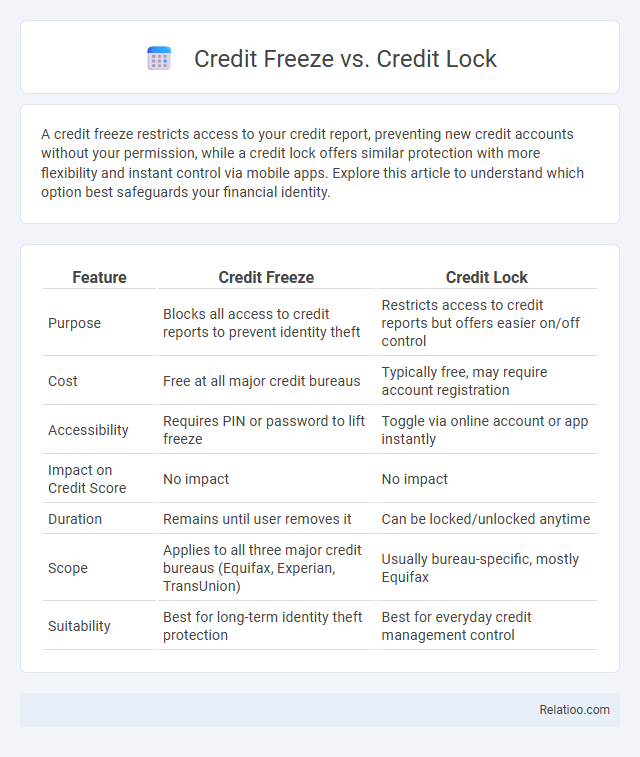

A credit freeze restricts access to your credit report, preventing new credit accounts without your permission, while a credit lock offers similar protection with more flexibility and instant control via mobile apps. Explore this article to understand which option best safeguards your financial identity.

Table of Comparison

| Feature | Credit Freeze | Credit Lock |

|---|---|---|

| Purpose | Blocks all access to credit reports to prevent identity theft | Restricts access to credit reports but offers easier on/off control |

| Cost | Free at all major credit bureaus | Typically free, may require account registration |

| Accessibility | Requires PIN or password to lift freeze | Toggle via online account or app instantly |

| Impact on Credit Score | No impact | No impact |

| Duration | Remains until user removes it | Can be locked/unlocked anytime |

| Scope | Applies to all three major credit bureaus (Equifax, Experian, TransUnion) | Usually bureau-specific, mostly Equifax |

| Suitability | Best for long-term identity theft protection | Best for everyday credit management control |

Understanding Credit Freeze and Credit Lock

A credit freeze restricts access to your credit report, preventing new creditors from viewing it without your permission, thus blocking unauthorized credit inquiries and reducing the risk of identity theft. A credit lock offers similar protection but is typically more flexible and can be toggled on or off instantly through the credit bureau's app or website, providing greater convenience for your ongoing credit management. Understanding these tools helps you control who accesses your credit information, safeguarding your financial reputation while allowing you to manage credit report accessibility effectively.

Key Differences Between Credit Freeze and Credit Lock

A credit freeze restricts access to your credit report, preventing lenders from viewing it without your explicit permission, which offers strong protection against identity theft but can take time to lift. A credit lock provides more flexible and instantaneous control over your credit file via mobile apps or websites, allowing you to lock and unlock your report quickly, though it may not be as legally regulated as a freeze. Your credit report is a detailed record of your credit history that both a freeze and lock aim to protect, but understanding the key differences helps you choose the best method to secure your financial information.

How a Credit Freeze Works

A credit freeze restricts access to your credit report, preventing lenders from viewing it without your explicit permission, thereby protecting against unauthorized credit inquiries and identity theft. Unlike a credit lock, which is a service offered by credit bureaus with varying terms and fees, a credit freeze is regulated by law and available for free. To lift a freeze, consumers must use a PIN or password to authorize access, ensuring tighter control over who can check their credit information.

How a Credit Lock Works

A credit lock restricts access to your credit report through the credit bureaus' proprietary systems, allowing you to quickly block or unblock access via an app or website. Unlike a credit freeze, which is regulated by law and often free, credit locks may require a subscription fee and provide more immediate control over your credit data. Locking your credit prevents new creditors from viewing your information, reducing the risk of identity theft and unauthorized credit inquiries.

Pros and Cons of Credit Freezes

Credit freezes prevent lenders from accessing your credit report, significantly reducing the risk of identity theft but requiring you to lift the freeze each time you apply for credit, which can be time-consuming. Unlike credit locks, freezes are free by law and offer stronger legal protections under the Fair Credit Reporting Act, though they may delay credit approval processes. Your credit report remains accessible to existing creditors and certain government agencies, so while freezes enhance security, they do not block all possible credit inquiries.

Pros and Cons of Credit Locks

Credit locks offer a quick and easy way to restrict access to your credit report, providing superior convenience without the formalities required for credit freezes. They allow instant access toggling through mobile apps or websites, minimizing wait times for consumers but may not have the same legal protections as credit freezes under the Fair Credit Reporting Act (FCRA). While credit freezes are free and offer stronger security by legally preventing credit checks, credit locks can expose users to potential risks if the service provider's platform or app experiences vulnerabilities.

Which Option Is More Secure?

A credit freeze offers the highest level of security by completely restricting access to your credit report, making it nearly impossible for identity thieves to open new accounts in your name without your consent. A credit lock provides similar protection but is typically easier to toggle on and off via mobile apps or websites, though it may not be governed by federal law, potentially affecting its reliability. Reviewing your credit report regularly gives you insight into your credit status but does not prevent unauthorized access, so for maximum protection, a credit freeze is generally the most secure choice for safeguarding your credit.

Costs and Accessibility

Credit freezes are typically free and prevent creditors from accessing your credit report without your permission, ensuring maximum security but requiring you to lift the freeze when applying for new credit. Credit locks offer similar protection but may come with monthly fees through private services, providing more flexibility with instant locking and unlocking via apps or websites. Your credit report is accessible annually for free from major bureaus and can be purchased more frequently, giving you insight into your credit history without restricting access to lenders.

Steps to Set Up a Credit Freeze or Lock

To set up a credit freeze, you must contact each of the three major credit bureaus--Experian, Equifax, and TransUnion--either online, by phone, or by mail, providing your personal information and identity verification documents. Setting up a credit lock generally involves enrolling in a credit monitoring service offered by the bureaus, allowing you to control access to your credit report instantly via an app or website. Your choice depends on how quickly you want to restrict access: a freeze is a formal, free action requiring manual lifts, while a lock offers more flexible, immediate control but often comes with a subscription fee.

Choosing the Best Protection for Your Credit

Credit freeze offers the strongest protection by restricting access to your credit report, making it nearly impossible for identity thieves to open new accounts without your permission. Credit locks provide flexible, convenient control over your credit file access through a mobile app or website but may not offer the same legal protections as freezes. Regularly monitoring your credit report allows you to spot fraudulent activity early, but combining monitoring with a freeze or lock provides comprehensive defense against identity theft and unauthorized credit inquiries.

Infographic: Credit Freeze vs Credit Lock

relatioo.com

relatioo.com