Social Security provides retirement and disability benefits based on work credits, while Supplemental Security Income (SSI) offers financial assistance to low-income elderly, blind, or disabled individuals regardless of work history. Explore this article to understand the key differences between Social Security and SSI.

Table of Comparison

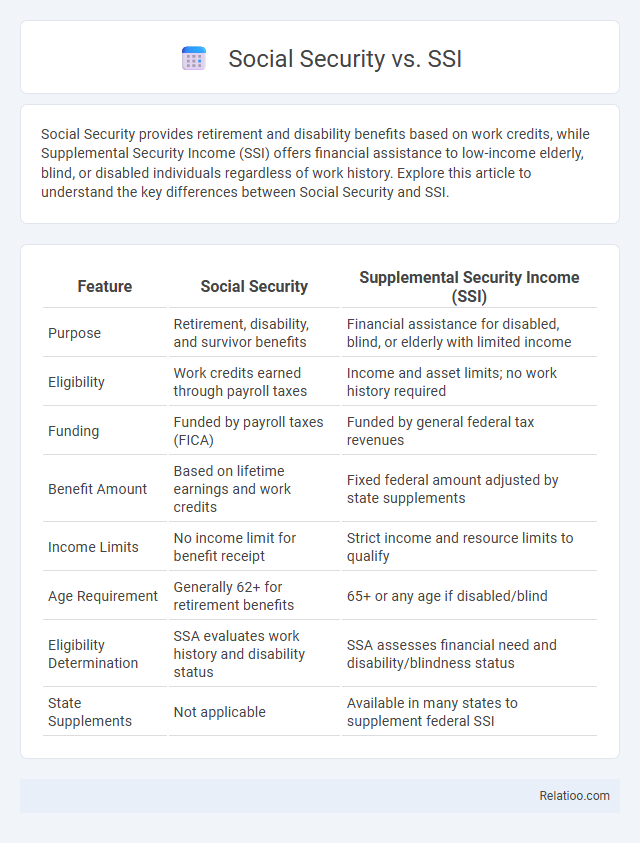

| Feature | Social Security | Supplemental Security Income (SSI) |

|---|---|---|

| Purpose | Retirement, disability, and survivor benefits | Financial assistance for disabled, blind, or elderly with limited income |

| Eligibility | Work credits earned through payroll taxes | Income and asset limits; no work history required |

| Funding | Funded by payroll taxes (FICA) | Funded by general federal tax revenues |

| Benefit Amount | Based on lifetime earnings and work credits | Fixed federal amount adjusted by state supplements |

| Income Limits | No income limit for benefit receipt | Strict income and resource limits to qualify |

| Age Requirement | Generally 62+ for retirement benefits | 65+ or any age if disabled/blind |

| Eligibility Determination | SSA evaluates work history and disability status | SSA assesses financial need and disability/blindness status |

| State Supplements | Not applicable | Available in many states to supplement federal SSI |

Overview of Social Security and SSI

Social Security is a federal program that provides retirement, disability, and survivors benefits based on an individual's work history and earnings. Supplemental Security Income (SSI) is a needs-based program offering financial assistance to elderly, blind, or disabled individuals with limited income and resources. Both programs are administered by the Social Security Administration but serve distinct populations with different eligibility criteria and funding sources.

Key Differences Between Social Security and SSI

Social Security benefits are primarily based on your work history and payroll tax contributions, providing retirement, disability, or survivors benefits, whereas Supplemental Security Income (SSI) offers need-based financial assistance to elderly, blind, or disabled individuals with limited income and resources. Eligibility for Social Security depends on your earnings record, while SSI eligibility focuses on financial need and living situation. Understanding these key differences helps you determine which program best supports your financial security and well-being.

Eligibility Criteria for Social Security Benefits

Social Security benefits require individuals to earn sufficient work credits through employment subject to Social Security taxes, with eligibility based on age, disability, or survivor status. Supplemental Security Income (SSI) targets low-income individuals who are aged, blind, or disabled, without work credit requirements. Social Security Disability Insurance (SSDI) provides benefits to disabled workers who meet work credit thresholds but differs from SSI, which focuses on financial need rather than employment history.

SSI Eligibility Requirements

SSI eligibility requires applicants to have limited income and resources, be age 65 or older, blind, or disabled, and be U.S. citizens or qualified non-citizens. In contrast, Social Security benefits depend on work credits earned through employment, with retirees and disabled individuals qualifying based on their contribution history. Social Security primarily provides retirement and disability benefits, whereas SSI offers financial support to individuals with minimal resources regardless of work history.

How Social Security Benefits Are Calculated

Social Security benefits are calculated based on an individual's highest 35 years of indexed earnings, adjusted for inflation, to determine the average indexed monthly earnings (AIME). The Social Security Administration applies a progressive formula to the AIME, using bend points that calculate the primary insurance amount (PIA), which represents the monthly benefit at full retirement age. Supplemental Security Income (SSI) benefits differ as they are need-based and do not depend on work history or earnings but rather on financial need, income, and resources.

SSI Payment Calculation and Amounts

SSI payment calculation is based on federal benefit rates, counting an individual's income, living arrangements, and state supplements, with maximum monthly amounts typically set at $914 for individuals and $1,371 for couples in 2024. Social Security benefits rely on an individual's lifetime earnings record, with payments determined by the Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA), which vary widely compared to the fixed SSI amounts. SSI provides financial assistance to disabled, blind, or aged individuals with limited income and resources, while Social Security benefits are earned based on work history and contributions to FICA taxes.

Application Process for Social Security vs SSI

Understanding the application process for Social Security and Supplemental Security Income (SSI) is crucial since they serve different needs; Social Security benefits require proof of work credits and can be applied for online, by phone, or in person at a Social Security office. SSI applications focus on financial need, requiring detailed income and asset documentation, and are processed primarily through local Social Security offices, often necessitating an in-person interview. Your eligibility depends on meeting specific criteria, so gathering all necessary documentation beforehand streamlines the application experience and improves chances for approval.

Benefits and Limitations of Social Security

Social Security provides retirement, disability, and survivor benefits primarily based on your work history and earned credits, offering financial support during retirement or in case of disability. It has limitations including eligibility criteria tied to work history, a fixed monthly benefit amount that may not fully cover living expenses, and taxes on benefits for higher income levels. Supplemental Security Income (SSI) offers need-based assistance for disabled or elderly individuals with limited income, while Social Security Disability Insurance (SSDI) supports disabled workers who have earned sufficient work credits.

SSI Advantages and Disadvantages

Supplemental Security Income (SSI) provides financial assistance to low-income individuals who are elderly, blind, or disabled, separate from Social Security retirement or disability benefits which depend on work credits. SSI advantages include eligibility for individuals with limited work history and access to additional state benefits, while disadvantages involve strict income and resource limits that can restrict total household earnings. Unlike Social Security benefits that increase with work credits, SSI offers a baseline safety net but often requires recipients to meet stringent means-testing criteria.

Choosing Between Social Security and SSI

Choosing between Social Security and Supplemental Security Income (SSI) depends on eligibility criteria and financial need; Social Security benefits are based on work history and payroll contributions, while SSI provides needs-based assistance for individuals with limited income and resources. Social Security primarily serves retired or disabled workers with sufficient work credits, whereas SSI targets disabled, blind, or elderly individuals who meet strict income and asset limits. Understanding your work record, disability status, and financial situation is crucial for determining the appropriate program to apply for.

Infographic: Social Security vs SSI

relatioo.com

relatioo.com