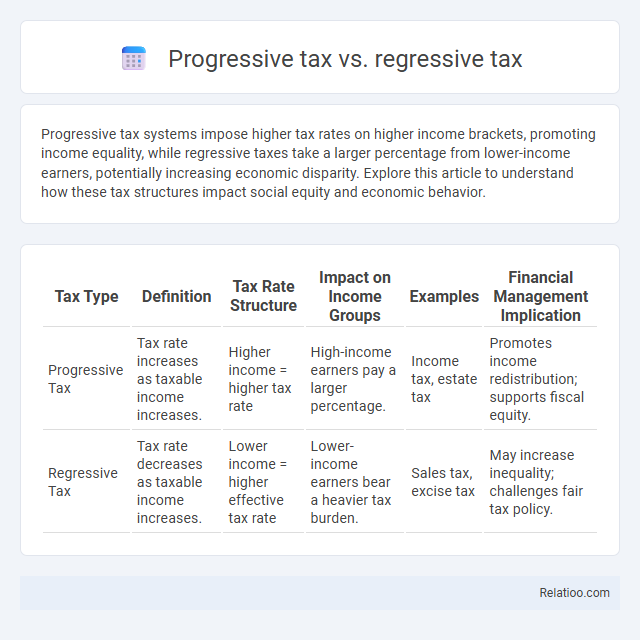

Progressive tax systems impose higher tax rates on higher income brackets, promoting income equality, while regressive taxes take a larger percentage from lower-income earners, potentially increasing economic disparity. Explore this article to understand how these tax structures impact social equity and economic behavior.

Table of Comparison

| Tax Type | Definition | Tax Rate Structure | Impact on Income Groups | Examples | Financial Management Implication |

|---|---|---|---|---|---|

| Progressive Tax | Tax rate increases as taxable income increases. | Higher income = higher tax rate | High-income earners pay a larger percentage. | Income tax, estate tax | Promotes income redistribution; supports fiscal equity. |

| Regressive Tax | Tax rate decreases as taxable income increases. | Lower income = higher effective tax rate | Lower-income earners bear a heavier tax burden. | Sales tax, excise tax | May increase inequality; challenges fair tax policy. |

Introduction to Taxation Systems

Progressive tax systems impose higher tax rates on individuals with greater income, promoting income redistribution and reducing economic inequality. Regressive tax structures apply lower rates to higher incomes, often placing a heavier relative burden on low-income earners through mechanisms like sales taxes or flat taxes. Understanding these models is essential for analyzing taxation systems, as they directly influence government revenue, social equity, and economic behavior.

What Is a Progressive Tax?

A progressive tax imposes a higher tax rate on individuals or entities with greater income, ensuring that taxpayers with larger earnings contribute a larger percentage of their income. In contrast, a regressive tax applies a higher burden on lower-income earners, as the tax rate decreases as income increases. Understanding the progressive tax system highlights its role in reducing income inequality by redistributing wealth through targeted tax brackets.

Key Features of Progressive Taxation

Progressive taxation imposes higher tax rates on higher income brackets, ensuring that Your tax burden increases with earnings, promoting income redistribution and economic equity. Key features include graduated tax rates, where the marginal tax rate rises as taxable income increases, and exemptions or deductions that can reduce taxable income. This system contrasts with regressive taxes, which disproportionately impact lower-income earners, and general tax structures that may not adjust based on income levels.

What Is a Regressive Tax?

A regressive tax imposes a higher relative burden on low-income earners, as the tax rate decreases when income increases, unlike progressive taxes where higher incomes are taxed at higher rates. Common examples of regressive taxes include sales taxes and excise taxes, which take a larger percentage of income from the poor than the rich. Understanding the impact of regressive taxes is crucial for evaluating tax fairness and their effects on income inequality.

Key Features of Regressive Taxation

Regressive taxation imposes a higher burden on low-income individuals by taxing lower earnings at a higher effective rate than higher incomes, often through flat taxes on essential goods and services. Key features include fixed-rate taxes that consume a larger portion of poorer taxpayers' income, such as sales taxes or excise taxes, leading to decreased disposable income and increased inequality. In contrast, progressive taxes increase rates with income, while general tax systems may incorporate elements of both to balance revenue generation and fairness.

Comparing Progressive and Regressive Taxes

Progressive tax systems impose higher tax rates on individuals with greater income, ensuring those with more wealth contribute a larger share to public finances. Regressive taxes, such as sales taxes, disproportionately impact lower-income individuals by taking a larger percentage of their earnings compared to wealthier taxpayers. Understanding your tax structure helps in assessing the fairness and economic effects of these different approaches on income distribution.

Economic Impacts of Different Tax Systems

Progressive tax systems, where tax rates increase with income, help reduce income inequality by redistributing wealth and funding social programs that support economic stability. Regressive taxes, which impose a higher burden on lower-income individuals through fixed rates or consumption taxes, can exacerbate economic disparities and reduce overall consumer spending power. Understanding how your tax structure impacts economic growth, public services, and social equity is essential for informed financial planning and policy advocacy.

Equity and Fairness in Taxation

Progressive tax systems promote equity by taxing higher incomes at increased rates, ensuring that those with greater financial capacity contribute a fairer share to public services. Regressive taxes, such as sales taxes, disproportionately impact lower-income individuals, reducing overall fairness in taxation by placing a heavier burden on those least able to pay. Your understanding of these tax structures is crucial for advocating policies that balance revenue generation with social equity and fiscal responsibility.

Real-World Examples of Tax Structures

Progressive tax systems, such as the U.S. federal income tax, increase tax rates as income rises, ensuring higher earners contribute a larger share. Regressive taxes, like sales taxes on goods, disproportionately impact lower-income individuals by taking a larger percentage of their income. Your understanding of these tax structures is crucial for navigating fiscal policies and their implications on personal finance and economic equity.

Choosing the Right Tax System for Society

Choosing the right tax system for society involves understanding how progressive, regressive, and proportional taxes impact economic equity and revenue generation. Progressive tax systems charge higher rates on higher incomes, promoting wealth redistribution and social welfare, while regressive taxes impose a heavier burden on lower-income individuals, often exacerbating inequality. Your decision should balance fairness and efficiency, ensuring that tax policies fund public services without disproportionately disadvantaging vulnerable populations.

Infographic: Progressive tax vs regressive tax

relatioo.com

relatioo.com