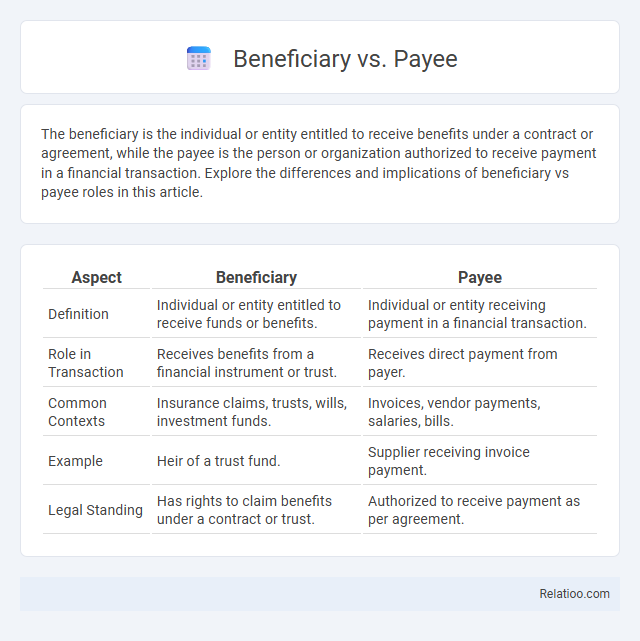

The beneficiary is the individual or entity entitled to receive benefits under a contract or agreement, while the payee is the person or organization authorized to receive payment in a financial transaction. Explore the differences and implications of beneficiary vs payee roles in this article.

Table of Comparison

| Aspect | Beneficiary | Payee |

|---|---|---|

| Definition | Individual or entity entitled to receive funds or benefits. | Individual or entity receiving payment in a financial transaction. |

| Role in Transaction | Receives benefits from a financial instrument or trust. | Receives direct payment from payer. |

| Common Contexts | Insurance claims, trusts, wills, investment funds. | Invoices, vendor payments, salaries, bills. |

| Example | Heir of a trust fund. | Supplier receiving invoice payment. |

| Legal Standing | Has rights to claim benefits under a contract or trust. | Authorized to receive payment as per agreement. |

Understanding Beneficiary and Payee: Key Differences

Understanding the key differences between a beneficiary and a payee is crucial for accurately managing financial transactions. A beneficiary is the person or entity entitled to receive benefits from a trust, insurance policy, or estate, while a payee is the individual or organization designated to receive payment from a transaction or contract. Your ability to distinguish these roles ensures clarity in legal and financial documentation, reducing errors in fund distribution.

Definitions: Who is a Beneficiary?

A beneficiary is an individual or entity entitled to receive benefits, assets, or proceeds from a legal arrangement such as a trust, insurance policy, or will. A payee is the person or organization designated to receive payment in a financial transaction. Unlike the payee, the beneficiary specifically benefits from the transfer of ownership or rights, often in the context of estate planning or contractual agreements.

Definitions: Who is a Payee?

A payee is the individual or entity authorized to receive payment in a financial transaction, such as a check or electronic transfer. In contrast, a beneficiary is the person entitled to benefits or assets from a trust, insurance policy, or will, while the term beneficiary can sometimes overlap with payee depending on context. Understanding your role as a payee is essential to correctly processing payments and ensuring funds reach the intended recipient.

Core Roles of a Beneficiary

The core role of a beneficiary is to receive benefits or assets from a trust, will, or insurance policy, distinguishing them from payees who are typically recipients of payment in financial transactions. Beneficiaries hold legal rights to the property or funds designated to them, ensuring the transfer aligns with the grantor's intentions. Your understanding of these differences clarifies who has entitlement versus who simply receives payment, emphasizing the beneficiary's crucial position in estate and financial planning.

Core Roles of a Payee

A payee is the individual or entity designated to receive payment in a financial transaction, serving as the core recipient of funds or assets. The beneficiary is the person who ultimately gains from a trust, insurance policy, or will, which may differ from the immediate payee. Understanding the payee's role is crucial in ensuring accurate transaction processing, as they hold the legal right to collect the specified payment directly from the payer.

Legal Implications: Beneficiary vs Payee

The legal distinction between a beneficiary and a payee hinges on their roles in financial transactions; a beneficiary is entitled to benefits or assets outlined in contracts, wills, or insurance policies, while a payee is the party designated to receive payment in a financial transaction or contract. Your understanding of these terms is crucial for ensuring compliance with legal obligations and protecting your rights, especially in estate planning and contractual agreements. Misidentifying these roles can lead to disputes, delays in payments, or potential loss of entitlement under the law.

Common Scenarios: When to Use Each Term

In financial transactions, a payee is the individual or entity receiving payment, commonly seen on checks or invoices, while a beneficiary typically refers to a person entitled to benefits from a trust, insurance policy, or will. You encounter a beneficiary in estate planning or insurance claims, whereas the payee is involved in direct payment contexts like payroll or vendor services. Understanding the distinction ensures accurate legal and financial documentation tailored to your specific transaction scenario.

Financial Transactions: Beneficiary vs Payee Explained

In financial transactions, the beneficiary is the individual or entity entitled to receive funds or benefits from an account or contract, while the payee is the person or organization to whom the payment is made or instructed. Your understanding of these roles ensures clarity when managing transfers, as the beneficiary often receives payments indirectly, whereas the payee is the direct recipient during transactions. Distinguishing between beneficiary and payee is crucial for accurate documentation and compliance in banking and legal processes.

How to Designate a Beneficiary or Payee

To designate a beneficiary or payee, clearly specify the full legal name and contact details on the relevant financial or legal documents to avoid any ambiguity. Your designation should include the relationship to you, such as spouse or child, along with any contingency instructions for alternative recipients. Use formal documentation like wills, trusts, or account forms to ensure your beneficiary or payee designation is legally binding and easily enforceable.

Frequently Asked Questions: Beneficiary vs Payee

In financial transactions, the beneficiary is the person or entity entitled to receive benefits or funds under a contract or policy, while the payee is the individual or organization receiving payment in a specific transaction. Frequently asked questions about beneficiary vs payee often revolve around their distinct roles in banking, insurance, and legal documents, where the beneficiary is linked to rights or claims, and the payee is directly paid. Understanding these differences is crucial for managing accounts, trusts, insurance claims, and wills accurately.

Infographic: Beneficiary vs Payee

relatioo.com

relatioo.com