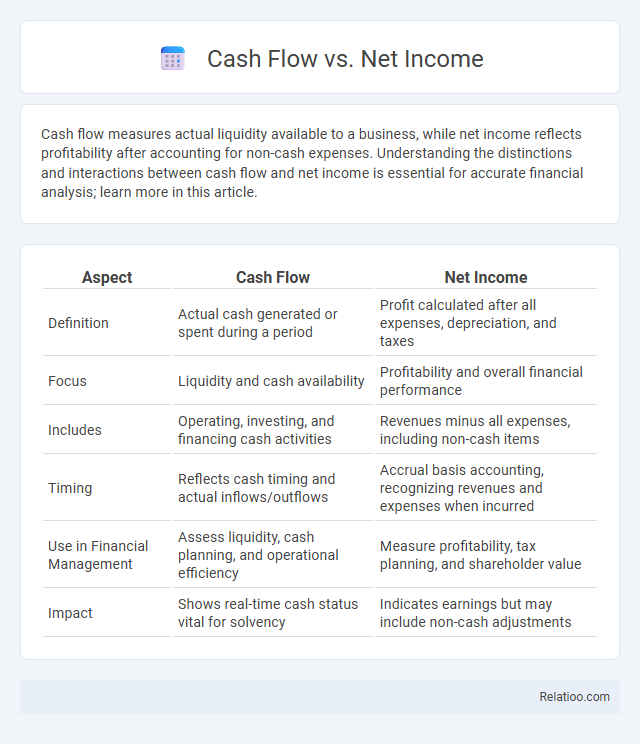

Cash flow measures actual liquidity available to a business, while net income reflects profitability after accounting for non-cash expenses. Understanding the distinctions and interactions between cash flow and net income is essential for accurate financial analysis; learn more in this article.

Table of Comparison

| Aspect | Cash Flow | Net Income |

|---|---|---|

| Definition | Actual cash generated or spent during a period | Profit calculated after all expenses, depreciation, and taxes |

| Focus | Liquidity and cash availability | Profitability and overall financial performance |

| Includes | Operating, investing, and financing cash activities | Revenues minus all expenses, including non-cash items |

| Timing | Reflects cash timing and actual inflows/outflows | Accrual basis accounting, recognizing revenues and expenses when incurred |

| Use in Financial Management | Assess liquidity, cash planning, and operational efficiency | Measure profitability, tax planning, and shareholder value |

| Impact | Shows real-time cash status vital for solvency | Indicates earnings but may include non-cash adjustments |

Understanding Cash Flow: Definition and Key Components

Cash flow represents the actual inflow and outflow of cash within a business during a specific period, encompassing operating, investing, and financing activities, which directly impact liquidity and financial health. Net income measures profitability by calculating total revenues minus total expenses, including non-cash items like depreciation, offering insight into overall performance but not cash availability. Understanding cash flow is critical for assessing a company's ability to meet short-term obligations, invest in growth, and sustain operations independently from accounting profits reflected in net income.

What is Net Income? Breaking Down the Basics

Net income represents a company's total profit after deducting all expenses, taxes, and costs from total revenue, reflecting the bottom-line profitability on the income statement. It differs from cash flow, which tracks the actual inflow and outflow of cash within a business over a period, highlighting liquidity rather than profitability. Understanding net income helps investors gauge operational efficiency and profitability, while cash flow offers insights into a company's ability to sustain operations and manage financial obligations.

Core Differences Between Cash Flow and Net Income

Cash flow measures the actual inflow and outflow of cash within a business during a specific period, reflecting liquidity and operational efficiency, while net income represents the profit after all expenses, including non-cash items like depreciation and amortization, are deducted from total revenue. Cash flow provides a clear picture of a company's ability to generate cash to meet short-term obligations, whereas net income focuses on profitability accounting principles under accrual accounting. The core difference lies in cash flow's emphasis on liquidity versus net income's focus on overall financial performance and profitability.

Why Cash Flow Matters for Business Survival

Cash flow represents the actual liquidity available for daily operations, while net income reflects the company's profitability over a period, including non-cash items like depreciation. Positive cash flow ensures a business can meet immediate obligations such as payroll, rent, and supplier payments, which is critical for survival and avoiding insolvency. Even profitable companies with strong net income can fail if they experience poor cash flow management, highlighting cash flow's essential role in sustaining operational stability.

The Role of Net Income in Financial Reporting

Net income represents a company's profitability by calculating total revenues minus expenses, providing a key metric for financial reporting and performance evaluation. Unlike cash flow, which tracks actual cash movement in and out of the business, net income includes non-cash items like depreciation and accounts receivable adjustments, affecting reported earnings but not immediate liquidity. Understanding net income's role helps investors and stakeholders assess a company's operational efficiency and long-term financial health beyond just cash availability.

How Cash Flow and Net Income Are Calculated

Cash flow is calculated by adjusting net income for non-cash expenses, changes in working capital, and operating activities cash inflows and outflows, providing a measure of actual cash generated or used by a business. Net income is determined by subtracting total expenses, including operating costs, interest, taxes, and depreciation, from total revenue, reflecting profitability according to accrual accounting principles. Understanding the difference between cash flow and net income is crucial for assessing a company's liquidity versus its accounting profitability.

Common Misconceptions: Cash Flow vs Net Income

Many confuse cash flow with net income, but they represent different financial metrics; net income reflects profitability based on accounting principles, including non-cash items like depreciation, while cash flow indicates the actual cash generated or used in operations. A positive net income does not guarantee positive cash flow since revenue recognition can precede cash collection, leading to discrepancies. Understanding the distinction is critical for accurate financial analysis and business decision-making.

Real-Life Examples: Comparing Cash Flow and Net Income

Cash flow represents the actual cash generated or used by a business during a period, while net income accounts for revenue minus expenses, including non-cash items like depreciation. For instance, a profitable company with high net income may still face cash flow problems if its receivables are not collected promptly. A retail store showing strong net income due to accrued sales might struggle to pay suppliers on time if its operating cash flow is negative, highlighting the importance of monitoring cash flow alongside net income in real-life business management.

Cash Flow and Net Income in Financial Decision-Making

Cash flow represents the actual inflow and outflow of cash in your business, reflecting liquidity and operational efficiency, while net income indicates profitability after all expenses have been deducted. For sound financial decision-making, prioritizing cash flow ensures you can meet immediate obligations and invest in growth, whereas net income highlights overall profitability trends. Balancing both metrics provides a comprehensive picture to guide budgeting, forecasting, and strategic planning.

Tips for Managing Both Cash Flow and Net Income Effectively

Maintaining accurate cash flow and net income records requires regular monitoring of accounts receivable and payable to avoid liquidity issues and ensure profitability. Implementing a detailed budgeting process with realistic revenue and expense projections helps balance cash inflows and outflows while optimizing net income margins. Utilizing financial software tools enables real-time tracking and forecasting, supporting informed decision-making for sustainable business growth.

Infographic: Cash Flow vs Net Income

relatioo.com

relatioo.com