Understanding the difference between needs and wants is essential for building healthy relationships, as fulfilling emotional needs fosters trust and connection while unfulfilled wants can lead to misunderstandings. Explore how prioritizing needs over wants strengthens bonds and ensures lasting harmony in this article.

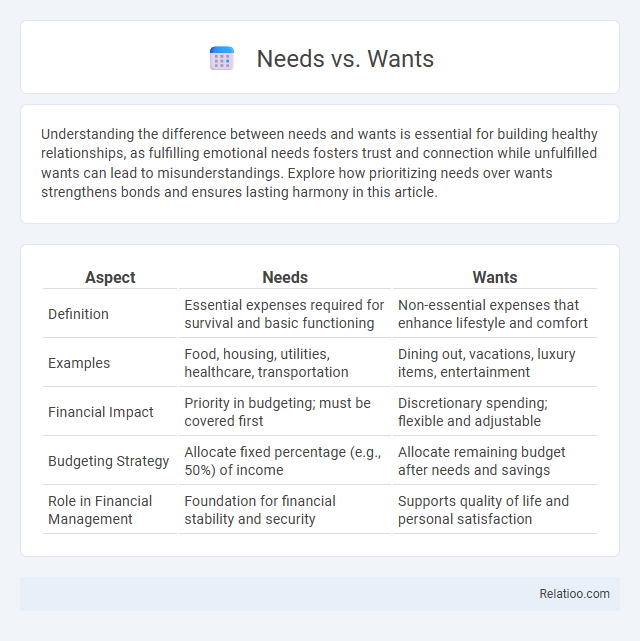

Table of Comparison

| Aspect | Needs | Wants |

|---|---|---|

| Definition | Essential expenses required for survival and basic functioning | Non-essential expenses that enhance lifestyle and comfort |

| Examples | Food, housing, utilities, healthcare, transportation | Dining out, vacations, luxury items, entertainment |

| Financial Impact | Priority in budgeting; must be covered first | Discretionary spending; flexible and adjustable |

| Budgeting Strategy | Allocate fixed percentage (e.g., 50%) of income | Allocate remaining budget after needs and savings |

| Role in Financial Management | Foundation for financial stability and security | Supports quality of life and personal satisfaction |

Understanding the Difference: Needs vs Wants

Understanding the difference between needs and wants is crucial for effective financial management. Needs are essential expenses required for basic survival, such as food, shelter, and healthcare, while wants are non-essential items that enhance your lifestyle but aren't necessary. By distinguishing your needs from your wants, you can prioritize your spending to ensure financial stability and avoid unnecessary debt.

The Psychology Behind Needs and Wants

Understanding the psychology behind needs and wants reveals how Your brain differentiates between essential survival requirements and desire-driven luxuries, influencing spending behavior. Needs trigger basic survival instincts and immediate necessity, while wants activate emotional gratification centers, often leading to impulsive purchases. Recognizing these psychological drivers helps you manage spending more effectively by prioritizing necessities and controlling emotional impulses.

Basic Human Needs: Essentials for Survival

Basic human needs such as food, water, shelter, and clothing form the foundation for survival and must be prioritized in your spending. These essentials differ from wants, which include non-essential items that enhance comfort but do not sustain life. Understanding the distinction between needs and wants helps you allocate your resources effectively, ensuring your basic needs are always met first.

Common Examples of Wants in Daily Life

Common examples of wants in daily life include dining at restaurants, purchasing the latest electronics, and choosing branded clothing over generic options. These wants often go beyond essential needs like food, shelter, and basic clothing, reflecting personal preferences and lifestyle choices. Understanding the difference between your needs and wants helps you manage spending more effectively and prioritize financial goals.

The Impact of Needs and Wants on Decision Making

Your financial decisions are heavily influenced by distinguishing between needs and wants, as needs prioritize essential expenses critical for survival such as housing, food, and healthcare, while wants represent non-essential items and experiences that enhance lifestyle but are discretionary. This distinction impacts your budgeting, as allocating resources to needs ensures stability and security, whereas overspending on wants can lead to financial strain or debt. Understanding the impact of needs versus wants helps you make informed spending choices that align with your long-term financial goals and avoid impulsive decisions.

Financial Management: Prioritizing Needs Over Wants

Effective financial management requires distinguishing needs--such as housing, food, and healthcare--from wants like luxury items or entertainment. Prioritizing essential expenses ensures financial stability, prevents debt accumulation, and supports long-term savings goals. Strategic budgeting that allocates resources first to needs helps maintain control over spending and reinforces disciplined monetary habits.

Societal Influences on Needs and Wants

Societal influences heavily shape your perception of needs versus wants by dictating trends, cultural norms, and social expectations that redefine what is considered essential or desirable. Marketing and peer pressure often blur the lines between needs and wants, encouraging consumption beyond necessity. Understanding these influences helps you make more informed financial decisions by distinguishing true needs from socially-induced desires.

Needs vs Wants in Consumer Behavior

Understanding the distinction between needs and wants is crucial in consumer behavior, as needs represent essential goods and services required for survival and basic functioning, while wants are non-essential desires shaped by individual preferences and cultural influences. Consumers prioritize spending on needs such as food, housing, and healthcare before allocating resources to wants like entertainment or luxury items, reflecting budget constraints and psychological motivations. This differentiation drives purchasing decisions, influences budgeting strategies, and shapes market demand patterns in various economic contexts.

Tips for Distinguishing Between Needs and Wants

Identify needs as essential expenses required for basic living, such as housing, utilities, and groceries, while wants are non-essential items that enhance comfort or enjoyment. Create a detailed budget categorizing expenses and analyze each purchase by asking if it supports health, safety, or basic functionality. Use time to test impulsive desires; if an item remains desirable after a waiting period, it may be a justified want rather than a need.

Striking a Balance: Achieving Satisfaction Through Wise Choices

Striking a balance between needs, wants, and spending is essential for financial satisfaction and stability. Prioritizing essential needs like housing, food, and healthcare ensures security, while allocating funds for wants enhances quality of life without compromising financial goals. Wise choices in budgeting and mindful spending empower individuals to achieve both immediate enjoyment and long-term financial well-being.

Infographic: Needs vs Wants

relatioo.com

relatioo.com