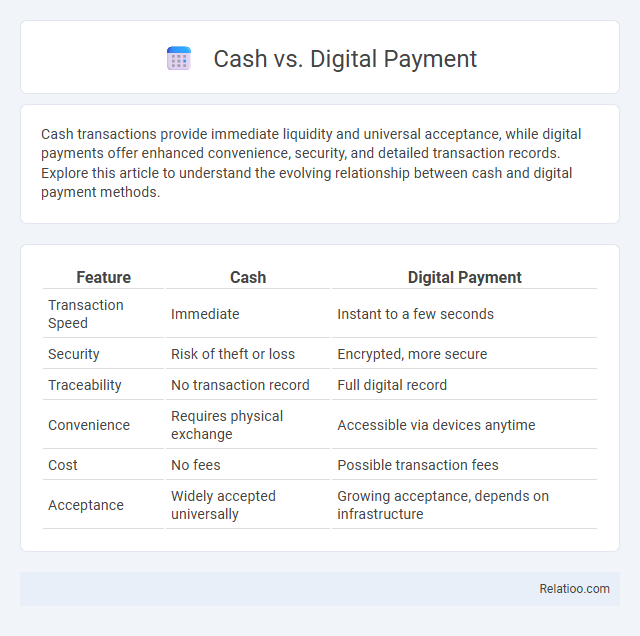

Cash transactions provide immediate liquidity and universal acceptance, while digital payments offer enhanced convenience, security, and detailed transaction records. Explore this article to understand the evolving relationship between cash and digital payment methods.

Table of Comparison

| Feature | Cash | Digital Payment |

|---|---|---|

| Transaction Speed | Immediate | Instant to a few seconds |

| Security | Risk of theft or loss | Encrypted, more secure |

| Traceability | No transaction record | Full digital record |

| Convenience | Requires physical exchange | Accessible via devices anytime |

| Cost | No fees | Possible transaction fees |

| Acceptance | Widely accepted universally | Growing acceptance, depends on infrastructure |

Understanding Cash and Digital Payment Methods

Cash offers immediate, tangible transactions with no need for electronic devices, making it universally accessible. Digital payment methods leverage technology like mobile apps, credit cards, and online platforms, providing speed, convenience, and enhanced security features. Your choice between cash and digital payments depends on factors such as transaction speed, privacy preferences, and the availability of electronic infrastructure.

Evolution of Payment Systems

The evolution of payment systems has transitioned from traditional cash transactions to digital payment platforms, enhancing convenience, speed, and security in financial exchanges. Digital payments leverage technologies such as mobile wallets, blockchain, and contactless cards, reducing reliance on physical currency and expanding access to global markets. In parallel, chore compensation systems have integrated digital methods, enabling seamless and transparent transfer of value for personal services, reflecting a shift towards cashless and automated financial interactions.

Security Considerations: Cash vs Digital Payments

Cash transactions offer anonymity and immediate settlement but pose risks like theft and loss since there is no recourse once the money is gone. Digital payments provide encrypted transactions, fraud detection, and the ability to track spending, enhancing security and reducing the chances of unauthorized access. Your choice between cash and digital payment methods should weigh convenience against the level of protection needed for your financial activities.

Transaction Speed and Convenience

Cash transactions offer immediate settlement but require physical presence, limiting convenience compared to digital payments. Digital payment methods provide rapid transaction speeds and the convenience of remote access via mobile devices or online platforms. Your choice impacts efficiency, with chore compensation systems often integrating digital payments for quick, traceable settlements.

Accessibility and Inclusivity

Cash remains universally accessible, especially for those without smartphones or bank accounts, ensuring financial inclusion across all demographics. Digital payments offer convenience and speed but require internet access and digital literacy, which can exclude vulnerable populations such as the elderly or low-income individuals. Your choice between cash, digital options, or chore compensation should prioritize accessibility to accommodate diverse needs and promote inclusive participation.

Cost Implications for Consumers and Businesses

Cash payments often incur costs related to handling, storage, and security for businesses, while consumers may face withdrawal fees and limited tracking capabilities. Digital payments reduce operational expenses through automation and faster transactions but can involve processing fees and potential cybersecurity risks that impact both parties. Chore compensation systems, typically used in informal settings, minimize direct financial costs but may limit scalability and formal economic benefits for Your transactions.

Impact on Personal Financial Management

Cash payments offer immediate liquidity and straightforward budgeting but can complicate tracking expenditures over time. Digital payments enable detailed transaction records and easier expense categorization, enhancing financial planning and accountability. Chore compensation systems introduce non-monetary value exchange, fostering financial discipline and responsibility without direct cash flow impact.

Privacy and Data Concerns

Cash payments ensure maximum privacy by leaving no digital trail, protecting users from data breaches and unauthorized tracking. Digital payments, although convenient, generate extensive transaction data that raises concerns over data privacy, potential profiling, and third-party access. Chore compensation platforms often collect personal and behavioral data, increasing risks related to privacy invasion and misuse without stringent data protection measures.

The Role of Technology in Shaping Payment Preferences

Technology revolutionizes payment preferences by increasing the accessibility and convenience of digital payments through smartphones and contactless cards. Cash remains relevant for anonymity and immediate settlement, but digital platforms offer real-time tracking and security features that cater to your evolving financial habits. Chore compensation apps leverage technology to automate earnings, fostering accountability and seamless transactions within households or communities.

Future Trends in Payment Methods

Future trends in payment methods reveal a strong shift towards digital payments driven by advancements in blockchain technology, mobile wallets, and contactless transactions. Cash usage is rapidly declining as consumers and businesses prioritize convenience, security, and speed offered by cryptocurrencies and instant payment platforms. Chore compensation is increasingly integrated into digital ecosystems, leveraging smart contracts and tokenization to create transparent, automated reward systems that align with the growing gig economy.

Infographic: Cash vs Digital Payment

relatioo.com

relatioo.com