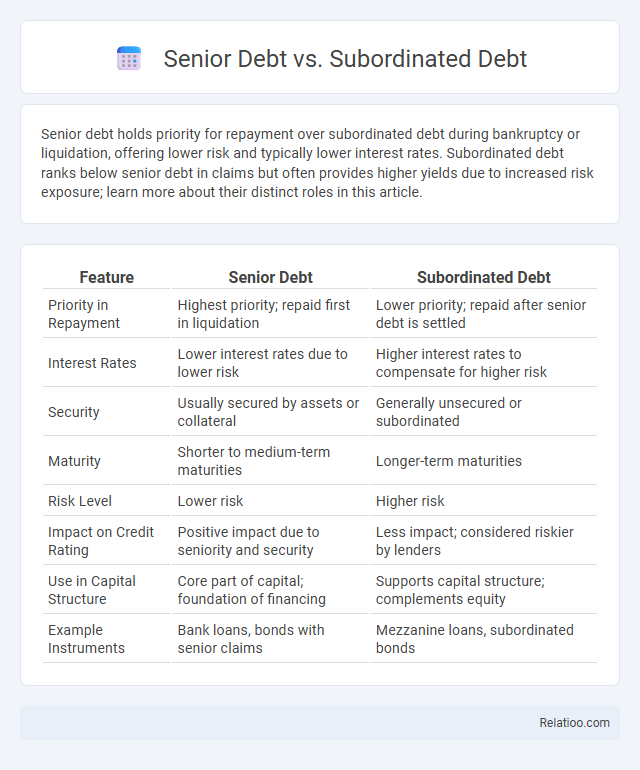

Senior debt holds priority for repayment over subordinated debt during bankruptcy or liquidation, offering lower risk and typically lower interest rates. Subordinated debt ranks below senior debt in claims but often provides higher yields due to increased risk exposure; learn more about their distinct roles in this article.

Table of Comparison

| Feature | Senior Debt | Subordinated Debt |

|---|---|---|

| Priority in Repayment | Highest priority; repaid first in liquidation | Lower priority; repaid after senior debt is settled |

| Interest Rates | Lower interest rates due to lower risk | Higher interest rates to compensate for higher risk |

| Security | Usually secured by assets or collateral | Generally unsecured or subordinated |

| Maturity | Shorter to medium-term maturities | Longer-term maturities |

| Risk Level | Lower risk | Higher risk |

| Impact on Credit Rating | Positive impact due to seniority and security | Less impact; considered riskier by lenders |

| Use in Capital Structure | Core part of capital; foundation of financing | Supports capital structure; complements equity |

| Example Instruments | Bank loans, bonds with senior claims | Mezzanine loans, subordinated bonds |

Introduction to Senior Debt and Subordinated Debt

Senior debt holds priority over subordinated debt in repayment, making it a safer investment with lower interest rates due to its secured status. Subordinated debt, also known as junior debt, ranks below senior debt in bankruptcy claims, resulting in higher risk and therefore higher yields for lenders. Understanding the differences between senior and subordinated debt helps you assess the risk and return profile of various financing options.

Defining Senior Debt: Key Features

Senior debt ranks highest in the capital structure, ensuring priority claims on assets and repayment during liquidation or bankruptcy. It typically carries lower interest rates due to reduced risk, secured by collateral or specific assets. Senior debt covenants impose strict financial and operational requirements, enhancing lender protection and reducing default risk compared to subordinated debt or unsecured debt instruments.

Understanding Subordinated Debt: Essential Characteristics

Subordinated debt ranks below senior debt in priority of repayment, making it riskier but often offering higher interest rates to compensate investors. This type of debt is typically unsecured and repaid only after all senior obligations are met in case of borrower default or bankruptcy. Understanding its essential characteristics helps investors evaluate risk, reward, and the strategic role subordinated debt plays within a company's capital structure.

Priority of Payment: Senior vs Subordinated Debt Explained

Senior debt holds the highest priority in payment hierarchy, ensuring it is repaid before subordinated debt during liquidation or bankruptcy. Subordinated debt, also known as junior debt, ranks below senior debt, meaning its claims are settled only after all senior obligations are fully met. This priority structure affects risk levels and interest rates, with senior debt generally offering lower risk and interest compared to subordinated debt.

Risk Levels and Investor Considerations

Senior debt holds the highest priority in the capital structure, offering lower risk due to its secured or priority claim on assets during liquidation, making it attractive to risk-averse investors seeking stable returns. Subordinated debt ranks below senior debt, carries higher risk as it is repaid only after senior obligations, and typically offers higher yields to compensate investors for increased default risk. General debt encompasses various types, with risk levels influenced by seniority, collateral status, and issuer credit quality, requiring investors to carefully assess these factors to balance potential returns against exposure to loss.

Interest Rates Comparison: Senior Debt vs Subordinated Debt

Senior debt typically carries lower interest rates compared to subordinated debt due to its higher priority in the capital structure and lower risk for lenders. Subordinated debt demands higher interest rates as compensation for increased risk since it is repaid after senior debt in the event of liquidation. The disparity in interest rates reflects the different levels of risk and repayment preference between senior and subordinated debt instruments.

Collateral and Security Differences

Senior debt holds the highest priority claim on collateral in the event of default, offering your lender substantial security through assets such as property, equipment, or receivables. Subordinated debt ranks below senior debt, meaning its repayment is secured only after senior debt obligations are met, often providing limited or no collateral protection. General debt may lack specific collateral and relies more on the borrower's creditworthiness, resulting in lower security compared to senior or subordinated debt.

Role in Capital Structure

Senior debt holds the highest priority in a company's capital structure, ensuring repayment before all other debts, which minimizes risk for lenders and lowers borrowing costs for your business. Subordinated debt ranks below senior debt and carries higher risk due to its lower repayment priority, often commanding higher interest rates as compensation. General debt encompasses both senior and subordinated debt, with its role in capital structure defined by the specific seniority and terms assigned to each debt type.

Common Uses and Examples in Corporate Finance

Senior debt holds priority over other debts in corporate finance, commonly used for secured loans or revolving credit facilities, ensuring lower risk for lenders with examples like syndicated loans. Subordinated debt ranks below senior debt in repayment hierarchy, often utilized in mezzanine financing or as part of leveraged buyouts, offering higher yields due to increased risk. Your capital structure strategy benefits from understanding these distinctions, as traditional debt provides general financing, while senior and subordinated debts balance risk and return profiles effectively.

Choosing Between Senior and Subordinated Debt

Senior debt holds priority claim on assets and income during liquidation, offering lower risk and typically lower interest rates than subordinated debt. Subordinated debt ranks below senior debt in repayment order, carrying higher risk but providing higher interest rates to compensate investors. Choosing between senior and subordinated debt depends on balancing risk tolerance, cost of capital, and the company's capital structure needs.

Infographic: Senior Debt vs Subordinated Debt

relatioo.com

relatioo.com