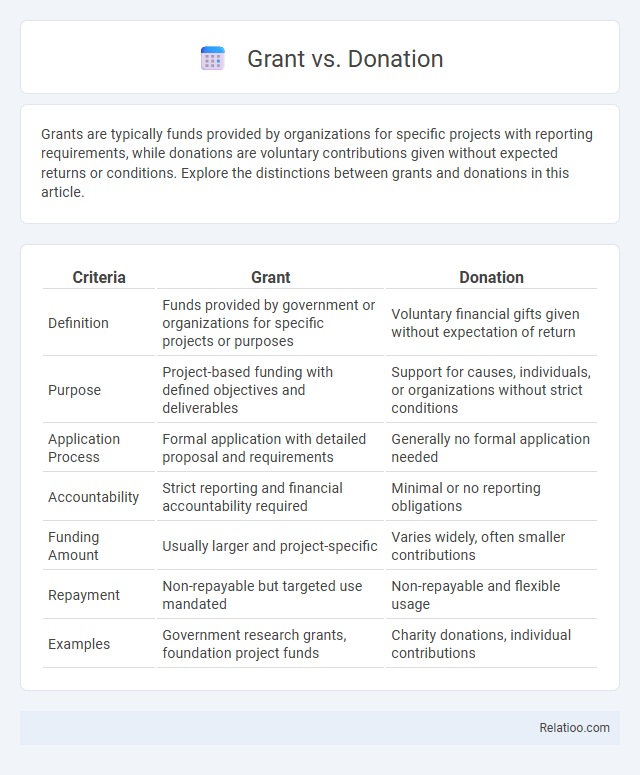

Grants are typically funds provided by organizations for specific projects with reporting requirements, while donations are voluntary contributions given without expected returns or conditions. Explore the distinctions between grants and donations in this article.

Table of Comparison

| Criteria | Grant | Donation |

|---|---|---|

| Definition | Funds provided by government or organizations for specific projects or purposes | Voluntary financial gifts given without expectation of return |

| Purpose | Project-based funding with defined objectives and deliverables | Support for causes, individuals, or organizations without strict conditions |

| Application Process | Formal application with detailed proposal and requirements | Generally no formal application needed |

| Accountability | Strict reporting and financial accountability required | Minimal or no reporting obligations |

| Funding Amount | Usually larger and project-specific | Varies widely, often smaller contributions |

| Repayment | Non-repayable but targeted use mandated | Non-repayable and flexible usage |

| Examples | Government research grants, foundation project funds | Charity donations, individual contributions |

Understanding Grants and Donations

Grants are funds awarded by government agencies, foundations, or corporations for specific projects or initiatives, often requiring detailed applications and reporting. Donations are voluntary contributions from individuals or organizations made without expectation of repayment, typically supporting general or specific causes. Understanding the differences between grants and donations helps nonprofits align their fundraising strategies with appropriate funding sources to maximize impact and compliance.

Key Differences Between Grants and Donations

Grants are typically funds awarded by government agencies, foundations, or corporations based on a formal application process with specific eligibility criteria, while donations are voluntary gifts from individuals or organizations without stringent requirements. Grants often require detailed reporting and accountability for the use of funds, whereas donations generally have fewer restrictions and can be given anonymously. The key difference lies in the purpose and conditions; grants are intended to support specific projects or outcomes, whereas donations are usually provided to support general organizational needs or causes.

Sources of Grants and Donations

Grants typically originate from government agencies, private foundations, and corporations, providing structured funding for specific projects or initiatives. Donations are contributed by individual donors, philanthropists, or charitable organizations, often given without strict usage restrictions. Understanding these diverse sources helps organizations strategically align their fundraising efforts with applicable eligibility criteria and funding priorities.

Application Process for Grants vs Donations

Grants require a formal application process involving detailed proposals, eligibility criteria, and specific reporting requirements, while donations typically involve a simpler process such as a direct request or fundraising campaign. You must provide comprehensive documentation and evidence of how the grant funds will be used to meet the grantor's objectives, whereas donations often rely on the donor's discretionary decision without strict application guidelines. Understanding these differences is crucial for successfully securing financial support for your projects.

Purpose and Usage Restrictions

Grants are typically funds provided by government agencies or organizations with strict stipulations on purpose and usage, often requiring detailed reporting to ensure compliance. Donations are generally given by individuals or entities with fewer restrictions, allowing recipients more flexibility in how they use the funds based on their needs. Understanding your organization's goals and funding requirements helps determine whether a grant or donation best supports your mission while aligning with the intended usage purpose.

Legal and Tax Implications

Grants are funds provided by government agencies or organizations with specific conditions and reporting requirements, often requiring compliance with strict legal and tax frameworks. Donations are voluntary contributions given without expectation of return, qualifying for tax deductions under IRS regulations if made to registered charities, but lack the contractual obligations of grants. Understanding the distinct legal and tax implications of grants versus donations enables you to optimize compliance and benefit from potential tax advantages.

Reporting and Accountability Requirements

Grants require detailed reporting and accountability, including financial statements and progress updates to funding agencies, ensuring transparency and compliance with specific terms. Donations generally have fewer reporting requirements but may still involve basic acknowledgments or impact reports depending on the size and source. Understanding these differences helps your organization maintain proper documentation and fulfill obligations effectively.

Pros and Cons of Grants

Grants provide substantial funding for specific projects or needs without requiring repayment, enabling organizations to advance initiatives that align with grantor priorities; however, they often involve rigorous application processes and strict reporting requirements that can demand significant time and resources. Unlike donations, grants usually come with conditions and performance metrics, which help ensure accountability but may limit flexibility in fund usage. While grants can enable large-scale impact, their dependency on external criteria and potential for competitive scarcity present challenges for sustained financial planning.

Pros and Cons of Donations

Donations provide a flexible source of funding for nonprofits without requiring repayment, fostering goodwill and community engagement. However, donations can be unpredictable and inconsistent, making long-term financial planning challenging. Unlike grants that often come with strict guidelines, donations offer fewer restrictions but may lack substantial amounts needed for large-scale projects.

Choosing the Right Funding Option

Choosing the right funding option depends on your organization's needs and goals, as grants provide specific amounts often tied to project milestones, while donations usually offer flexible, voluntary support without stringent requirements. Grants are typically awarded by government agencies or foundations and require detailed proposals and reports, whereas donations come from individuals or corporations motivated by your mission or events. Understanding these differences enables you to target funding sources that align with your goals and maximize financial support.

Infographic: Grant vs Donation

relatioo.com

relatioo.com