Automatic payments ensure timely transactions by securely deducting funds without user intervention, reducing late fees and enhancing cash flow management. Discover the key differences, benefits, and potential drawbacks of Automatic Payment versus Manual Payment in this article.

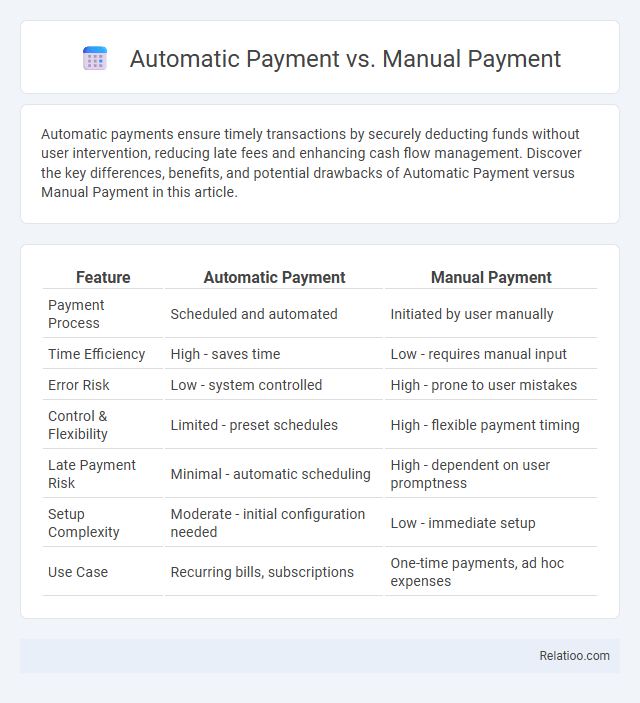

Table of Comparison

| Feature | Automatic Payment | Manual Payment |

|---|---|---|

| Payment Process | Scheduled and automated | Initiated by user manually |

| Time Efficiency | High - saves time | Low - requires manual input |

| Error Risk | Low - system controlled | High - prone to user mistakes |

| Control & Flexibility | Limited - preset schedules | High - flexible payment timing |

| Late Payment Risk | Minimal - automatic scheduling | High - dependent on user promptness |

| Setup Complexity | Moderate - initial configuration needed | Low - immediate setup |

| Use Case | Recurring bills, subscriptions | One-time payments, ad hoc expenses |

Introduction to Automatic and Manual Payments

Automatic payments streamline bill management by scheduling transactions through bank accounts or credit cards, ensuring timely payments without user intervention. Manual payments require individuals to initiate each transaction, providing control but increasing the risk of missed deadlines. Both methods impact financial planning, with automatic payments offering convenience and consistency, while manual payments demand active participation and monitoring.

Key Differences Between Automatic and Manual Payments

Automatic payments streamline your bill management by scheduling transactions to occur on set dates, reducing the risk of late fees and improving financial consistency. Manual payments require you to actively initiate each transaction, offering greater control but increasing the chance of missed deadlines and administrative effort. Key differences include automation level, timing precision, and user intervention, with automatic payments prioritizing convenience and manual payments emphasizing control.

Advantages of Automatic Payment Systems

Automatic payment systems offer the advantage of ensuring timely bill payments, reducing the risk of late fees and service interruptions by automating recurring transactions. They provide convenience by eliminating the need for manual entry, saving You time and effort while enhancing financial management through consistent and predictable payment schedules. Security features in automatic systems often include encryption and fraud detection, adding a layer of protection compared to manual payments.

Benefits of Manual Payment Methods

Manual payment methods offer enhanced control over transaction timing and amounts, allowing users to review invoices and budgets carefully before authorization. This approach reduces the risk of overdrafts and unauthorized charges compared to automatic payments, which execute transactions automatically on scheduled dates. Furthermore, manual payments can foster better financial awareness and discipline, as users actively engage in managing their expenses.

Common Use Cases for Automatic Payments

Automatic payments are commonly used for recurring bills such as utilities, mortgage, subscriptions, and insurance premiums, ensuring timely and consistent transactions without manual intervention. Manual payments remain preferred for irregular or one-time expenses like freelance invoices, custom orders, or emergency repairs, allowing greater control and flexibility. Auto payments reduce late fees, improve credit scores, and simplify budgeting by automating fixed monthly obligations across banking and billing platforms.

Situations Where Manual Payments Are Preferred

Manual payments are preferred in situations requiring precise control, such as irregular billing cycles or when verifying charges before approval. You benefit from manual payments when managing one-time expenses or adjusting payment amounts to avoid overdrafts or errors. This method ensures flexibility and oversight, especially when transactions lack automation or require personalized handling.

Security and Fraud Considerations

Automatic payments utilize encryption and tokenization to securely process transactions, reducing the likelihood of human error and unauthorized access compared to manual payments. Manual payments often involve direct handling of sensitive information, increasing exposure to fraud risks like phishing or data theft. Two-factor authentication and real-time fraud monitoring enhance the security of automatic payments, making them more resilient against cyber threats than manual methods.

Cost Implications and Efficiency

Automatic payment streamlines your financial management by reducing transaction times and minimizing late fees, ultimately lowering overall costs. Manual payment often incurs higher labor expenses and increased risk of errors, leading to potential penalties and inefficient cash flow. Comparing automatic and manual methods, automation enhances efficiency through consistent processing and cost savings, making it the preferred choice for optimizing your payment workflows.

User Experience and Convenience

Automatic Payment streamlines your financial management by ensuring timely transactions without manual intervention, reducing the risk of missed payments and late fees. Manual Payment offers greater control and flexibility, allowing you to choose payment timing and amount, which can be preferable for users who monitor cash flow closely. Automatic Payment balances convenience and consistency, minimizing effort while providing peace of mind, making it the preferred choice for enhancing user experience and simplifying routine bill settlements.

Choosing the Right Payment Method for Your Needs

Selecting the right payment method depends on your transaction frequency, control preferences, and convenience. Automatic payments offer seamless, timely bill settlements ideal for recurring expenses, while manual payments provide greater control and flexibility, suitable for irregular or varying amounts. Balancing automation with oversight helps optimize cash flow management and reduces the risk of missed or duplicate payments.

Infographic: Automatic Payment vs Manual Payment

relatioo.com

relatioo.com