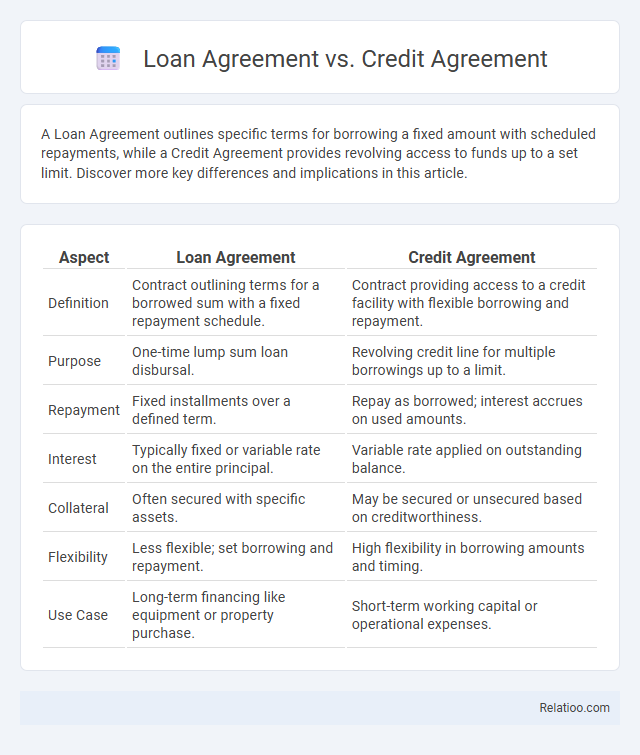

A Loan Agreement outlines specific terms for borrowing a fixed amount with scheduled repayments, while a Credit Agreement provides revolving access to funds up to a set limit. Discover more key differences and implications in this article.

Table of Comparison

| Aspect | Loan Agreement | Credit Agreement |

|---|---|---|

| Definition | Contract outlining terms for a borrowed sum with a fixed repayment schedule. | Contract providing access to a credit facility with flexible borrowing and repayment. |

| Purpose | One-time lump sum loan disbursal. | Revolving credit line for multiple borrowings up to a limit. |

| Repayment | Fixed installments over a defined term. | Repay as borrowed; interest accrues on used amounts. |

| Interest | Typically fixed or variable rate on the entire principal. | Variable rate applied on outstanding balance. |

| Collateral | Often secured with specific assets. | May be secured or unsecured based on creditworthiness. |

| Flexibility | Less flexible; set borrowing and repayment. | High flexibility in borrowing amounts and timing. |

| Use Case | Long-term financing like equipment or property purchase. | Short-term working capital or operational expenses. |

Introduction to Loan Agreements and Credit Agreements

Loan agreements and credit agreements are fundamental legal contracts outlining the terms and conditions for borrowing money. A loan agreement typically involves a lump sum disbursed upfront with a fixed repayment schedule and interest rate, whereas a credit agreement provides a revolving credit line allowing You to borrow, repay, and borrow again up to a predetermined limit. Understanding the distinctions between these agreements helps in managing Your financial obligations and selecting the appropriate borrowing structure for Your needs.

Defining Loan Agreements

Loan agreements are legally binding contracts that outline the terms and conditions under which a lender provides funds to a borrower, specifying repayment schedules, interest rates, and default consequences. Unlike credit agreements that often detail revolving credit lines or credit facility terms, loan agreements define fixed amounts and fixed repayment plans tailored to specific borrowing needs. Understanding the distinctions between loan agreements, credit agreements, and broader financial agreements helps you choose the right contract for your financing requirements.

Understanding Credit Agreements

Credit agreements outline the specific terms under which a lender extends credit to a borrower, detailing the credit limit, interest rates, repayment schedules, and covenants. Unlike loan agreements, which typically involve a lump sum disbursement payable over a fixed term, credit agreements often provide revolving credit, allowing borrowers to draw and repay funds as needed. Understanding credit agreements is crucial for managing revolving credit facilities, ensuring compliance with terms that protect both parties while maintaining financial flexibility.

Key Differences Between Loan and Credit Agreements

Loan agreements specify a fixed amount borrowed with a set repayment schedule and interest rate, while credit agreements provide a revolving credit limit allowing repeated borrowing up to the limit. Loan agreements often involve lump-sum disbursements and fixed terms, whereas credit agreements offer flexibility in borrowing and repayment amounts within the credit limit. Financial agreements encompass both loan and credit agreements but may also include broader terms relating to financial transactions and obligations between parties.

Legal Framework and Regulatory Considerations

Loan agreements establish specific terms for borrowing principal amounts, governed primarily by contract law and banking regulations that dictate interest rates, repayment schedules, and default clauses. Credit agreements often include revolving credit lines or credit limits with regulatory oversight from consumer protection laws and financial supervisory authorities to prevent usury and ensure transparency. Financial agreements encompass a broader scope of contracts involving various financial instruments, subject to securities laws, commercial codes, and regulatory agencies to manage risk, disclosure, and compliance requirements within financial markets.

Typical Terms and Conditions in Loan Agreements

Loan agreements typically specify principal amount, interest rate, repayment schedule, and collateral requirements, ensuring clarity on borrower obligations and lender protections. Credit agreements often include credit limits, usage terms, and conditions for revolving credit, emphasizing flexibility in borrowing. Financial agreements encompass a broader range of contracts, detailing payment terms, financial covenants, and default remedies tailored to specific financial transactions.

Typical Terms and Conditions in Credit Agreements

Credit Agreements commonly include terms such as interest rates, repayment schedules, credit limits, and default consequences, which are essential to managing Your obligations and protecting lender rights. Loan Agreements typically specify the loan amount, disbursement details, and collateral requirements, focusing on the direct borrowing terms between the lender and borrower. Financial Agreements broadly cover various financial transactions and may integrate clauses from both credit and loan agreements, but credit agreements remain distinct due to their revolving nature and detailed credit-specific provisions.

Use Cases: When to Choose a Loan vs. a Credit Agreement

A Loan Agreement is ideal for fixed amounts with set repayment schedules, typically used for large, one-time expenses like buying a home or financing equipment. A Credit Agreement suits ongoing borrowing needs such as working capital or revolving credit, providing flexibility to draw and repay funds repeatedly. Understanding your financial requirements helps you choose the right contract, ensuring Your borrowing aligns with either fixed repayment or continuous access to funds.

Risks and Benefits of Loan and Credit Agreements

Loan agreements outline specific terms for borrowing a fixed sum with scheduled repayments and interest rates, offering predictable costs but exposing you to default risk if payments are missed. Credit agreements provide flexible access to funds up to a limit, enabling ongoing borrowing and repayment, yet carry risks of variable interest rates and potential debt escalation. Understanding these agreements helps you manage financial commitments effectively while balancing liquidity needs against repayment obligations.

Conclusion: Selecting the Right Financial Agreement

Choosing the right financial agreement depends on your specific borrowing needs, risk tolerance, and repayment capacity. Loan agreements typically offer fixed terms and amounts, while credit agreements provide flexible access to funds up to a credit limit, and financial agreements may include broader terms covering various financial transactions. Understanding these distinctions helps you secure favorable terms and manage your financial obligations effectively.

Infographic: Loan Agreement vs Credit Agreement

relatioo.com

relatioo.com