The Lockbox System accelerates payment processing by outsourcing mail handling and check deposits to a secure third-party, while In-House Processing manages these tasks internally, allowing for greater control over cash flow. Discover the key benefits and drawbacks of each approach to optimize your organization's financial operations in this article.

Table of Comparison

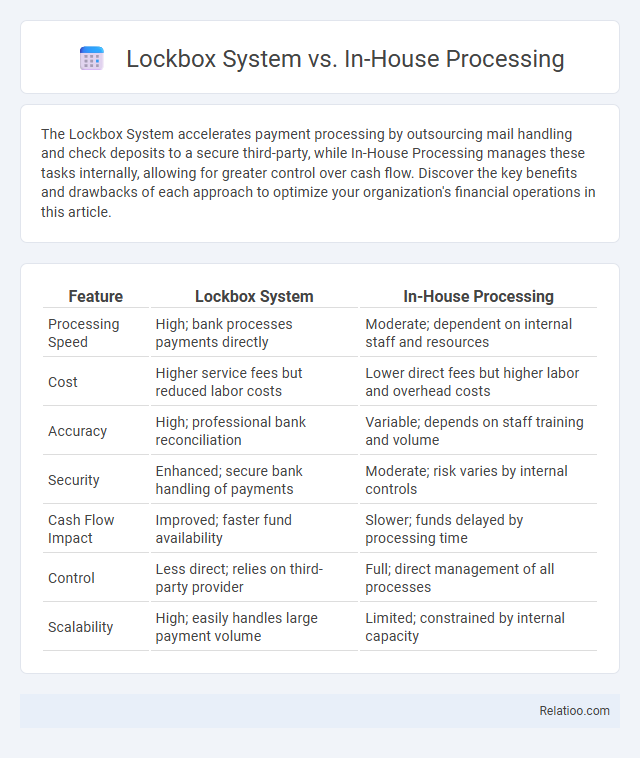

| Feature | Lockbox System | In-House Processing |

|---|---|---|

| Processing Speed | High; bank processes payments directly | Moderate; dependent on internal staff and resources |

| Cost | Higher service fees but reduced labor costs | Lower direct fees but higher labor and overhead costs |

| Accuracy | High; professional bank reconciliation | Variable; depends on staff training and volume |

| Security | Enhanced; secure bank handling of payments | Moderate; risk varies by internal controls |

| Cash Flow Impact | Improved; faster fund availability | Slower; funds delayed by processing time |

| Control | Less direct; relies on third-party provider | Full; direct management of all processes |

| Scalability | High; easily handles large payment volume | Limited; constrained by internal capacity |

Introduction to Lockbox Systems and In-House Processing

Lockbox systems streamline payment processing by outsourcing the receipt and handling of customer payments to a secure third-party facility, significantly reducing your organization's mail handling and deposit delays. In contrast, in-house processing keeps the entire payment workflow within your company, offering greater control but requiring more time-intensive data entry and reconciliation. Understanding these distinctions helps optimize cash flow management and improve operational efficiency in your accounts receivable process.

How Lockbox Systems Work

Lockbox systems streamline payment processing by directing customer payments to a secure post office box managed by a bank, where checks are collected, processed, and deposited directly into your business account. This reduces handling time and errors compared to in-house processing, which requires manual check collection and data entry within your organization. Collection methods vary, but lockbox services accelerate cash flow by automating payment deposits and providing detailed remittance data efficiently.

Overview of In-House Payment Processing

In-house payment processing involves a company handling its own transactions directly through internal systems without relying on third-party providers like lockbox services. This method offers greater control over payment data, faster access to funds, and reduced reliance on external vendors, but requires robust IT infrastructure and compliance management. Businesses with high transaction volumes often prefer in-house processing for enhanced security, customized workflows, and immediate reconciliation capabilities.

Cost Comparison: Lockbox vs In-House

Lockbox systems reduce overhead expenses by outsourcing payment processing, leading to lower labor and infrastructure costs compared to in-house operations which require dedicated staff and technology investments. In-house processing often incurs higher fixed costs due to equipment maintenance, software updates, and employee management, whereas lockbox fees are typically variable and scale with transaction volume. Companies choosing lockbox solutions benefit from economies of scale and faster processing times, ultimately resulting in cost efficiencies over maintaining internal collection departments.

Speed and Efficiency Analysis

Lockbox systems significantly accelerate payment processing by automating check receipt and data capture, reducing manual entry errors and improving cash flow visibility compared to in-house processing. In-house processing offers greater control but typically incurs slower turnaround times due to manual sorting and data entry, impacting overall efficiency. Collection methods rely heavily on customer follow-up and negotiation, which can be time-consuming and less predictable, making lockbox systems the preferred choice for maximizing speed and operational efficiency.

Security and Fraud Prevention

Lockbox systems provide enhanced security by outsourcing payments to specialized banks that use encrypted channels and strict access controls, significantly reducing risks of internal fraud. In-house processing demands robust internal controls and continuous monitoring to prevent employee theft, but it can be vulnerable without advanced fraud detection technologies. Collection agencies leverage sophisticated fraud prevention tools and compliance frameworks, minimizing the chances of payment fraud while ensuring secure handling of sensitive financial data.

Integration with Accounting Systems

Lockbox systems offer seamless integration with accounting software by automatically importing payment data, reducing manual entry errors and accelerating cash application. In-house processing requires robust IT infrastructure to ensure accurate synchronization with your accounting systems, which can increase operational complexity and cost. Collection systems often provide limited integration capabilities, focusing more on debt recovery than on streamlining accounting workflows.

Scalability for Growing Businesses

The Lockbox System offers unparalleled scalability for growing businesses by automating payment processing and reducing manual data entry, facilitating faster cash flow management as transaction volumes increase. In-house processing requires significant investment in infrastructure and staff training to handle higher volumes, which can limit scalability and increase operational costs. Collection processes benefit from scalability when integrated with automated software, but manual collections often struggle to keep pace with growth due to labor-intensive follow-ups and inconsistent tracking.

Key Decision Factors for Businesses

Lockbox systems accelerate payment processing and reduce administrative burden by outsourcing to banks, ideal for businesses prioritizing cash flow efficiency and reduced labor costs. In-house processing offers greater control and customization but requires investment in technology and staff, suitable for companies emphasizing security and internal oversight. Collection services specialize in recovering overdue payments, critical for businesses facing high delinquency rates and needing expertise in debt recovery strategies.

Conclusion: Choosing the Right Payment Processing Solution

Selecting the ideal payment processing solution depends on a business's transaction volume, cash flow needs, and administrative capacity. Lockbox systems streamline receivables by outsourcing payment processing to banks, providing faster funds availability and reducing internal workload, while in-house processing offers greater control but demands more resources and infrastructure. Collection services focus on recovering overdue payments, complementing processing methods but not replacing them, making a hybrid approach often most effective for optimizing revenue cycle management.

Infographic: Lockbox System vs In-House Processing

relatioo.com

relatioo.com