Contribution in relationships involves mutual effort and shared growth, while donation implies one-sided giving without expectation of return. Discover how balancing contribution and donation impacts relationship health in this article.

Table of Comparison

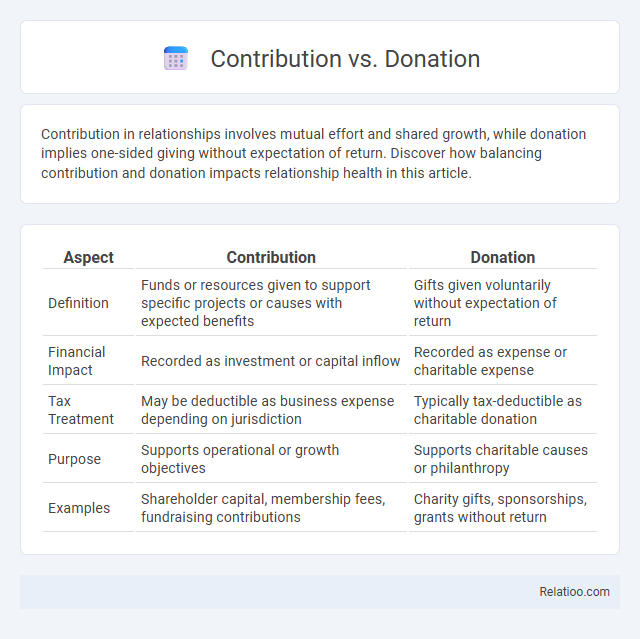

| Aspect | Contribution | Donation |

|---|---|---|

| Definition | Funds or resources given to support specific projects or causes with expected benefits | Gifts given voluntarily without expectation of return |

| Financial Impact | Recorded as investment or capital inflow | Recorded as expense or charitable expense |

| Tax Treatment | May be deductible as business expense depending on jurisdiction | Typically tax-deductible as charitable donation |

| Purpose | Supports operational or growth objectives | Supports charitable causes or philanthropy |

| Examples | Shareholder capital, membership fees, fundraising contributions | Charity gifts, sponsorships, grants without return |

Understanding Contribution vs Donation

Understanding the difference between contribution and donation is essential in financial and charitable contexts. A contribution typically involves giving money, goods, or services to support a specific cause or organization, often implying ongoing support or membership, whereas a donation usually refers to a voluntary gift without expectation of return or ongoing obligation. Tax regulations may treat contributions and donations differently, impacting deductibility and reporting requirements for individuals and businesses.

Definitions: What is a Contribution?

A contribution refers to the act of giving resources such as money, goods, or services to support a cause or organization, often implying participation or involvement. Unlike a donation, which is typically a voluntary gift without expectations, a contribution may be part of a collective effort or shared responsibility. Contributions can be financial or non-financial and are essential for funding projects, community initiatives, or organizational objectives.

Definitions: What is a Donation?

A donation is a voluntary gift of money, goods, or services given without expecting anything in return, typically to support a charitable cause or organization. Contributions can include donations but also extend to efforts such as volunteer work or advocacy, reflecting active participation beyond financial support. Understanding the precise definition of a donation clarifies its role in philanthropy and differentiates it from broader forms of contribution.

Key Differences Between Contributions and Donations

Contributions typically refer to giving that supports political campaigns or causes, whereas donations often relate to charitable gifts for nonprofits or personal causes. The key differences include the purpose, tax implications, and regulatory oversight, with contributions being subject to stricter reporting under election laws compared to donations. Understanding these distinctions helps you determine the appropriate way to support organizations while maximizing your tax benefits and compliance.

Motivations Behind Contributions vs Donations

Contributions often stem from a desire to support a cause or organization through active involvement or resource sharing, reflecting personal commitment and values. Donations typically represent a financial gift made without expecting direct involvement, motivated by altruism, tax benefits, or social responsibility. Understanding your motivations can help distinguish whether you seek engagement or simply wish to provide financial support.

Legal and Tax Implications

Understanding the legal and tax implications of contributions, donations, and grants is essential for your financial planning and compliance. Contributions often refer to assets or services given, with possible tax deductions if made to qualified organizations, while donations specifically imply giving without expecting return, typically qualifying for charitable tax deductions under IRS guidelines. Grants, however, are funds awarded based on applications or proposals and may require reporting as income, impacting your tax liability differently than straightforward donations or contributions.

Impact on Beneficiaries

Contributions often involve active participation or resources that directly enhance programs, creating sustainable benefits for recipients, whereas donations typically refer to gifts of money or goods that address immediate needs without long-term engagement. The impact of contributions tends to be more profound as they may include expertise, time, or services that empower beneficiaries beyond financial support. Donations provide essential relief and support but may lack the enduring influence that contributions can generate through ongoing involvement.

Examples in Real-world Scenarios

Contributions often refer to the active input or effort given towards a cause, such as volunteering time at a community clean-up or providing expertise during disaster relief efforts. Donations typically involve monetary or material gifts, like giving money to a charity supporting education or donating clothes to a homeless shelter. In real-world scenarios, an individual contributing skills as a software developer to a nonprofit contrasts with donating funds to help build schools in underdeveloped regions.

Choosing Between Contribution and Donation

Choosing between contribution and donation depends on the intent and nature of your giving. Contributions often imply a participatory role or ongoing support, while donations are typically one-time gifts without direct involvement. Understanding your goals can help you decide whether your support should be a contribution that fosters engagement or a simple donation that provides immediate assistance.

The Future of Giving: Trends and Perspectives

The future of giving is increasingly shaped by the nuanced differences between contributions, donations, and gifts, each playing a vital role in philanthropy. Contributions often refer to financial support directed towards specific projects or causes, emphasizing targeted impact, while donations encompass a broader range of charitable giving, including goods, services, and money without restriction. Emerging trends highlight a growing preference for transparent, accountable giving platforms and impact-driven contributions that leverage technology to engage donors and maximize social benefit.

Infographic: Contribution vs Donation

relatioo.com

relatioo.com