Earned income from wages and salaries provides consistent cash flow, while investment income from dividends, interest, and capital gains offers potential for passive growth and wealth accumulation. Discover how balancing both income types can strengthen your financial relationship in this article.

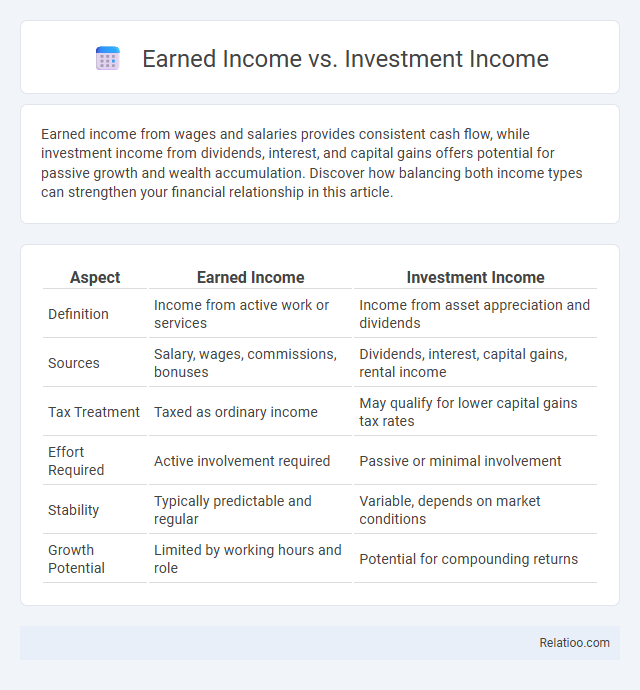

Table of Comparison

| Aspect | Earned Income | Investment Income |

|---|---|---|

| Definition | Income from active work or services | Income from asset appreciation and dividends |

| Sources | Salary, wages, commissions, bonuses | Dividends, interest, capital gains, rental income |

| Tax Treatment | Taxed as ordinary income | May qualify for lower capital gains tax rates |

| Effort Required | Active involvement required | Passive or minimal involvement |

| Stability | Typically predictable and regular | Variable, depends on market conditions |

| Growth Potential | Limited by working hours and role | Potential for compounding returns |

Understanding Earned Income

Earned income refers to the money received from active work such as wages, salaries, bonuses, and self-employment earnings, which is subject to payroll taxes like Social Security and Medicare. Unlike investment income, which includes dividends, interest, and capital gains generated passively from financial assets, earned income requires continuous labor input. Understanding earned income is crucial for tax planning and financial management because it impacts eligibility for various deductions, tax credits, and retirement contributions more directly than unearned income sources.

What Is Investment Income?

Investment income refers to earnings generated from assets such as stocks, bonds, real estate, or mutual funds, including dividends, interest, and capital gains. Unlike earned income, which comes from wages or salaries for services performed, investment income is typically passive and dependent on the performance of your financial assets. Understanding the distinction between earned income and investment income helps you optimize tax strategies and grow your wealth effectively.

Key Differences Between Earned and Investment Income

Earned income is money you receive from active work such as wages, salaries, tips, and commissions, while investment income comes from passive sources like dividends, interest, and capital gains. Key differences include tax treatment, where earned income is subject to payroll taxes and higher tax rates, whereas investment income often benefits from lower tax rates and tax deferral opportunities. Understanding these distinctions helps you optimize your financial strategy and tax planning effectively.

Tax Implications of Earned Income

Earned income, derived from wages, salaries, and self-employment, is subject to payroll taxes including Social Security and Medicare, making its tax implications more significant compared to investment income, which is generally taxed at capital gains rates or qualified dividend rates. Investment income, such as dividends, interest, and capital gains, often benefits from lower tax rates and can be deferred or minimized through strategic planning. Your earned income's higher tax burden requires careful consideration to optimize deductions and tax credits that can reduce overall liabilities.

Tax Treatment of Investment Income

Investment income, including dividends, interest, and capital gains, is typically taxed differently than earned income, which comes from wages or salaries. While earned income is subject to ordinary income tax rates and payroll taxes, investment income may qualify for lower capital gains tax rates or qualified dividend tax rates, depending on holding periods and income brackets. Tax-efficient strategies often focus on maximizing after-tax returns by leveraging the preferential treatment of long-term capital gains and tax-advantaged accounts such as IRAs and 401(k)s.

Examples of Earned vs Investment Income

Earned income includes wages, salaries, tips, and self-employment earnings, such as a software engineer's paycheck or a freelance graphic designer's fees. Investment income consists of dividends from stocks, interest from savings accounts, and capital gains from selling assets like real estate or securities. Differentiating examples clarify that earned income arises from active work, while investment income is generated passively through asset ownership.

Pros and Cons of Earned Income

Earned income, including wages, salaries, and tips, provides stable cash flow and often qualifies for employer benefits like health insurance and retirement plans, but it is typically taxed at higher ordinary income rates compared to investment income. Investment income, derived from dividends, interest, and capital gains, benefits from lower tax rates and passive earning potential, while earned income requires active work and time commitment. The main drawback of earned income is its dependence on continuous labor, limiting financial scalability and exposure to income loss if employment ends.

Pros and Cons of Investment Income

Investment income offers the advantage of potential passive earnings through dividends, interest, and capital gains, enabling wealth growth without active work. However, it carries risks such as market volatility, potential loss of principal, and tax complexities that can reduce net returns. Unlike earned income, which is more stable and predictable, investment income requires strategic management to maximize benefits while minimizing financial exposure.

Strategies to Increase Investment Income

Strategies to increase investment income include diversifying portfolios across stocks, bonds, and real estate to balance risk and return while maximizing passive earnings. Utilizing tax-advantaged accounts such as IRAs or 401(k)s helps compound growth and reduces taxable income. Regularly reinvesting dividends and interest payments accelerates wealth accumulation by leveraging the power of compound interest over time.

Choosing the Right Income Source for Financial Goals

Understanding the differences between earned income, investment income, and general income is crucial for choosing the right income source that aligns with your financial goals. Earned income, derived from wages or salaries, provides steady cash flow and is essential for daily living expenses, while investment income, including dividends, interest, and capital gains, offers potential for wealth growth and passive earnings. You should evaluate your risk tolerance, time horizon, and liquidity needs to balance these income sources effectively for optimized financial planning.

Infographic: Earned Income vs Investment Income

relatioo.com

relatioo.com