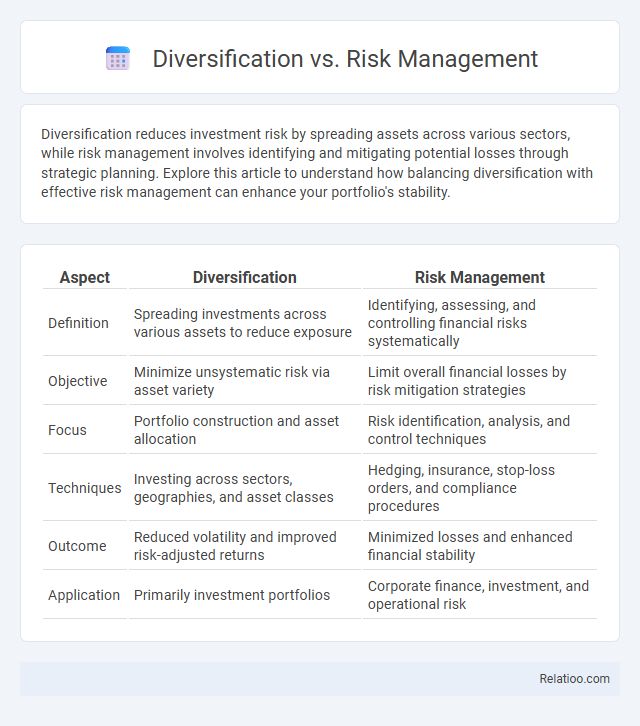

Diversification reduces investment risk by spreading assets across various sectors, while risk management involves identifying and mitigating potential losses through strategic planning. Explore this article to understand how balancing diversification with effective risk management can enhance your portfolio's stability.

Table of Comparison

| Aspect | Diversification | Risk Management |

|---|---|---|

| Definition | Spreading investments across various assets to reduce exposure | Identifying, assessing, and controlling financial risks systematically |

| Objective | Minimize unsystematic risk via asset variety | Limit overall financial losses by risk mitigation strategies |

| Focus | Portfolio construction and asset allocation | Risk identification, analysis, and control techniques |

| Techniques | Investing across sectors, geographies, and asset classes | Hedging, insurance, stop-loss orders, and compliance procedures |

| Outcome | Reduced volatility and improved risk-adjusted returns | Minimized losses and enhanced financial stability |

| Application | Primarily investment portfolios | Corporate finance, investment, and operational risk |

Understanding Diversification and Risk Management

Understanding diversification involves spreading investments across different assets to reduce exposure to any single risk, enhancing portfolio stability. Risk management focuses on identifying, assessing, and mitigating potential losses through strategies like asset allocation and hedging to protect your investments. Together, diversification and risk management form a comprehensive approach that balances growth opportunities while controlling financial uncertainty.

Key Differences Between Diversification and Risk Management

Diversification involves spreading investments across various assets or sectors to reduce exposure to any single risk, whereas risk management encompasses a broader range of strategies to identify, assess, and mitigate potential financial losses. Key differences include diversification's focus on portfolio allocation to minimize unsystematic risk, while risk management addresses multiple risk types, including market, credit, and operational risks through tools like hedging, insurance, and stop-loss orders. Effective financial strategy integrates both diversification and risk management to optimize returns while controlling overall risk exposure.

The Role of Diversification in Investment Portfolios

Diversification in investment portfolios reduces unsystematic risk by spreading assets across various sectors, asset classes, and geographic regions, thereby minimizing the impact of any single investment's poor performance. Effective risk management combines diversification with strategies such as asset allocation and hedging to protect portfolios against market volatility and systemic risks. Prioritizing diversification enhances portfolio resilience, optimizes returns, and serves as a fundamental principle in long-term investment strategy.

How Risk Management Safeguards Assets

Risk management safeguards your assets by identifying, assessing, and prioritizing potential risks that could lead to financial losses or operational disruptions. Unlike diversification, which spreads investments to reduce exposure to a single asset class, risk management uses strategies such as insurance, hedging, and contingency planning to directly mitigate threats. Effective risk management ensures long-term asset protection by minimizing the impact of unforeseen events on your portfolio and business operations.

Benefits of Diversification Strategies

Diversification strategies reduce portfolio risk by spreading investments across various asset classes, sectors, and geographic regions, enhancing potential returns while minimizing exposure to individual asset volatility. Effective diversification benefits investors by balancing risk and reward, preserving capital during market fluctuations, and improving long-term portfolio resilience. Combining diversification with risk management techniques creates a robust investment approach that optimizes performance and mitigates losses.

Limitations of Diversification for Risk Control

Limitations of diversification for risk control include diminishing returns as adding more assets beyond a certain point yields minimal risk reduction. Your portfolio may still be vulnerable to systemic risks that affect entire markets or sectors, which diversification cannot eliminate. Effective risk management requires combining diversification with strategies such as asset allocation, hedging, and regular portfolio review to mitigate these inherent limitations.

Essential Risk Management Techniques

Effective risk management techniques are vital for minimizing potential losses and ensuring financial stability, incorporating methods such as diversification, hedging, and asset allocation. Diversification spreads investments across various asset classes, reducing exposure to any single market or sector's volatility. Combining diversification with risk assessment tools and continuous monitoring enhances the ability to identify, evaluate, and mitigate risks systematically.

Integrating Diversification with Risk Management Practices

Integrating diversification with risk management practices enhances Your portfolio's resilience by spreading investments across various asset classes, industries, and geographies to minimize exposure to any single risk factor. Effective risk management assesses potential threats while diversification reduces the impact of market volatility and specific asset underperformance. Combining these strategies ensures balanced growth and protection against unforeseen financial downturns.

Common Misconceptions about Both Approaches

Diversification spreads your investments across various assets to reduce unsystematic risk, but it does not eliminate systemic market risk, which many investors mistakenly believe. Risk management involves identifying, assessing, and mitigating potential losses but is often confused with diversification, though it includes strategies like hedging, stop-loss orders, and asset allocation adjustments. Both approaches are essential, yet relying solely on diversification without active risk management can leave your portfolio vulnerable to market downturns.

Choosing the Right Strategy for Financial Success

Choosing the right strategy for financial success involves understanding the distinct roles of diversification and risk management. Diversification spreads investments across various asset classes to reduce exposure to any single market risk, while risk management actively monitors and mitigates potential losses through techniques like stop-loss orders and portfolio rebalancing. Balancing diversification with robust risk management ensures a resilient portfolio that maximizes returns while protecting against market volatility.

Infographic: Diversification vs Risk Management

relatioo.com

relatioo.com