The Balance Sheet provides a snapshot of a company's financial position at a specific point in time, detailing assets, liabilities, and equity. The Income Statement reveals profitability over a period by showing revenues, expenses, and net income; explore how these reports interrelate to assess financial health in this article.

Table of Comparison

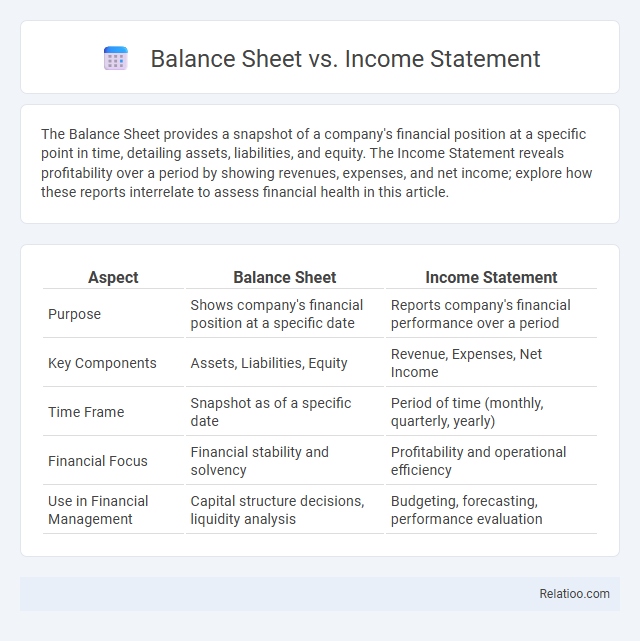

| Aspect | Balance Sheet | Income Statement |

|---|---|---|

| Purpose | Shows company's financial position at a specific date | Reports company's financial performance over a period |

| Key Components | Assets, Liabilities, Equity | Revenue, Expenses, Net Income |

| Time Frame | Snapshot as of a specific date | Period of time (monthly, quarterly, yearly) |

| Financial Focus | Financial stability and solvency | Profitability and operational efficiency |

| Use in Financial Management | Capital structure decisions, liquidity analysis | Budgeting, forecasting, performance evaluation |

Understanding the Balance Sheet

The balance sheet provides a snapshot of your company's financial position at a specific point in time, detailing assets, liabilities, and equity to help assess stability and liquidity. Unlike the income statement, which summarizes revenue and expenses over a period to show profitability, the balance sheet reveals how your resources are funded and allocated. Understanding the balance sheet is essential for analyzing solvency and making informed financial decisions within the broader context of the financial statement.

What Is an Income Statement?

An income statement, also known as a profit and loss statement, summarizes your company's revenues and expenses over a specific period, highlighting net profit or loss. Unlike the balance sheet, which provides a snapshot of assets, liabilities, and equity at a single point in time, the income statement focuses on operational performance and profitability. It forms a critical part of your overall financial statements, helping you evaluate business performance and make informed financial decisions.

Key Components of a Balance Sheet

The key components of a Balance Sheet include assets, liabilities, and shareholders' equity, providing a snapshot of a company's financial position at a specific point in time. Assets are divided into current and non-current categories, reflecting what the company owns and can use to generate revenue. Liabilities indicate the company's obligations, while shareholders' equity represents the owners' residual interest after liabilities are deducted.

Major Elements of an Income Statement

The major elements of an Income Statement include revenues, expenses, gains, and losses, which collectively determine Your net income or net loss over a specific period. Unlike the Balance Sheet, which details assets, liabilities, and equity at a single point in time, the Income Statement reflects financial performance dynamically. The Income Statement is a core component of the broader Financial Statement package, providing critical insight into profitability that complements the balance sheet's snapshot of financial position.

Purpose and Significance of the Balance Sheet

The Balance Sheet provides a snapshot of Your company's financial position at a specific point in time, detailing assets, liabilities, and equity to assess solvency and liquidity. Unlike the Income Statement, which tracks profitability over a period by summarizing revenues and expenses, the Balance Sheet highlights financial stability and resource allocation. As a key component of the Financial Statement, the Balance Sheet is crucial for investors and creditors to evaluate Your company's ability to meet long-term obligations and sustain operations.

Purpose and Significance of the Income Statement

The Income Statement provides a detailed summary of Your company's revenues, expenses, and net profit over a specific period, highlighting operational performance and profitability. Unlike the Balance Sheet, which snapshots assets, liabilities, and equity at a point in time, the Income Statement reveals how efficiently the business generates income and manages costs. Financial Statements as a whole include both these documents, but the Income Statement's purpose is crucial for assessing growth potential and informing investment decisions.

Main Differences Between Balance Sheet and Income Statement

The main differences between the balance sheet and income statement lie in the information they provide: the balance sheet presents Your company's financial position at a specific point in time by detailing assets, liabilities, and shareholders' equity, while the income statement shows financial performance over a period, highlighting revenue, expenses, and net profit or loss. The balance sheet reflects accumulated financial data and stability, whereas the income statement focuses on operational results and profitability. Together, these statements form critical components of the broader financial statement used to assess overall business health.

How Investors Use Balance Sheets vs Income Statements

Investors analyze balance sheets to evaluate a company's financial health by assessing assets, liabilities, and equity, which reveals its stability and long-term solvency. Income statements provide insight into profitability and operational performance over a specific period, highlighting revenue growth and expense management. Together, these financial statements offer complementary perspectives, enabling investors to make informed decisions about the company's past performance and future potential.

Common Misconceptions About Financial Statements

Many people mistakenly believe the balance sheet, income statement, and financial statement are interchangeable, but each serves a distinct purpose: the balance sheet shows assets, liabilities, and equity at a specific point, while the income statement details revenue and expenses over a period. Financial statements broadly encompass these reports, providing a comprehensive overview of a company's financial health. Understanding these differences helps you avoid misinterpreting financial data and make better business decisions.

Choosing the Right Financial Statement for Analysis

Choosing the right financial statement for analysis depends on your specific objectives: a balance sheet provides a snapshot of a company's assets, liabilities, and equity at a given date, essential for assessing financial stability, while the income statement focuses on revenue, expenses, and profitability over a period, crucial for evaluating operational performance. Financial statements collectively offer comprehensive insights, but understanding the unique purpose of each--balance sheet, income statement, and cash flow statement--ensures you analyze relevant data accurately and make informed decisions. Your choice should align with whether you need to measure liquidity, profitability, or overall financial health.

Infographic: Balance Sheet vs Income Statement

relatioo.com

relatioo.com