Fixed costs, such as rent and salaries, remain constant regardless of production levels, while variable costs, like raw materials and utilities, fluctuate with output. Understanding the relationship between fixed and variable costs is crucial for effective budgeting and pricing strategies; explore this article to learn more.

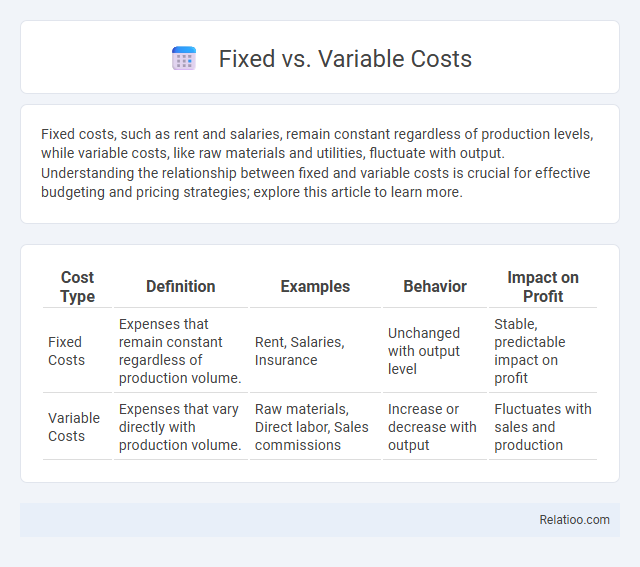

Table of Comparison

| Cost Type | Definition | Examples | Behavior | Impact on Profit |

|---|---|---|---|---|

| Fixed Costs | Expenses that remain constant regardless of production volume. | Rent, Salaries, Insurance | Unchanged with output level | Stable, predictable impact on profit |

| Variable Costs | Expenses that vary directly with production volume. | Raw materials, Direct labor, Sales commissions | Increase or decrease with output | Fluctuates with sales and production |

Understanding Fixed and Variable Costs

Fixed costs remain constant regardless of production levels, such as rent or salaries, providing stability in budgeting. Variable costs fluctuate directly with output, including raw materials and labor costs tied to production volume. Allocating these costs accurately is essential for determining product pricing and managing profitability effectively.

Key Differences Between Fixed and Variable Costs

Fixed costs remain constant regardless of production volume, including expenses such as rent, salaries, and insurance, providing predictable financial planning. Variable costs fluctuate directly with production output, encompassing raw materials, direct labor, and utility expenses, impacting your cost per unit. Allocation involves distributing both fixed and variable costs across departments or products to accurately assess profitability and manage budgeting effectively.

Examples of Fixed Costs in Business

Fixed costs in business include expenses that remain constant regardless of production levels, such as rent for office space, salaries of permanent staff, and insurance premiums. You can allocate fixed costs across departments or products to better understand profitability, ensuring that your financial analysis reflects true cost distribution. Unlike variable costs, these fixed expenses provide stability in budgeting but require careful allocation to optimize resource management.

Examples of Variable Costs in Business

Variable costs in business fluctuate directly with production levels, examples include raw materials, direct labor wages, and sales commissions. These costs vary because they are tied to the volume of goods or services produced, unlike fixed costs such as rent or salaries, which remain constant regardless of output. Proper allocation of variable costs helps in accurate product costing, profitability analysis, and budget planning.

How Fixed and Variable Costs Impact Pricing Strategies

Fixed costs, such as rent and salaries, remain constant regardless of production volume and directly influence your baseline pricing to ensure profitability over time. Variable costs fluctuate with production levels, affecting the marginal cost of each unit and guiding flexible pricing strategies to adapt to market demand and competition. Strategic allocation of these costs allows businesses to optimize pricing decisions, balance cost recovery, and maintain competitive advantage.

The Role of Cost Structure in Profitability

Understanding the interplay between fixed costs, variable costs, and allocation is crucial for optimizing your cost structure and enhancing profitability. Fixed costs remain constant regardless of production volume, providing stability, while variable costs fluctuate with output levels, directly impacting profit margins. Effective allocation of these costs ensures accurate financial analysis, enabling better decision-making to maximize your business's profit potential.

Fixed vs. Variable Costs in Budgeting and Forecasting

Fixed costs, such as rent and salaries, remain constant regardless of your production levels, while variable costs, like raw materials and direct labor, fluctuate based on output. Accurate budgeting and forecasting require distinguishing between these two to predict expenses accurately and optimize resource allocation. Understanding the behavior of fixed versus variable costs empowers you to make informed financial decisions and improve profit margins.

Calculating Break-Even Point Using Fixed and Variable Costs

Calculating the break-even point involves dividing your fixed costs by the contribution margin per unit, which is the selling price minus variable costs per unit. Fixed costs remain constant regardless of production volume, while variable costs fluctuate directly with output, making accurate allocation crucial for precise break-even analysis. Understanding the distinction between these costs allows you to determine the sales volume needed to cover all expenses and start generating profit.

Managing and Reducing Business Costs Effectively

Understanding fixed costs, such as rent and salaries, versus variable costs, like raw materials and utilities, is crucial for managing and reducing business expenses effectively. Allocating costs accurately enables precise budgeting and cost control, helping identify areas where reductions or efficiency improvements are possible. Implementing strategic allocation methods, such as activity-based costing, can optimize resource use and enhance overall financial performance.

Conclusion: Choosing the Right Cost Strategy for Your Business

Selecting the appropriate cost strategy depends on your business model, market stability, and cash flow needs. Fixed costs provide predictability with consistent expenses, while variable costs offer flexibility by aligning expenses with production levels. Effective cost allocation ensures resources are assigned accurately to optimize profitability and support strategic decision-making.

Infographic: Fixed vs Variable costs

relatioo.com

relatioo.com