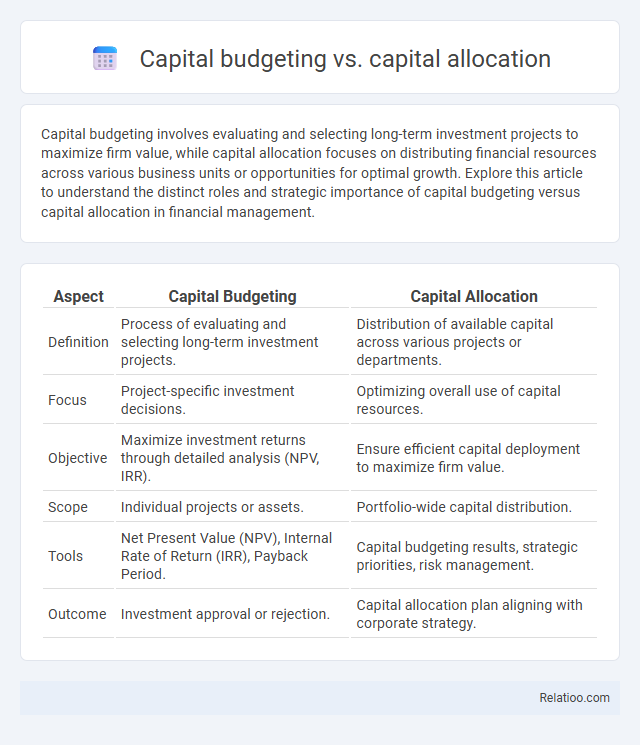

Capital budgeting involves evaluating and selecting long-term investment projects to maximize firm value, while capital allocation focuses on distributing financial resources across various business units or opportunities for optimal growth. Explore this article to understand the distinct roles and strategic importance of capital budgeting versus capital allocation in financial management.

Table of Comparison

| Aspect | Capital Budgeting | Capital Allocation |

|---|---|---|

| Definition | Process of evaluating and selecting long-term investment projects. | Distribution of available capital across various projects or departments. |

| Focus | Project-specific investment decisions. | Optimizing overall use of capital resources. |

| Objective | Maximize investment returns through detailed analysis (NPV, IRR). | Ensure efficient capital deployment to maximize firm value. |

| Scope | Individual projects or assets. | Portfolio-wide capital distribution. |

| Tools | Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period. | Capital budgeting results, strategic priorities, risk management. |

| Outcome | Investment approval or rejection. | Capital allocation plan aligning with corporate strategy. |

Introduction to Capital Budgeting and Capital Allocation

Capital budgeting involves evaluating and selecting long-term investment projects based on their potential to generate future cash flows, ensuring your business invests in profitable ventures. Capital allocation refers to the process of distributing financial resources among various projects or departments to maximize overall returns and strategic goals. Understanding capital budgeting helps you make informed decisions on which projects to fund, while capital allocation ensures efficient use of your available capital across the organization.

Defining Capital Budgeting

Capital budgeting is the process of evaluating and selecting long-term investment projects based on their potential to generate future cash flows and maximize shareholder value. It involves analyzing capital expenditure decisions using techniques like net present value (NPV), internal rate of return (IRR), and payback period to prioritize projects aligned with corporate strategic goals. While capital allocation refers to distributing financial resources across various investment opportunities, capital budgeting specifically focuses on assessing individual projects for viability and profitability within the overall allocation framework.

Understanding Capital Allocation

Capital allocation refers to the strategic process of distributing financial resources across various projects, investments, or business units to maximize returns and support organizational goals. It differs from capital budgeting, which focuses on evaluating and selecting specific long-term investment projects based on their expected cash flows and profitability. Effective capital allocation ensures optimal use of capital by balancing risk, return, and growth opportunities, driving overall corporate value and financial stability.

Key Differences Between Capital Budgeting and Capital Allocation

Capital budgeting involves evaluating potential long-term investments or projects based on their expected cash flows and profitability, while capital allocation refers to the strategic distribution of financial resources across various business units or investments to maximize overall value. Capital budgeting focuses on analyzing individual projects' feasibility and returns, whereas capital allocation encompasses the broader process of prioritizing and funding projects to align with your company's goals. Understanding these distinctions helps you optimize financial decision-making and enhance investment effectiveness.

Objectives of Capital Budgeting

Capital budgeting focuses on evaluating potential investment projects to maximize long-term shareholder value by estimating future cash flows, assessing risks, and selecting projects with the highest net present value (NPV). In contrast, capital allocation involves distributing financial resources across different business units or projects based on strategic priorities and performance metrics. The primary objective of capital budgeting is to ensure efficient resource utilization by prioritizing projects that generate sustainable returns and align with the company's growth strategy.

Goals of Capital Allocation

Capital budgeting evaluates specific projects' potential returns and risks to ensure profitable investments while capital allocation focuses on distributing financial resources across different business units or assets to maximize overall growth and value creation. The primary goal of capital allocation is to optimize the use of Your resources by prioritizing investments that align with strategic objectives, improve operational efficiency, and generate sustainable long-term returns. Effective allocation balances risk and return to support innovation, expansion, and shareholder value enhancement.

Techniques Used in Capital Budgeting

Capital budgeting primarily involves techniques such as Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, and Profitability Index to evaluate the profitability and risk of long-term investment projects. Capital allocation refers to the strategic distribution of resources across various business units or projects, often guided by capital budgeting analysis and organizational priorities. Allocation, in a broader financial context, pertains to the process of dividing available funds among different assets or departments to optimize overall returns and growth.

Strategies for Effective Capital Allocation

Effective capital allocation strategies prioritize investing in projects with the highest risk-adjusted returns, balancing short-term liquidity needs and long-term growth objectives. Capital budgeting involves detailed evaluation and selection of specific investment opportunities, while capital allocation is the broader process of distributing financial resources across various business units or asset classes. Firms implementing data-driven analysis and scenario planning enhance resource efficiency and maximize shareholder value through disciplined capital allocation frameworks.

Impact on Business Value and Growth

Capital budgeting involves evaluating and selecting long-term investment projects that maximize business value by forecasting cash flows and assessing risk, directly impacting growth through strategic capital deployment. Capital allocation extends beyond project selection by optimizing the distribution of financial resources across various business units, balancing risk and return to enhance overall organizational performance and shareholder value. Allocation, in a broader sense, includes the prioritization and management of resources such as capital, labor, and time, influencing operational efficiency and sustained growth potential.

Choosing the Right Approach for Your Organization

Capital budgeting focuses on evaluating and selecting specific long-term investment projects based on cash flow projections and risk assessments, while capital allocation involves distributing financial resources across various divisions or initiatives to maximize overall value. Allocation, in a broader sense, refers to the strategic assignment of resources, including capital, time, and personnel, tailored to your organization's priorities and goals. Choosing the right approach requires analyzing your company's financial structure, growth objectives, and market conditions to ensure optimal deployment of resources for sustained competitive advantage.

Infographic: Capital budgeting vs Capital allocation

relatioo.com

relatioo.com