Foreclosure occurs when a lender takes ownership of a property due to unpaid mortgage, whereas repossession involves reclaiming personal property after missed loan payments. Explore this article to understand the key differences and impacts of foreclosure versus repossession.

Table of Comparison

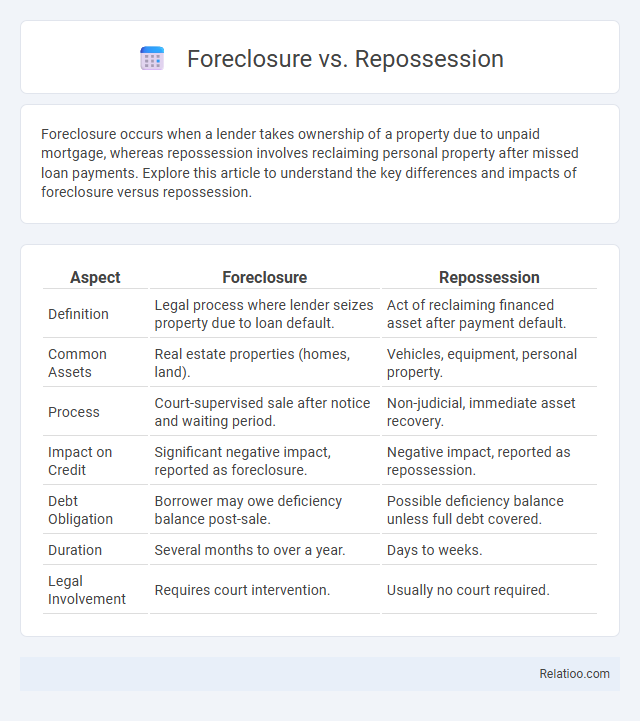

| Aspect | Foreclosure | Repossession |

|---|---|---|

| Definition | Legal process where lender seizes property due to loan default. | Act of reclaiming financed asset after payment default. |

| Common Assets | Real estate properties (homes, land). | Vehicles, equipment, personal property. |

| Process | Court-supervised sale after notice and waiting period. | Non-judicial, immediate asset recovery. |

| Impact on Credit | Significant negative impact, reported as foreclosure. | Negative impact, reported as repossession. |

| Debt Obligation | Borrower may owe deficiency balance post-sale. | Possible deficiency balance unless full debt covered. |

| Duration | Several months to over a year. | Days to weeks. |

| Legal Involvement | Requires court intervention. | Usually no court required. |

Understanding Foreclosure and Repossession

Foreclosure occurs when a lender seizes your property due to missed mortgage payments, leading to the sale of the home to recover the loan balance. Repossession involves reclaiming personal property, such as vehicles, when you default on secured loan payments, often without court intervention. Understanding these processes helps you protect your assets and explore options to avoid losing your home or possessions.

Key Differences Between Foreclosure and Repossession

Foreclosure involves a lender taking ownership of a property due to the borrower's failure to meet mortgage payments, primarily affecting real estate assets. Repossession occurs when a lender reclaims personal property, such as vehicles, after missed loan payments on secured loans. The key difference lies in the type of collateral: foreclosure pertains to real property, while repossession concerns movable personal property.

How Foreclosure Works: Step-by-Step

Foreclosure initiates when a homeowner defaults on mortgage payments, triggering the lender to file a public notice of default. The process progresses through a waiting period during which you may cure the default by paying owed amounts before the property is auctioned. If unresolved, the lender sells the home at a foreclosure auction, transferring ownership and potentially impacting your credit score significantly.

The Repossession Process Explained

The repossession process involves the lender reclaiming property, typically a vehicle, due to missed loan payments without requiring court approval, distinguishing it from foreclosure which concerns real estate and often involves legal proceedings. Your creditor can repossess the item once you default, often allowing them to sell it to recover the remaining loan balance. Understanding these differences helps you navigate the recovery methods lenders use and protect your assets during financial hardship.

Types of Properties Affected

Foreclosure primarily affects real estate properties, including residential homes and commercial buildings, where the borrower defaults on mortgage payments. Repossession involves movable assets such as vehicles, machinery, or personal belongings used as collateral for loans. Unlike repossession, foreclosure deals exclusively with immovable property secured by a mortgage lien.

Legal Implications of Foreclosure and Repossession

Foreclosure legally terminates a homeowner's rights to their property due to mortgage default, often involving court proceedings and public notices. Repossession applies primarily to personal property like vehicles, allowing lenders to reclaim assets without necessarily involving a judicial process. Both processes impact credit scores but foreclosure can result in more severe legal consequences, including deficiency judgments where borrowers owe remaining debt beyond asset value.

Impact on Credit Scores

Foreclosure typically has a more severe and long-lasting negative impact on credit scores compared to repossession, as it indicates failure to repay a mortgage loan. Repossession impacts credit scores less severely but still significantly, reflecting missed payments on secured personal property like vehicles. Both foreclosure and repossession can remain on credit reports for up to seven years, affecting future loan approvals and interest rates.

Ways to Avoid Foreclosure and Repossession

Ways to avoid foreclosure and repossession include contacting your lender promptly to negotiate loan modifications or repayment plans tailored to your financial situation. Exploring government assistance programs and seeking advice from housing counselors can provide solutions to prevent asset loss. Maintaining open communication with creditors and budgeting to prioritize mortgage or loan payments significantly reduces the risk of losing your home or vehicle.

Financial Consequences for Borrowers

Foreclosure results in the loss of your home and significantly damages your credit score, often remaining on your credit report for up to seven years, which impacts future loan approvals and interest rates. Repossession, typically related to vehicles or personal property, similarly harms your credit and may leave you liable for the remaining loan balance after the asset is sold. Both processes carry severe financial consequences, including difficulty obtaining new credit, higher interest rates, and potential legal obligations for any deficiency balance.

Frequently Asked Questions: Foreclosure vs. Repossession

Foreclosure involves the legal process where a lender takes ownership of a property due to unpaid mortgage, while repossession refers to the lender reclaiming personal property, such as a car, after missed loan payments. Your primary concern should be understanding that foreclosure affects real estate and can lead to eviction, whereas repossession affects movable assets and typically results in the removal of the item. Common FAQs around foreclosure vs. repossession address differences in legal procedures, timelines, and impact on credit scores.

Infographic: Foreclosure vs Repossession

relatioo.com

relatioo.com