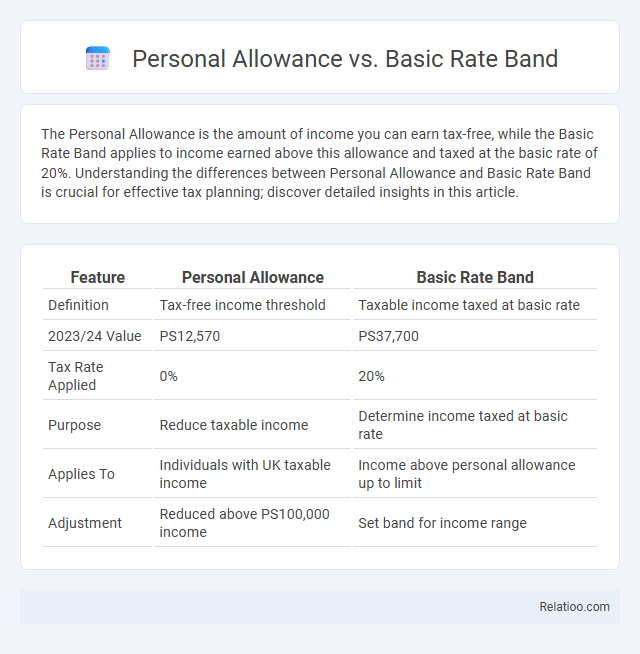

The Personal Allowance is the amount of income you can earn tax-free, while the Basic Rate Band applies to income earned above this allowance and taxed at the basic rate of 20%. Understanding the differences between Personal Allowance and Basic Rate Band is crucial for effective tax planning; discover detailed insights in this article.

Table of Comparison

| Feature | Personal Allowance | Basic Rate Band |

|---|---|---|

| Definition | Tax-free income threshold | Taxable income taxed at basic rate |

| 2023/24 Value | PS12,570 | PS37,700 |

| Tax Rate Applied | 0% | 20% |

| Purpose | Reduce taxable income | Determine income taxed at basic rate |

| Applies To | Individuals with UK taxable income | Income above personal allowance up to limit |

| Adjustment | Reduced above PS100,000 income | Set band for income range |

Understanding Personal Allowance

Personal Allowance refers to the amount of income an individual can earn tax-free each tax year, currently set at PS12,570 in the UK for 2023/24. The Basic Rate Band is the income range above the Personal Allowance taxed at the basic rate of 20%, typically extending up to PS37,700. Understanding Personal Allowance is crucial for tax planning, as income above this threshold is subject to income tax, impacting overall taxable earnings and financial decisions.

What is the Basic Rate Band?

The Basic Rate Band in the UK tax system is the range of income on which you pay the basic income tax rate of 20%, currently set between PS12,571 and PS50,270 for the 2023/24 tax year. Your Personal Allowance is the amount you can earn tax-free, typically PS12,570, which reduces your taxable income before applying the Basic Rate Band. Income above your Personal Allowance up to the Basic Rate Band limit is taxed at the basic rate, while any earnings beyond this band are subject to higher rates.

Key Differences Between Personal Allowance and Basic Rate Band

The Personal Allowance is the amount of income you can earn tax-free each year, set at PS12,570 for the 2023/24 tax year, while the Basic Rate Band defines the range of income taxed at the 20% rate, which starts after the Personal Allowance and extends up to PS37,700. The key difference lies in their functions: Personal Allowance reduces your taxable income to zero up to its limit, whereas the Basic Rate Band determines the portion of your income subject to the basic income tax rate. Understanding these distinctions helps in effective tax planning and maximizing take-home pay.

How Personal Allowance Impacts Your Taxable Income

Personal Allowance is the amount of income you can earn tax-free each year, directly reducing your taxable income and the amount of tax you owe. The Basic Rate Band determines the income range taxed at the basic rate, starting immediately after the Personal Allowance is fully used. As your earnings exceed the Personal Allowance, only the income above this threshold is taxed within the Basic Rate Band, effectively lowering your taxable income by the allowance amount.

Calculating Tax with the Basic Rate Band

Calculating tax with the Basic Rate Band involves applying a 20% tax rate to your taxable income above the Personal Allowance, which is the amount you can earn tax-free each year. The Personal Allowance reduces your gross income before the Basic Rate Band threshold is considered, ensuring you only pay tax on income exceeding this allowance. Understanding the interaction between your Personal Allowance and the Basic Rate Band helps you optimize your tax liability and accurately estimate your income tax payments.

Eligibility for Personal Allowance

Eligibility for Personal Allowance depends on an individual's income level and residency status in the UK. The Personal Allowance is the amount of income an individual can earn tax-free before paying income tax, usually set at PS12,570 for the tax year 2023/24. Basic Rate Band refers to the income range above the Personal Allowance taxed at 20%, while exceeding certain income thresholds can reduce or eliminate the Personal Allowance.

Changes to Personal Allowance and Basic Rate Band Over Time

The Personal Allowance and Basic Rate Band have undergone significant adjustments over the past decade, reflecting government efforts to manage taxation thresholds in line with inflation and economic conditions. The Personal Allowance increased from PS6,475 in 2010-11 to PS12,570 in 2023-24, reducing the tax burden on lower-income earners, while the Basic Rate Band, which defines the income taxed at 20%, has also expanded from PS37,400 to approximately PS37,700. These increments have collectively influenced the taxable income thresholds, offering greater tax relief but also requiring taxpayers to stay updated on current figures to optimize their financial planning.

Reductions and Adjustments: When Allowances Decrease

Personal Allowance gradually reduces by PS1 for every PS2 earned above PS100,000 until it reaches zero, impacting the taxable income calculation significantly. The Basic Rate Band remains fixed at PS37,700 for most taxpayers in the 2023/24 tax year but can adjust depending on individual circumstances like marriage allowance transfers or Scottish tax rates. Reduction in Personal Allowance directly increases the taxable income portion within the Basic Rate Band and higher rate thresholds, resulting in greater tax liability.

Strategies to Maximize Your Tax-Free Income

Maximize your tax-free income by fully utilizing the Personal Allowance, which currently stands at PS12,570 for the 2023/24 tax year, alongside the Basic Rate Band of PS37,700 that applies to income taxed at 20%. Strategies include transferring unused Personal Allowance through the Marriage Allowance, thereby increasing the tax-free threshold for couples, and managing income sources to optimize the use of the Basic Rate Band. Careful planning of dividends, savings, and salary can help ensure income stays within these bands, minimizing higher-rate tax liability.

Frequently Asked Questions About Personal Allowance and Basic Rate Band

Personal Allowance is the amount of income you can earn tax-free each tax year, currently set at PS12,570 in the UK, while the Basic Rate Band refers to the income range taxed at the basic rate of 20%, typically from PS12,571 to PS50,270. Frequently asked questions often address how these thresholds affect tax liability, including how Personal Allowance reduces taxable income before the Basic Rate Band applies. Understanding the interaction between Personal Allowance and Basic Rate Band helps taxpayers accurately calculate their income tax and avoid overpayment.

Infographic: Personal Allowance vs Basic Rate Band

relatioo.com

relatioo.com