Depreciable assets, such as machinery and vehicles, lose value over time due to wear and tear, while non-depreciable assets like land maintain their value indefinitely. Discover more key differences and implications of these asset types in this article.

Table of Comparison

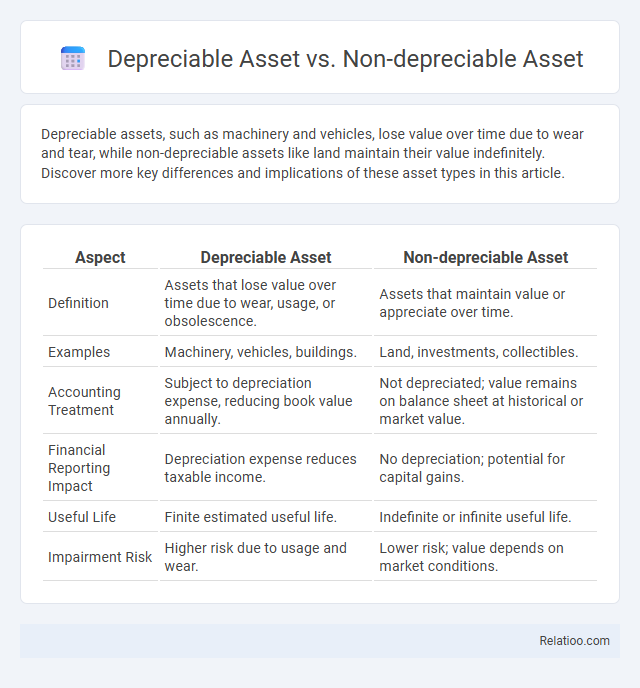

| Aspect | Depreciable Asset | Non-depreciable Asset |

|---|---|---|

| Definition | Assets that lose value over time due to wear, usage, or obsolescence. | Assets that maintain value or appreciate over time. |

| Examples | Machinery, vehicles, buildings. | Land, investments, collectibles. |

| Accounting Treatment | Subject to depreciation expense, reducing book value annually. | Not depreciated; value remains on balance sheet at historical or market value. |

| Financial Reporting Impact | Depreciation expense reduces taxable income. | No depreciation; potential for capital gains. |

| Useful Life | Finite estimated useful life. | Indefinite or infinite useful life. |

| Impairment Risk | Higher risk due to usage and wear. | Lower risk; value depends on market conditions. |

Introduction to Depreciable and Non-depreciable Assets

Depreciable assets are tangible fixed assets such as machinery, buildings, and equipment that lose value over time due to wear and tear, allowing businesses to allocate their cost as depreciation expenses over their useful life. Non-depreciable assets include land and intangible assets with indefinite useful lives, which do not undergo systematic depreciation because they typically retain or appreciate in value. Understanding the distinction between depreciable and non-depreciable assets is essential for accurate financial reporting and effective asset management.

Definition of Depreciable Assets

Depreciable assets are tangible fixed assets that lose value over time due to wear, usage, or obsolescence, such as machinery, vehicles, and buildings. Non-depreciable assets, in contrast, include land or intangible assets that do not diminish in value through use. Understanding the definition of depreciable assets helps you accurately allocate expenses and manage asset value on your financial statements.

Definition of Non-depreciable Assets

Non-depreciable assets are tangible or intangible assets that do not lose value over time due to usage or wear and tear, such as land or certain types of investments. Unlike depreciable assets, which include machinery, vehicles, and buildings subject to systematic depreciation, non-depreciable assets maintain their value on the balance sheet indefinitely. Understanding the distinction is crucial for accurate financial reporting and asset management in accounting.

Key Differences Between Depreciable and Non-depreciable Assets

Depreciable assets, such as machinery and vehicles, lose value over time due to wear and usage, allowing for systematic depreciation expense deductions on your financial statements. Non-depreciable assets, including land and certain collectibles, retain their value without systematic depreciation since they do not experience measurable wear. Understanding these key differences helps you accurately classify assets and optimize tax and accounting strategies based on asset type.

Examples of Depreciable Assets

Depreciable assets include tangible items such as machinery, vehicles, buildings, and equipment that lose value over time due to wear and tear or obsolescence. Non-depreciable assets typically consist of land and intangible assets like patents or trademarks, which do not experience systematic depreciation. Understanding examples of depreciable assets helps businesses allocate costs accurately for accounting and tax purposes, improving financial planning and reporting.

Examples of Non-depreciable Assets

Non-depreciable assets are long-term assets that do not lose value over time, such as land, artwork, and certain types of intellectual property like trademarks with indefinite life. Unlike depreciable assets like machinery, vehicles, and buildings, which lose value due to wear and tear, non-depreciable assets typically maintain or even appreciate in value. Understanding the distinction helps in accurate financial reporting and tax calculation.

Accounting Treatment for Depreciable Assets

Depreciable assets, such as machinery and vehicles, are capital assets subject to systematic allocation of their cost over their useful lives through depreciation expense in accounting records. Non-depreciable assets, like land, do not incur depreciation since their value typically remains stable or appreciates over time. Your accounting treatment for depreciable assets involves recording depreciation expense periodically to match revenue generation, ensuring accurate financial statements and tax compliance.

Accounting Treatment for Non-depreciable Assets

Non-depreciable assets, such as land, are not subject to depreciation because they do not lose value over time, contrasting with depreciable assets like machinery that require systematic expense allocation. In accounting treatment, non-depreciable assets are recorded at historical cost and carried at that value unless impaired, ensuring your financial statements reflect their stable worth. Proper classification and monitoring prevent misstatement of asset values and ensure compliance with accounting standards.

Impact on Financial Statements

Depreciable assets, such as machinery and vehicles, reduce in value over time through depreciation expense, lowering net income and the asset's book value on the balance sheet. Non-depreciable assets, including land and certain intangible assets, maintain their recorded value without periodic expense recognition, thus not affecting the income statement but remaining constant on the balance sheet. Overall asset valuation impacts total asset reporting and equity, influencing financial ratios and stakeholder decisions based on the classification and treatment of these assets.

Choosing Between Depreciable and Non-depreciable Assets

Choosing between depreciable and non-depreciable assets depends on your business needs and tax strategy. Depreciable assets, such as machinery and vehicles, lose value over time and provide tax deductions through depreciation. Non-depreciable assets, like land, maintain value and do not offer depreciation benefits, making them ideal for long-term investment and stability.

Infographic: Depreciable Asset vs Non-depreciable Asset

relatioo.com

relatioo.com