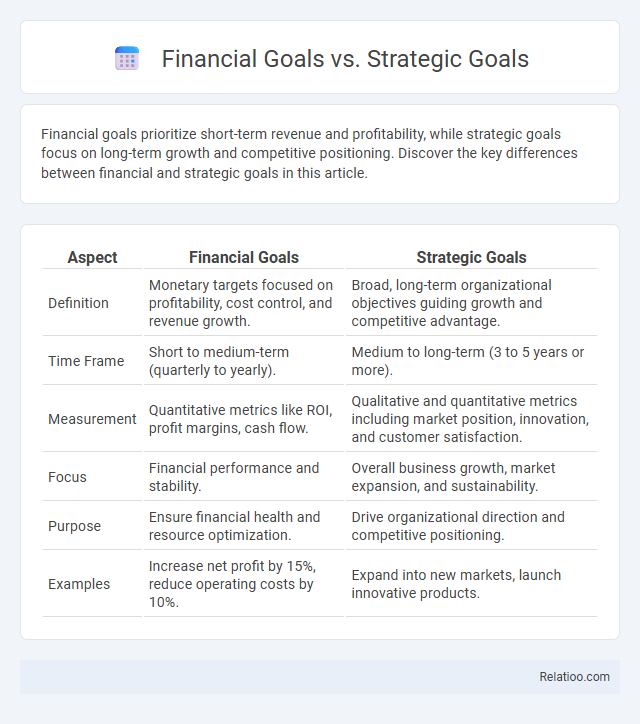

Financial goals prioritize short-term revenue and profitability, while strategic goals focus on long-term growth and competitive positioning. Discover the key differences between financial and strategic goals in this article.

Table of Comparison

| Aspect | Financial Goals | Strategic Goals |

|---|---|---|

| Definition | Monetary targets focused on profitability, cost control, and revenue growth. | Broad, long-term organizational objectives guiding growth and competitive advantage. |

| Time Frame | Short to medium-term (quarterly to yearly). | Medium to long-term (3 to 5 years or more). |

| Measurement | Quantitative metrics like ROI, profit margins, cash flow. | Qualitative and quantitative metrics including market position, innovation, and customer satisfaction. |

| Focus | Financial performance and stability. | Overall business growth, market expansion, and sustainability. |

| Purpose | Ensure financial health and resource optimization. | Drive organizational direction and competitive positioning. |

| Examples | Increase net profit by 15%, reduce operating costs by 10%. | Expand into new markets, launch innovative products. |

Defining Financial Goals

Defining financial goals involves setting specific, measurable targets related to your organization's revenue, profit margins, cash flow, and cost management. Financial goals focus on quantifiable monetary outcomes such as increasing sales by 15%, reducing expenses by 10%, or achieving a targeted net income within a fiscal year. Your strategic goals encompass broader, long-term objectives that guide overall business direction, including market expansion and innovation, while financial goals serve as tangible benchmarks to track economic performance and ensure fiscal health.

What Are Strategic Goals?

Strategic goals define Your organization's long-term vision by focusing on key priorities that drive sustainable growth and competitive advantage. These goals align resources and efforts toward achieving broader objectives beyond immediate financial performance. Unlike financial goals, which concentrate on specific monetary targets like revenue or profit, strategic goals encompass market positioning, innovation, and operational effectiveness to shape future success.

Key Differences Between Financial and Strategic Goals

Financial goals focus on monetary outcomes such as revenue growth, profit margins, and cost reduction, while strategic goals encompass broader objectives like market expansion, innovation, and competitive positioning. Your financial goals are quantifiable and time-bound, directly impacting the company's bottom line, whereas strategic goals guide long-term vision and decision-making processes. Understanding these distinctions helps in aligning your operational plans with overall business success.

Short-Term vs Long-Term Objective Setting

Financial goals typically focus on short-term objectives such as cash flow management and quarterly profit targets, while strategic goals encompass long-term visions including market expansion and competitive positioning. Your short-term objectives are often quantifiable and tied directly to financial performance, whereas long-term strategic goals require deeper planning aligned with company growth and sustainability. Balancing both ensures your business achieves immediate financial health while building a roadmap for lasting success.

Aligning Financial Goals with Business Strategy

Aligning your financial goals with the overall business strategy ensures that resources are effectively allocated to support long-term growth and profitability. Financial goals, such as revenue targets and cost management, must be integrated with strategic objectives, like market expansion and innovation, to create a cohesive roadmap. This alignment enables better decision-making, prioritizes investments, and drives sustainable competitive advantage.

Measuring Success: Financial Metrics vs Strategic KPIs

Measuring success in financial goals relies heavily on financial metrics such as revenue growth, profit margins, and return on investment, which quantify monetary performance and fiscal health. Strategic goals, however, demand the use of strategic KPIs like market share expansion, customer satisfaction scores, and innovation rates to evaluate progress toward long-term vision and competitive positioning. Distinguishing between these measurement types ensures organizations can effectively track both immediate financial outcomes and overarching strategic achievements.

Challenges in Balancing Financial and Strategic Goals

Balancing financial goals and strategic goals presents significant challenges due to differing priorities and resource allocation demands. Financial goals prioritize short-term profitability and cash flow, while strategic goals focus on long-term growth and competitive positioning, often requiring substantial investment and risk. Your ability to align these objectives hinges on careful planning to ensure financial stability supports sustainable strategic initiatives without compromising either goal.

Impact on Decision Making and Resource Allocation

Financial goals prioritize measurable outcomes such as revenue growth, profitability, and cost reduction, directly influencing resource allocation to maximize short-term financial performance. Strategic goals encompass broader organizational vision and competitive positioning, guiding long-term decisions and prioritizing investments in innovation, market expansion, and capabilities development. Aligning financial goals with strategic goals ensures balanced decision-making, optimizing resource distribution to achieve sustainable growth and shareholder value.

Best Practices for Integrating Both Goal Types

Aligning financial goals with strategic goals requires clear communication between finance and executive teams to ensure both short-term profitability and long-term growth objectives are addressed. Implementing performance metrics that capture financial outcomes alongside strategic milestones enables continuous monitoring and adjustment, fostering agility in decision-making. Regularly reviewing integrated plans and encouraging cross-departmental collaboration promotes alignment of resources and priorities, maximizing overall organizational success.

Case Studies: Financial vs Strategic Goal Outcomes

Case studies reveal distinct differences between financial goals and strategic goals in driving business success. Financial goals focus on measurable outcomes like profit margins, revenue growth, and cost reduction, while strategic goals prioritize long-term vision, market positioning, and innovation. Your ability to balance these types of goals determines organizational resilience and competitive advantage over time.

Infographic: Financial Goals vs Strategic Goals

relatioo.com

relatioo.com