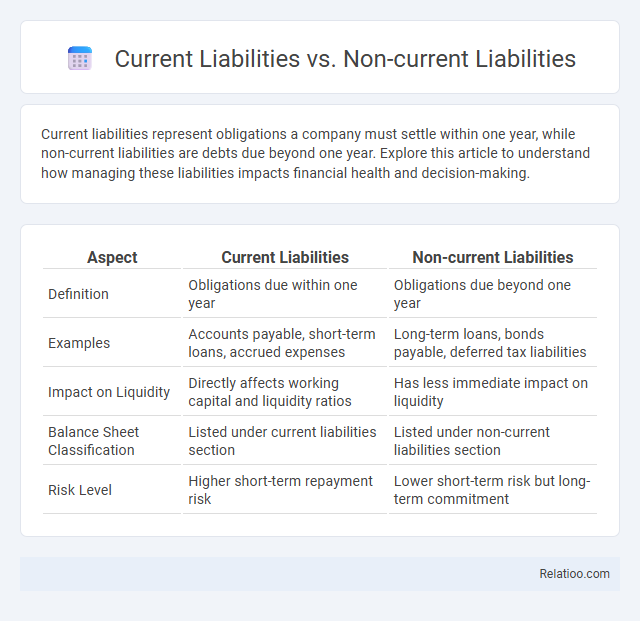

Current liabilities represent obligations a company must settle within one year, while non-current liabilities are debts due beyond one year. Explore this article to understand how managing these liabilities impacts financial health and decision-making.

Table of Comparison

| Aspect | Current Liabilities | Non-current Liabilities |

|---|---|---|

| Definition | Obligations due within one year | Obligations due beyond one year |

| Examples | Accounts payable, short-term loans, accrued expenses | Long-term loans, bonds payable, deferred tax liabilities |

| Impact on Liquidity | Directly affects working capital and liquidity ratios | Has less immediate impact on liquidity |

| Balance Sheet Classification | Listed under current liabilities section | Listed under non-current liabilities section |

| Risk Level | Higher short-term repayment risk | Lower short-term risk but long-term commitment |

Introduction to Liabilities in Accounting

Liabilities in accounting represent the financial obligations a company owes to external parties, classified into current liabilities and non-current liabilities based on their due dates. Current liabilities are short-term debts payable within one year, such as accounts payable and short-term loans, while non-current liabilities are long-term obligations like bonds payable and mortgages. Understanding these distinctions helps you accurately assess your business's financial health and manage its obligations effectively.

Definition of Current Liabilities

Current liabilities are short-term financial obligations that a company must settle within one year, including accounts payable, short-term loans, and accrued expenses. Non-current liabilities extend beyond one year, such as long-term debt and deferred tax liabilities. Understanding your current liabilities helps manage cash flow and ensures timely payment of debts classified under liability on your balance sheet.

Definition of Non-current Liabilities

Non-current liabilities are long-term financial obligations of a company that are due beyond one year, including bonds payable, long-term loans, and deferred tax liabilities. Unlike current liabilities, which must be settled within a fiscal year, non-current liabilities provide insight into a company's long-term financial health and leverage. Understanding the distinction between non-current liabilities and current liabilities is crucial for accurate financial analysis and assessing a company's debt structure.

Key Differences Between Current and Non-current Liabilities

Current liabilities are financial obligations due within one year, including accounts payable, short-term loans, and accrued expenses, whereas non-current liabilities extend beyond one year, such as long-term debt, bonds payable, and deferred tax liabilities. Understanding the key differences between current and non-current liabilities is crucial for assessing your business's short-term liquidity versus long-term financial stability. Proper classification impacts financial analysis, cash flow management, and strategic decision-making, ensuring accurate evaluation of your company's obligations and financial health.

Common Examples of Current Liabilities

Current liabilities include obligations like accounts payable, short-term loans, and accrued expenses due within one year, which directly impact your company's liquidity. Non-current liabilities, such as long-term debt and pension obligations, extend beyond one year and affect long-term financial stability. Understanding these distinctions helps you manage liabilities efficiently and maintain a healthy balance sheet.

Common Examples of Non-current Liabilities

Non-current liabilities represent obligations due beyond one year, including common examples such as long-term loans, bonds payable, and lease obligations. Current liabilities are short-term debts like accounts payable, accrued expenses, and short-term loans, whereas the overall category of liabilities encompasses all financial obligations a company must settle. Understanding your non-current liabilities is crucial for evaluating long-term financial stability and planning future investments.

Importance of Proper Liability Classification

Proper classification of liabilities into current and non-current categories is crucial for accurate financial analysis and reporting, helping stakeholders assess a company's short-term liquidity and long-term solvency. Current liabilities, typically due within one year, impact working capital management and cash flow forecasting, while non-current liabilities, payable beyond one year, influence debt structure and financial stability evaluation. Accurate liability classification ensures compliance with accounting standards, supports informed decision-making, and enhances transparency for investors, creditors, and regulatory bodies.

Impact on Financial Statements and Ratios

Current liabilities represent obligations due within one year, impacting your liquidity ratios such as the current ratio and quick ratio, which assess short-term financial health. Non-current liabilities consist of long-term debts and obligations, influencing solvency ratios like the debt-to-equity ratio that evaluate long-term financial stability. Understanding the distinction between current and non-current liabilities is crucial for accurately analyzing your balance sheet and interpreting key financial ratios that reflect both immediate and future financial obligations.

Managing Current and Non-current Liabilities

Managing current liabilities, which include short-term obligations like accounts payable and accrued expenses due within one year, is crucial for maintaining liquidity and ensuring smooth daily operations. Non-current liabilities, such as long-term debt and lease obligations, require strategic planning for future cash flow management and capital structure optimization. Effective liability management balances timely payment of current liabilities while planning long-term financing to support business growth and financial stability.

Conclusion: Implications for Businesses

Understanding the distinction between current liabilities, non-current liabilities, and overall liabilities is crucial for your business's financial health and strategic planning. Current liabilities, due within one year, impact your short-term liquidity, while non-current liabilities influence long-term solvency and capital structure. Proper management of these liabilities ensures balanced cash flow, optimized debt levels, and improved creditworthiness, directly affecting your business's operational efficiency and growth potential.

Infographic: Current Liabilities vs Non-current Liabilities

relatioo.com

relatioo.com