Real interest rate adjusts the nominal interest rate by accounting for inflation, reflecting the true cost of borrowing or the real yield on investments. Understanding the difference between real and nominal interest rates is essential for making informed financial decisions; explore this article to learn more.

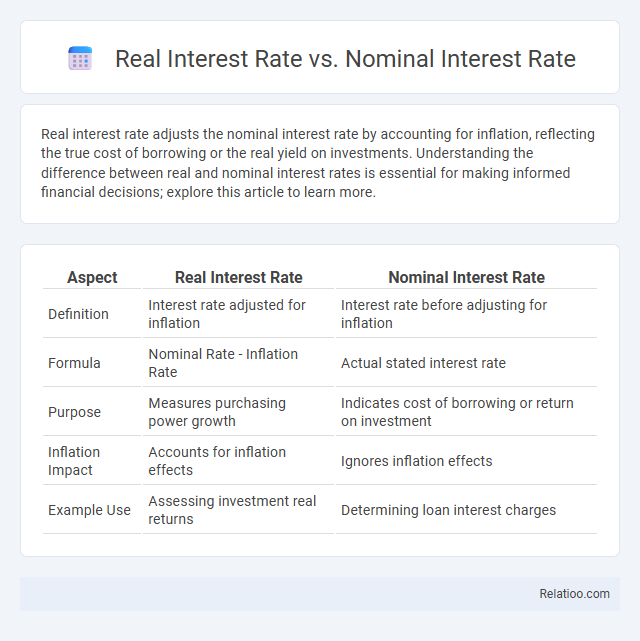

Table of Comparison

| Aspect | Real Interest Rate | Nominal Interest Rate |

|---|---|---|

| Definition | Interest rate adjusted for inflation | Interest rate before adjusting for inflation |

| Formula | Nominal Rate - Inflation Rate | Actual stated interest rate |

| Purpose | Measures purchasing power growth | Indicates cost of borrowing or return on investment |

| Inflation Impact | Accounts for inflation effects | Ignores inflation effects |

| Example Use | Assessing investment real returns | Determining loan interest charges |

Introduction to Real and Nominal Interest Rates

Real interest rate reflects the true cost of borrowing by adjusting nominal interest rate for inflation, revealing your actual purchasing power change over time. Nominal interest rate is the stated percentage without inflation adjustment, representing the agreed-upon cost of loans or returns on investments. Understanding the distinction between real and nominal rates is crucial for making informed financial decisions and measuring the true value of interest income or expenses.

Definition of Nominal Interest Rate

Nominal interest rate is the percentage increase in money that the borrower pays to the lender without adjusting for inflation, reflecting the stated rate on loans or investments. Real interest rate accounts for inflation by subtracting the inflation rate from the nominal interest rate, indicating the true purchasing power of the interest earned or paid. Interest itself represents the cost of borrowing money or the return on investment, typically expressed as a percentage of the principal amount over a period of time.

Understanding Real Interest Rate

The Real Interest Rate reflects the true cost of borrowing or the real yield on an investment after adjusting for inflation, making it a critical indicator for your purchasing power. Unlike the Nominal Interest Rate, which represents the stated percentage without considering inflation, the Real Interest Rate provides a more accurate measure of economic value over time. Understanding this distinction helps you make smarter financial decisions by revealing the genuine growth or expense associated with loans and investments.

Calculating Real vs Nominal Interest Rates

Calculating nominal interest rates involves considering the percentage increase in money without adjusting for inflation, representing the stated or advertised rate. Real interest rates are derived by subtracting the inflation rate from the nominal interest rate, reflecting the true purchasing power gain or loss over time. Understanding the difference between these rates is crucial for accurate financial planning, investment analysis, and gauging the actual return on savings or loans.

The Impact of Inflation on Interest Rates

Inflation significantly influences the relationship between real interest rates, nominal interest rates, and interest itself by eroding the purchasing power of money over time. The nominal interest rate represents the stated rate without adjusting for inflation, while the real interest rate accounts for inflation's impact, reflecting the true cost of borrowing or the real yield on savings. High inflation typically leads to higher nominal interest rates as lenders demand compensation, whereas the real interest rate may remain stable or even decline depending on inflation expectations.

Importance of Real Interest Rate in Investment Decisions

Real interest rate accounts for inflation, revealing the true cost of borrowing and the genuine yield on investments, making it crucial for accurate financial decision-making. Nominal interest rate reflects the stated percentage without adjusting for inflation, often misleading investors about actual returns. Understanding the real interest rate enables investors to assess purchasing power preservation and the real profitability of projects, guiding more informed and effective investment strategies.

Nominal Interest Rate and Loan Agreements

Nominal interest rate represents the stated percentage charged on a loan without adjusting for inflation, directly impacting your loan agreement terms and monthly payments. Unlike the real interest rate, which accounts for inflation to reflect the actual purchasing power cost, the nominal rate determines the upfront financial obligation you must meet. Understanding nominal interest rates helps you assess the total cost of borrowing and compare loan options effectively.

Comparing Real and Nominal Interest Rates: Key Differences

Real interest rates account for inflation, reflecting the true purchasing power of interest earned or paid, while nominal interest rates represent the stated percentage without adjusting for inflation. The key difference lies in the real interest rate providing a more accurate measure of investment returns or borrowing costs by subtracting the inflation rate from the nominal rate. Understanding this distinction is crucial for investors and borrowers to evaluate the actual cost or yield of financial products in changing economic environments.

Practical Examples of Real and Nominal Interest Rates

Nominal interest rate represents the stated percentage rate on a loan or investment without adjusting for inflation, while the real interest rate accounts for inflation's impact, reflecting the true cost or gain of borrowing or investing. For example, if a savings account offers a 5% nominal interest rate but inflation is 2%, your real interest rate is approximately 3%, indicating the actual growth of your purchasing power. Understanding the difference helps you make informed financial decisions by evaluating how much your money truly earns or costs over time.

Conclusion: Choosing the Right Rate for Financial Planning

Understanding the difference between real interest rate, nominal interest rate, and interest is crucial for accurate financial planning. The real interest rate accounts for inflation, reflecting the true cost or yield on your investments or loans, while the nominal rate does not consider inflation. You should prioritize the real interest rate in your financial decisions to ensure your purchasing power and overall financial goals are protected against inflationary effects.

Infographic: Real Interest Rate vs Nominal Interest Rate

relatioo.com

relatioo.com