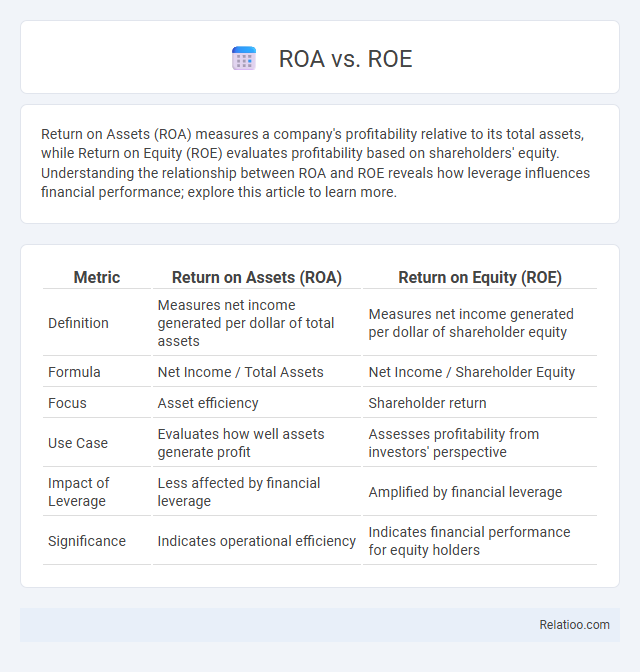

Return on Assets (ROA) measures a company's profitability relative to its total assets, while Return on Equity (ROE) evaluates profitability based on shareholders' equity. Understanding the relationship between ROA and ROE reveals how leverage influences financial performance; explore this article to learn more.

Table of Comparison

| Metric | Return on Assets (ROA) | Return on Equity (ROE) |

|---|---|---|

| Definition | Measures net income generated per dollar of total assets | Measures net income generated per dollar of shareholder equity |

| Formula | Net Income / Total Assets | Net Income / Shareholder Equity |

| Focus | Asset efficiency | Shareholder return |

| Use Case | Evaluates how well assets generate profit | Assesses profitability from investors' perspective |

| Impact of Leverage | Less affected by financial leverage | Amplified by financial leverage |

| Significance | Indicates operational efficiency | Indicates financial performance for equity holders |

Introduction to ROA and ROE

ROA (Return on Assets) measures how efficiently a company uses its assets to generate profit, providing insight into operational performance. ROE (Return on Equity) evaluates the return generated on shareholders' investment, reflecting profitability from the owners' perspective. Understanding these metrics helps you assess a company's financial health and investment potential.

Defining Return on Assets (ROA)

Return on Assets (ROA) measures how efficiently a company uses its assets to generate net income, calculated by dividing net profit by total assets. This metric indicates your ability to convert investments in assets into profitable operations, providing insight into overall operational efficiency. ROA differs from Return on Equity (ROE), which focuses on profitability relative to shareholder equity, while "Return" broadly refers to any financial gain from investments.

Understanding Return on Equity (ROE)

Return on Equity (ROE) measures a company's profitability by revealing how much profit is generated with shareholders' equity, making it a critical indicator of financial performance. Unlike Return on Assets (ROA), which evaluates efficiency by comparing net income to total assets, ROE focuses specifically on the return earned on invested capital by equity holders. Understanding ROE helps investors assess how effectively management is using equity financing to maximize returns and drive shareholder value.

Key Differences Between ROA and ROE

ROA (Return on Assets) measures a company's profitability relative to its total assets, indicating how efficiently management uses assets to generate earnings, while ROE (Return on Equity) assesses profitability based on shareholders' equity, reflecting returns to equity investors. ROA includes both debt and equity financing in its calculation, making it a broader measure of efficiency, whereas ROE focuses solely on equity, emphasizing financial leverage's impact on returns. The key difference lies in ROA's ability to evaluate asset utilization regardless of financing structure, contrasted with ROE's sensitivity to debt levels and equity investment performance.

Calculation Methods for ROA and ROE

Return on Assets (ROA) is calculated by dividing net income by total assets, measuring how efficiently a company uses its assets to generate profit. Return on Equity (ROE) is computed by dividing net income by shareholders' equity, indicating the profitability relative to shareholders' investments. Both metrics are key indicators of financial performance but focus on different aspects of a company's capital structure.

Interpreting ROA and ROE Figures

ROA (Return on Assets) measures a company's ability to generate profit from its total assets, indicating asset efficiency, while ROE (Return on Equity) assesses profitability relative to shareholder equity, reflecting how effectively equity capital is used. Interpreting ROA involves analyzing how well management utilizes assets to produce earnings, with higher ROA signaling efficient asset use and operational performance. ROE interpretation centers on the return generated on shareholders' investment, where a high ROE indicates strong financial leverage and profitability, but must be compared against industry benchmarks to assess sustainability and risk.

Industry Benchmarks for ROA and ROE

ROA (Return on Assets) and ROE (Return on Equity) are crucial financial ratios used to evaluate a company's profitability relative to its assets and shareholders' equity, respectively, with industry benchmarks varying significantly by sector. For instance, manufacturing industries typically exhibit ROA benchmarks around 5-7%, while technology firms often achieve higher ROE benchmarks of 15-20% due to leveraging equity more aggressively. Understanding these benchmarks enables you to assess your company's financial efficiency and performance compared to industry standards, guiding strategic decisions for improvement.

Pros and Cons of ROA and ROE

Return on Assets (ROA) measures how efficiently a company uses its assets to generate profit, offering a broad perspective on operational efficiency but may undervalue firms with high leverage. Return on Equity (ROE) focuses on profitability relative to shareholders' equity, highlighting the return generated for investors but can be inflated by excessive debt. ROA provides a conservative view of performance by accounting for total asset utilization, while ROE emphasizes investor return but carries the risk of obscuring financial health in highly leveraged companies.

Using ROA vs ROE in Investment Analysis

Return on Assets (ROA) measures a company's profitability relative to its total assets, indicating how efficiently management uses assets to generate earnings. Return on Equity (ROE) focuses on the return generated on shareholders' equity, highlighting financial leverage and the effectiveness of equity investment. Investors use ROA to assess operational efficiency, while ROE provides insight into the company's financial structure and risk, making both metrics essential for comprehensive investment analysis.

Conclusion: Choosing the Right Metric

Return on Assets (ROA) measures a company's efficiency in generating profit from its total assets, while Return on Equity (ROE) highlights the profitability relative to shareholders' equity, emphasizing financial leverage. Investors should prioritize ROA when assessing operational efficiency regardless of capital structure, whereas ROE is more suitable for analyzing returns on invested shareholder funds and the impact of debt. Selecting the right metric depends on the evaluation context--use ROA for asset utilization insight and ROE for equity performance, both critical for a comprehensive financial analysis.

Infographic: ROA vs ROE

relatioo.com

relatioo.com