Direct taxes are levied directly on individuals or organizations based on income or property, while indirect taxes are applied to goods and services, affecting consumers at the point of purchase. Explore this article to understand the impact of direct and indirect taxes on economic behavior and government revenue.

Table of Comparison

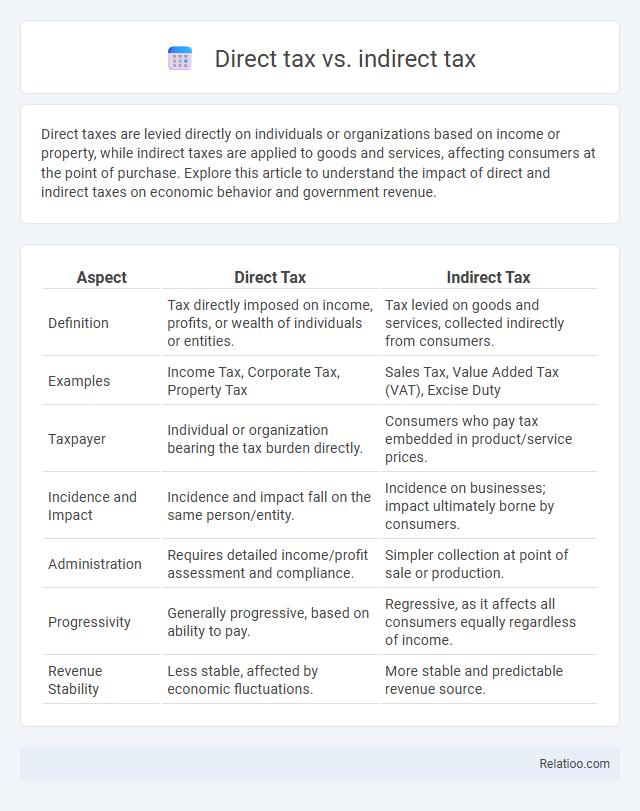

| Aspect | Direct Tax | Indirect Tax |

|---|---|---|

| Definition | Tax directly imposed on income, profits, or wealth of individuals or entities. | Tax levied on goods and services, collected indirectly from consumers. |

| Examples | Income Tax, Corporate Tax, Property Tax | Sales Tax, Value Added Tax (VAT), Excise Duty |

| Taxpayer | Individual or organization bearing the tax burden directly. | Consumers who pay tax embedded in product/service prices. |

| Incidence and Impact | Incidence and impact fall on the same person/entity. | Incidence on businesses; impact ultimately borne by consumers. |

| Administration | Requires detailed income/profit assessment and compliance. | Simpler collection at point of sale or production. |

| Progressivity | Generally progressive, based on ability to pay. | Regressive, as it affects all consumers equally regardless of income. |

| Revenue Stability | Less stable, affected by economic fluctuations. | More stable and predictable revenue source. |

Introduction to Direct and Indirect Taxes

Direct tax is levied directly on your income, property, or wealth, including income tax, corporate tax, and wealth tax. Indirect tax is imposed on goods and services, such as GST, sales tax, and excise duty, which you pay when purchasing products. Understanding the distinction between direct and indirect taxes helps you grasp how governments collect revenue and the impact on your financial planning.

Definition of Direct Taxes

Direct taxes are levied directly on individuals or entities, such as income tax, corporate tax, and property tax, and are paid directly to the government. Indirect taxes, including sales tax, value-added tax (VAT), and excise duty, are collected by intermediaries from consumers at the point of sale. Tax, as a general concept, refers to compulsory financial charges imposed by governments to fund public services and infrastructure.

Definition of Indirect Taxes

Indirect taxes are levies imposed on goods and services rather than directly on income or profits, meaning You pay these taxes when purchasing products or services. Common examples of indirect taxes include value-added tax (VAT), sales tax, and excise duties, which are collected by intermediaries like retailers and then passed on to the government. Unlike direct taxes, which are charged directly to an individual's or organization's income, indirect taxes influence consumption patterns without requiring direct payment to tax authorities from the income source.

Key Differences Between Direct and Indirect Taxes

Direct taxes are levied directly on individuals or organizations based on income, profits, or property ownership, such as income tax and corporate tax, reflecting the taxpayer's ability to pay. Indirect taxes, including sales tax, VAT, and excise duty, are imposed on goods and services and collected by intermediaries, ultimately passed on to the end consumer, making them less transparent. Key differences lie in the incidence and impact: direct taxes cannot be shifted, are progressive, and target specific taxpayers, while indirect taxes can be shifted, are often regressive, and affect the broader population through consumption.

Examples of Direct Taxes

Direct taxes are levied directly on your income or property, such as income tax, corporate tax, and property tax. These taxes are paid directly to the government by the individual or organization responsible for the tax liability. Examples of indirect taxes include sales tax, value-added tax (VAT), and excise duties, which are collected by intermediaries like retailers before being passed on to the government.

Examples of Indirect Taxes

Indirect taxes are levied on goods and services rather than on income or profits, with common examples including Value Added Tax (VAT), sales tax, excise duty, and customs duty. These taxes are collected by intermediaries such as retailers or manufacturers and passed on to the government, influencing consumer prices directly. Indirect taxes differ from direct taxes, which are imposed on individuals and corporate earnings, such as income tax and corporate tax.

Advantages of Direct Taxes

Direct taxes, such as income tax and property tax, provide governments with a stable and predictable revenue source by taxing individuals and corporations based on their ability to pay. These taxes promote equity by reducing income inequality through progressive tax rates, ensuring higher earners contribute a fairer share of their income. Direct taxes also enhance transparency and accountability in tax administration, as taxpayers are directly aware of their tax obligations and contributions to public services.

Advantages of Indirect Taxes

Indirect taxes offer Advantages such as simplicity in collection and broad-based revenue generation without directly burdening your income. They encourage compliance since taxes are included in the price of goods and services, reducing tax evasion. Indirect taxes also promote consumption-linked revenue, allowing governments to adjust rates based on economic behavior effectively.

Challenges and Limitations of Each Tax Type

Direct taxes, such as income tax and corporate tax, face challenges like tax evasion and administrative complexities that strain government resources. Indirect taxes, including VAT and sales tax, often suffer from regressive impacts on lower-income groups and difficulties in tracking transactions in informal sectors. Your understanding of these tax types highlights that while both have vital roles, limitations like compliance issues and economic distortions require continual policy adjustments.

Conclusion: Choosing the Right Tax Structure

Choosing the right tax structure depends on Your financial goals, business model, and compliance requirements. Direct taxes, like income tax, provide transparency and fairness by taxing income directly, while indirect taxes such as VAT or sales tax are easier to administer and impact consumption. Evaluating the balance between tax efficiency and regulatory burden helps optimize overall tax planning for maximum benefit.

Infographic: Direct tax vs indirect tax

relatioo.com

relatioo.com