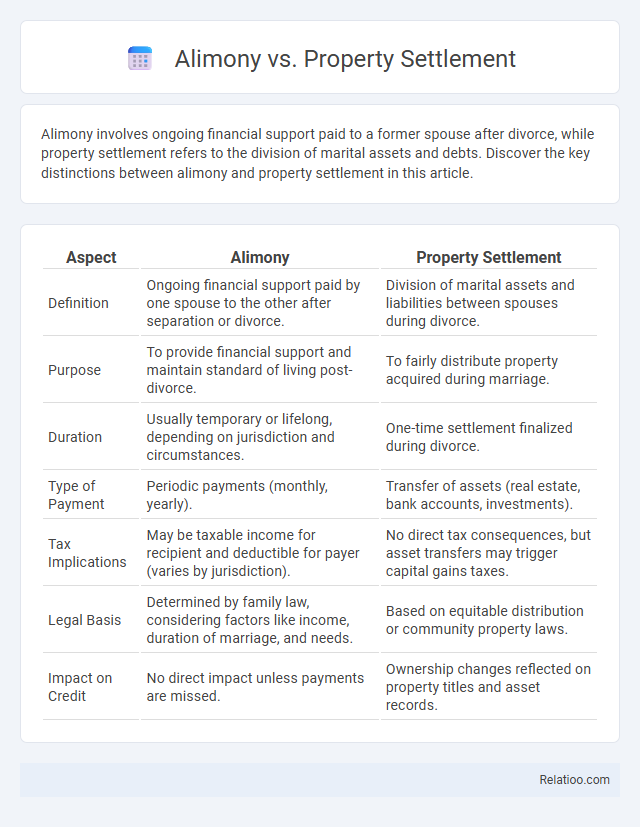

Alimony involves ongoing financial support paid to a former spouse after divorce, while property settlement refers to the division of marital assets and debts. Discover the key distinctions between alimony and property settlement in this article.

Table of Comparison

| Aspect | Alimony | Property Settlement |

|---|---|---|

| Definition | Ongoing financial support paid by one spouse to the other after separation or divorce. | Division of marital assets and liabilities between spouses during divorce. |

| Purpose | To provide financial support and maintain standard of living post-divorce. | To fairly distribute property acquired during marriage. |

| Duration | Usually temporary or lifelong, depending on jurisdiction and circumstances. | One-time settlement finalized during divorce. |

| Type of Payment | Periodic payments (monthly, yearly). | Transfer of assets (real estate, bank accounts, investments). |

| Tax Implications | May be taxable income for recipient and deductible for payer (varies by jurisdiction). | No direct tax consequences, but asset transfers may trigger capital gains taxes. |

| Legal Basis | Determined by family law, considering factors like income, duration of marriage, and needs. | Based on equitable distribution or community property laws. |

| Impact on Credit | No direct impact unless payments are missed. | Ownership changes reflected on property titles and asset records. |

Understanding Alimony: Definition and Purpose

Alimony refers to the financial support one spouse may be required to pay to the other after separation or divorce, aiming to assist with living expenses and maintain a standard of living. Property settlement involves dividing marital assets and debts between spouses, focusing on equitable distribution rather than ongoing payments. Understanding alimony helps you recognize its role distinct from property settlement, ensuring clarity in managing post-divorce financial responsibilities.

What Is Property Settlement? Key Concepts

Property settlement refers to the division of assets and liabilities between spouses following a separation or divorce, distinct from ongoing financial support obligations like alimony. It involves identifying, valuing, and distributing marital property--including real estate, investments, and debts--based on equitable factors rather than equal shares. Understanding the key concepts of property settlement is crucial, as it permanently resolves financial interests in shared property, whereas alimony addresses temporary or long-term spousal maintenance.

Legal Distinctions: Alimony vs Property Settlement

Alimony refers to ongoing financial support paid by one spouse to the other after separation or divorce, aimed at maintaining the recipient's standard of living. Property settlement involves the division of marital assets and debts, typically finalized through negotiation or court orders, and is a one-time distribution rather than continuous payments. Understanding the legal distinctions is crucial for Your divorce proceedings, as alimony addresses post-divorce support, while property settlement deals strictly with asset division.

Factors Influencing Alimony Decisions

Factors influencing alimony decisions include the length of the marriage, each spouse's income and earning capacity, and the standard of living established during the marriage. Property settlements typically involve the division of marital assets, such as real estate, investments, and personal property, which can impact the financial resources available for alimony payments. Understanding these distinctions helps you navigate the complexities of divorce settlements and ensures fair financial support tailored to your circumstances.

Factors Affecting Property Settlement Outcomes

Factors affecting property settlement outcomes include the duration of the marriage, each party's financial contributions, and future needs such as earning capacity and health conditions. Courts consider the value of assets acquired jointly or individually during the marriage, along with any debts and liabilities. Your unique circumstances, including the care of children and lifestyle established during the marriage, significantly influence the final property division.

Tax Implications: Alimony and Property Division

Alimony payments are typically taxable income for the recipient and tax-deductible for the payer under agreements finalized before 2019, while property settlements are not considered taxable events since they involve the division of marital assets rather than income transfers. Your alimony obligations can impact your taxable income and should be planned carefully to minimize tax liabilities, whereas property settlements focus on equitable asset distribution without immediate tax consequences. Understanding these differences is crucial for effective financial planning during divorce to optimize tax outcomes related to alimony and property division.

Duration and Modification: Comparing Alimony and Settlements

Alimony typically involves ongoing financial support paid for a specified or indefinite duration, often subject to modification based on changes in income or circumstances, while property settlements are usually one-time distributions of assets finalized at divorce without future adjustments. You should understand that alimony payments might continue for years or end upon remarriage, whereas property settlements legally transfer ownership and remain fixed. Courts generally allow more flexibility in modifying alimony agreements, reflecting your evolving financial needs, but property settlements are final and rarely altered post-divorce.

Enforcement and Non-Compliance Issues

Enforcement of alimony typically involves court orders mandating regular payments, with penalties such as wage garnishment or contempt of court for non-compliance. Property settlements are generally enforced through the division and transfer of assets, with courts able to impose liens or reverse transfers if parties fail to comply. Non-compliance with alimony is more frequently litigated due to its ongoing payment nature, whereas property settlement enforcement is usually a one-time process, although disputes can arise if parties resist asset division.

Common Misconceptions About Alimony and Property Settlement

Common misconceptions about alimony and property settlement often confuse their purposes and calculations, as alimony is designed to provide ongoing financial support to a lower-earning spouse, whereas property settlement involves the division of marital assets and debts. Many assume alimony automatically continues for life or that all marital property is divided equally, but alimony duration and amount depend on factors like income disparities and marriage length, while property settlements focus on equitable distribution rather than equal shares. Understanding these distinctions helps clarify financial expectations during divorce proceedings and avoid disputes.

Choosing the Right Approach: Legal Advice and Considerations

Choosing the right approach between alimony, property settlement, and child support depends on your specific financial circumstances and long-term goals. Legal advice is crucial in understanding the differences: alimony provides ongoing spousal support, property settlement divides marital assets, and child support ensures children's financial needs are met. Your attorney can help tailor a strategy that protects your interests and complies with relevant family law statutes.

Infographic: Alimony vs Property Settlement

relatioo.com

relatioo.com