.

Calculation Methods for Allowance for Receivables

The Allowance for Receivables is calculated using either the percentage of sales method or the aging of accounts receivable method, where a specific percentage is applied to estimated uncollectible accounts based on historical data or overdue periods. The Provision for Receivables often refers to the expense recorded to reflect this allowance, while the Allowance is the contra asset account reducing accounts receivable on the balance sheet. Understanding these calculation methods helps you accurately estimate potential losses, ensuring your financial statements reflect realistic asset values.

How Provisions for Receivables are Established

Provisions for receivables are established by assessing the estimated uncollectible amounts based on historical data, current economic conditions, and customer creditworthiness to create a realistic reserve for bad debts. Unlike a generic allowance or allowance for receivables, a provision specifically reflects anticipated losses aligned with accounting standards such as IFRS or GAAP. Your accurate calculation of provisions ensures financial statements present a true and fair view of expected cash inflows from outstanding receivables.

Impact on Financial Statements

Allowance for Receivables reduces the net accounts receivable on the balance sheet by estimating uncollectible amounts, directly impacting asset valuation and reflecting anticipated credit losses. Provision for Receivables, recorded as an expense on the income statement, recognizes potential bad debts, affecting net income and profitability. Both Allowance and Provision collectively ensure accurate financial reporting by aligning receivables with realistic collectability expectations and maintaining compliance with accounting standards like IFRS and GAAP.

Best Practices in Managing Receivables Allowances and Provisions

Best practices in managing receivables allowances and provisions emphasize accurate estimation of potential credit losses to maintain financial statement reliability. You should regularly review aging reports and historical collection data to adjust the Allowance for Receivables and Provision for Receivables, ensuring they reflect actual risk levels. Maintaining clear documentation and consistent application of accounting policies will optimize your financial risk management and compliance with accounting standards.

Conclusion: Choosing the Right Approach for Your Business

Choosing the right approach between Allowance for Receivables, Provision for Receivables, and a general Allowance depends on the specific financial reporting standards and the nature of the business's receivables. Businesses with more predictable and stable receivables may benefit from an Allowance for Receivables due to its precise estimation of bad debts, while those facing uncertain credit risks might prefer a Provision for Receivables for greater flexibility. Accurate estimation ensures improved financial statement reliability and better risk management, aligning with IFRS or GAAP requirements.

Infographic: Allowance for Receivables vs Provision for Receivables

relatioo.com

relatioo.com