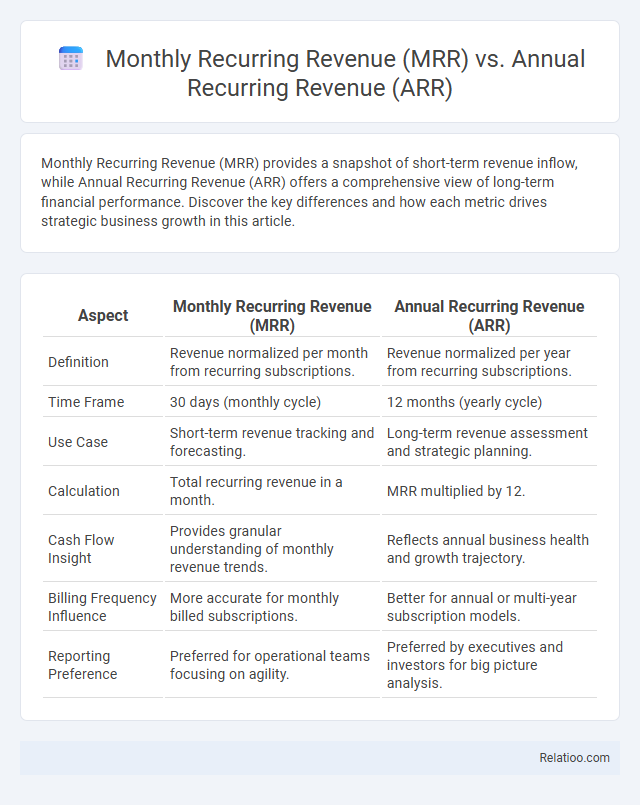

Monthly Recurring Revenue (MRR) provides a snapshot of short-term revenue inflow, while Annual Recurring Revenue (ARR) offers a comprehensive view of long-term financial performance. Discover the key differences and how each metric drives strategic business growth in this article.

Table of Comparison

| Aspect | Monthly Recurring Revenue (MRR) | Annual Recurring Revenue (ARR) |

|---|---|---|

| Definition | Revenue normalized per month from recurring subscriptions. | Revenue normalized per year from recurring subscriptions. |

| Time Frame | 30 days (monthly cycle) | 12 months (yearly cycle) |

| Use Case | Short-term revenue tracking and forecasting. | Long-term revenue assessment and strategic planning. |

| Calculation | Total recurring revenue in a month. | MRR multiplied by 12. |

| Cash Flow Insight | Provides granular understanding of monthly revenue trends. | Reflects annual business health and growth trajectory. |

| Billing Frequency Influence | More accurate for monthly billed subscriptions. | Better for annual or multi-year subscription models. |

| Reporting Preference | Preferred for operational teams focusing on agility. | Preferred by executives and investors for big picture analysis. |

Introduction to MRR and ARR

Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) are key metrics used to measure a company's subscription-based revenue streams. MRR provides a snapshot of predictable revenue earned each month, crucial for managing cash flow and short-term financial planning. Understanding MRR and ARR helps you accurately forecast growth and assess the health of your subscription business model.

Defining Monthly Recurring Revenue (MRR)

Monthly Recurring Revenue (MRR) is the predictable and consistent revenue a business earns each month from active subscriptions or contracts. It provides a granular view of revenue performance, allowing companies to track growth trends, churn rates, and expansion opportunities more frequently than Annual Recurring Revenue (ARR), which aggregates revenue on a yearly basis. MRR serves as a vital key performance indicator for subscription-based businesses, enabling precise financial forecasting and operational scaling.

Understanding Annual Recurring Revenue (ARR)

Annual Recurring Revenue (ARR) provides a comprehensive snapshot of your company's predictable revenue from subscriptions over a 12-month period, making it essential for long-term financial forecasting and growth analysis. Unlike Monthly Recurring Revenue (MRR), which tracks revenue on a month-to-month basis, ARR smooths out fluctuations and highlights overall subscription value and customer commitment for the year. Understanding ARR enables you to assess the stability and scalability of your subscription business, guiding strategic decisions on pricing, customer acquisition, and retention.

Key Differences Between MRR and ARR

Monthly Recurring Revenue (MRR) measures predictable revenue generated every month from subscriptions, while Annual Recurring Revenue (ARR) annualizes this figure to reflect yearly subscription income. MRR provides a granular, month-to-month financial snapshot ideal for tracking short-term growth or churn, whereas ARR offers a long-term perspective for annual planning and investor reporting. The key difference lies in their timeframes and use cases: MRR is best for operational insights, and ARR is essential for strategic financial assessments.

Benefits of Tracking MRR

Tracking Monthly Recurring Revenue (MRR) provides real-time insights into your subscription-based business's financial health, enabling quicker adjustments to growth strategies compared to Annual Recurring Revenue (ARR). MRR allows you to identify monthly trends, churn rates, and expansion opportunities with higher granularity, which supports more accurate forecasting and resource allocation. While ARR offers a long-term revenue perspective, your focus on MRR ensures actionable data that directly impacts your cash flow management and customer lifetime value optimization.

Advantages of Measuring ARR

Measuring Annual Recurring Revenue (ARR) offers a comprehensive view of your company's long-term financial health by capturing total predictable income over a 12-month period, smoothing out monthly fluctuations that can mislead short-term analysis. ARR provides strategic insights for forecasting growth, planning budgets, and securing investments with consistent revenue data compared to Monthly Recurring Revenue (MRR), which only reflects short-term trends. While subscriptions form the foundation of both metrics, ARR's annual perspective better aligns with strategic decision-making and performance evaluation, making it invaluable for subscription-based business models.

Use Cases: When to Focus on MRR vs ARR

Monthly Recurring Revenue (MRR) is ideal for startups and SaaS businesses seeking to monitor growth trends and manage cash flow with high granularity, providing immediate insight into monthly performance fluctuations. Annual Recurring Revenue (ARR) suits established enterprises that require long-term financial forecasting, investor reporting, and strategic planning, offering a comprehensive view of yearly subscription value. Subscription-based models benefit from tracking both MRR and ARR, but prioritizing MRR enables rapid iteration and agile decision-making, whereas ARR supports stability assessment and scalable growth strategies.

Impact on Financial Reporting and Forecasting

Monthly Recurring Revenue (MRR) provides granular insights into short-term subscription performance, enabling businesses to quickly identify trends and adjust financial forecasts with high precision. Annual Recurring Revenue (ARR) offers a broader overview of customer commitment and revenue stability, essential for long-term financial planning and investor reporting. Subscriptions drive both MRR and ARR metrics, with their growth and churn rates directly impacting revenue recognition, cash flow projections, and strategic business decisions in financial reporting.

Common Mistakes in Calculating MRR and ARR

Common mistakes in calculating Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) include double-counting upgrades and downgrades within the same period, leading to inflated revenue figures. Subscription churn, such as cancellations and pauses, is often overlooked, causing overestimation of recurring revenue. Ignoring one-time fees or non-recurring charges distorts the true MRR and ARR values, making accurate financial forecasting challenging.

Best Practices for Managing Recurring Revenue

Effective management of Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) hinges on accurate tracking and forecasting to ensure steady cash flow and business scalability. Implementing tiered subscription plans with flexible billing cycles enhances customer retention and optimizes revenue streams. Regular analysis of churn rates, customer lifetime value (CLV), and renewal patterns enables proactive adjustments to pricing strategies and improves overall subscription management.

Infographic: Monthly Recurring Revenue (MRR) vs Annual Recurring Revenue (ARR)

relatioo.com

relatioo.com