Debt and equity represent two primary methods companies use to raise capital, with debt involving borrowed funds that must be repaid with interest, while equity entails selling ownership stakes to investors. Explore this article to understand the advantages, risks, and impacts of debt versus equity on business growth and financial stability.

Table of Comparison

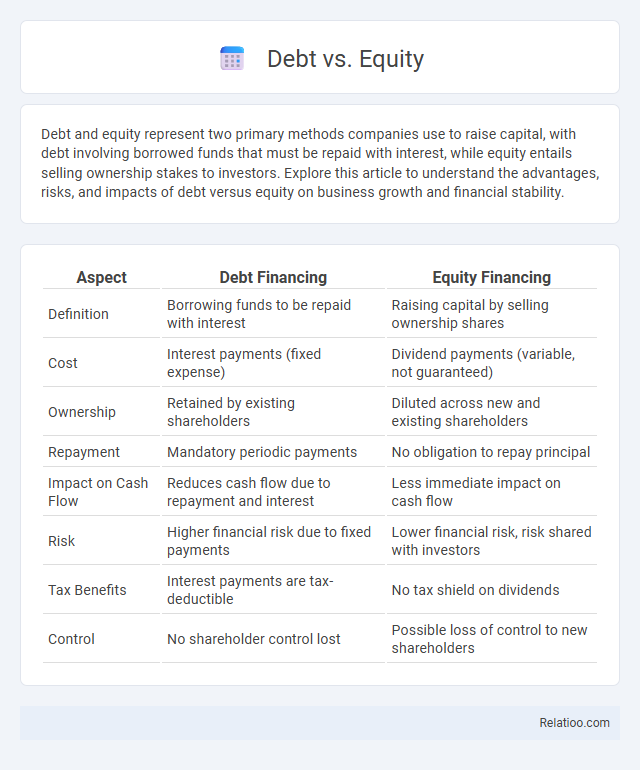

| Aspect | Debt Financing | Equity Financing |

|---|---|---|

| Definition | Borrowing funds to be repaid with interest | Raising capital by selling ownership shares |

| Cost | Interest payments (fixed expense) | Dividend payments (variable, not guaranteed) |

| Ownership | Retained by existing shareholders | Diluted across new and existing shareholders |

| Repayment | Mandatory periodic payments | No obligation to repay principal |

| Impact on Cash Flow | Reduces cash flow due to repayment and interest | Less immediate impact on cash flow |

| Risk | Higher financial risk due to fixed payments | Lower financial risk, risk shared with investors |

| Tax Benefits | Interest payments are tax-deductible | No tax shield on dividends |

| Control | No shareholder control lost | Possible loss of control to new shareholders |

Introduction to Debt and Equity

Debt represents borrowed capital that must be repaid with interest, often used by businesses to finance operations without diluting ownership. Equity involves raising funds by selling shares, giving investors ownership stakes and potential dividends, aligning their interests with the company's growth. Understanding the balance between debt and equity is crucial for optimizing Your financial strategy and maintaining healthy capital structure.

Key Differences Between Debt and Equity

Debt involves borrowing funds that must be repaid with interest, creating a financial obligation, while equity represents ownership in a company, giving shareholders a claim on profits and assets. Debt holders have priority over equity holders during liquidation, but equity holders benefit from potential capital appreciation and voting rights. Understanding these distinctions helps you make informed decisions on financing strategies and risk management for your business.

Advantages of Debt Financing

Debt financing offers advantages such as maintaining ownership control, as it does not dilute shareholder equity, and providing tax benefits since interest payments are often tax-deductible. It enables businesses to access immediate capital for growth or operational needs without altering the equity structure. Furthermore, well-managed debt can improve a company's credit profile and leverage financial performance.

Advantages of Equity Financing

Equity financing offers the advantage of not requiring repayment, reducing financial strain and preserving cash flow for business operations. It enhances a company's creditworthiness by minimizing debt obligations, thus improving the balance sheet and attracting further investment. Equity investors also share the business risk, aligning interests with growth and long-term success.

Disadvantages of Debt Financing

Debt financing can lead to significant financial strain due to mandatory interest payments that reduce your cash flow and profitability. Unlike equity, debt increases your company's risk of insolvency since lenders require repayment regardless of business performance. High debt levels may also limit your borrowing capacity and negatively impact your credit rating, restricting future financing opportunities.

Disadvantages of Equity Financing

Equity financing dilutes ownership, reducing control for original shareholders and potentially causing conflicts in decision-making. It often involves giving up a portion of future profits, which can be costly compared to debt with fixed interest payments. Raising equity can be time-consuming and expensive due to regulatory requirements and underwriting fees, making it less attractive for quick funding needs.

Impact on Ownership and Control

Debt financing allows companies to raise capital without diluting ownership or giving up control, as creditors do not have voting rights. Equity financing involves issuing shares, which dilutes existing ownership and distributes voting power among shareholders, potentially affecting control. Liabilities represent obligations that must be repaid, but unlike equity, they do not impact ownership structure or control unless covenants trigger changes in governance.

Risk Factors for Debt and Equity

Debt carries the risk of fixed repayment obligations that can strain your cash flow during economic downturns, potentially leading to default or bankruptcy. Equity financing, while less risky in terms of mandatory payments, dilutes ownership and exposes investors to market volatility and uncertain dividend returns. Understanding these risk factors helps you balance financial stability and growth potential in your capital structure decisions.

Choosing the Right Financing Option

Choosing the right financing option depends on balancing debt, equity, and liability to optimize capital structure and minimize cost of capital. Debt financing offers tax-deductible interest but increases financial risk due to fixed obligations, while equity financing dilutes ownership but provides permanent capital without mandatory repayments. Understanding the implications of each option on cash flow, control, and risk exposure is critical for sustainable business growth and investor confidence.

Conclusion: Debt vs Equity Comparison

Debt involves borrowing funds that must be repaid with interest, creating a fixed financial obligation, while equity represents ownership in a company without mandatory repayment but dilutes control. Equity financing provides long-term capital with potential for growth but may reduce earnings per share, whereas debt financing can enhance returns through leverage yet increases financial risk. Choosing between debt and equity depends on the company's risk tolerance, cost of capital, and strategic goals, balancing the benefits of financial leverage against ownership dilution.

Infographic: Debt vs Equity

relatioo.com

relatioo.com