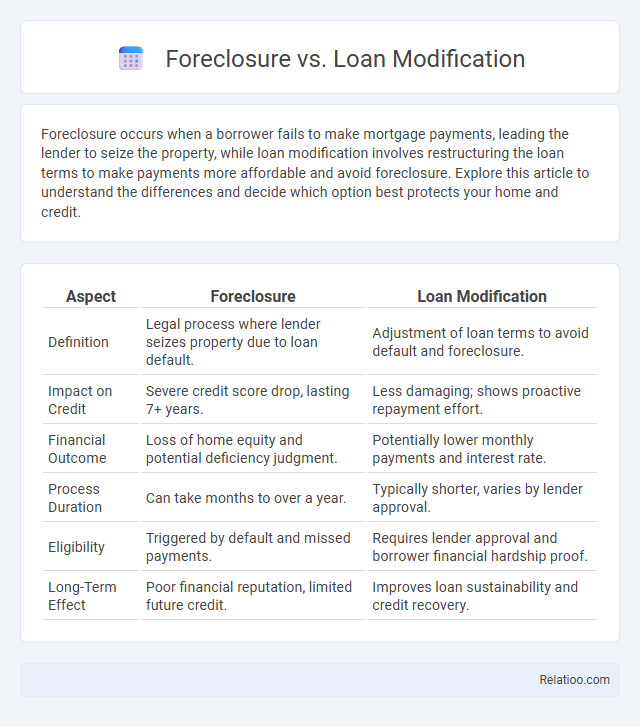

Foreclosure occurs when a borrower fails to make mortgage payments, leading the lender to seize the property, while loan modification involves restructuring the loan terms to make payments more affordable and avoid foreclosure. Explore this article to understand the differences and decide which option best protects your home and credit.

Table of Comparison

| Aspect | Foreclosure | Loan Modification |

|---|---|---|

| Definition | Legal process where lender seizes property due to loan default. | Adjustment of loan terms to avoid default and foreclosure. |

| Impact on Credit | Severe credit score drop, lasting 7+ years. | Less damaging; shows proactive repayment effort. |

| Financial Outcome | Loss of home equity and potential deficiency judgment. | Potentially lower monthly payments and interest rate. |

| Process Duration | Can take months to over a year. | Typically shorter, varies by lender approval. |

| Eligibility | Triggered by default and missed payments. | Requires lender approval and borrower financial hardship proof. |

| Long-Term Effect | Poor financial reputation, limited future credit. | Improves loan sustainability and credit recovery. |

Understanding Foreclosure: Definition and Process

Foreclosure is a legal process where a lender takes ownership of a property after the borrower fails to make mortgage payments. During foreclosure, your home is sold at auction to recover the outstanding loan balance, which can significantly impact your credit score. Understanding this process helps you explore alternatives like loan modification to avoid losing your property.

What is Loan Modification? Key Concepts

Loan modification is a legal process that changes the terms of an existing mortgage to make monthly payments more affordable, often by reducing the interest rate, extending the loan term, or changing the principal balance. It serves as a foreclosure alternative by helping homeowners avoid losing their property due to financial hardship while maintaining loan responsibility. Unlike foreclosure, which results in property repossession and credit damage, loan modification aims to keep borrowers in their homes and improve long-term financial stability.

Primary Differences: Foreclosure vs Loan Modification

Foreclosure occurs when a lender takes legal ownership of a property due to the borrower's failure to meet mortgage payments, resulting in the loss of your home and credit impact. Loan modification, on the other hand, involves renegotiating the terms of your existing mortgage--such as interest rate, loan duration, or principal balance--to make payments more affordable and avoid foreclosure. The primary difference lies in foreclosure ending homeownership through asset liquidation, whereas loan modification aims to keep you in your home by adjusting loan terms.

Pros and Cons of Foreclosure

Foreclosure can provide a fast resolution by allowing lenders to reclaim property and recover losses, but it significantly damages Your credit score and can result in the loss of your home. Unlike loan modification, which offers the potential to adjust loan terms and keep your home with manageable payments, foreclosure ends ownership and may lead to long-term financial consequences. Understanding the drawbacks such as legal fees, eviction risk, and difficulty obtaining future loans is crucial before deciding on foreclosure.

Advantages and Disadvantages of Loan Modification

Loan modification offers the advantage of potentially lowering monthly mortgage payments, making homeownership more affordable and avoiding foreclosure. This solution can preserve credit scores better than foreclosure but may involve extended loan terms and possible increases in total interest paid over time. The disadvantage includes the risk of trial periods that might fail, requiring borrowers to meet strict eligibility criteria and documentation to qualify for modification.

Eligibility Criteria for Foreclosure and Loan Modification

Eligibility for foreclosure typically involves a borrower's failure to make mortgage payments within a specified period, often 90 days or more, leading lenders to initiate legal proceedings to repossess the property. Loan modification eligibility usually requires demonstrated financial hardship, such as reduced income or increased expenses, and a willingness to negotiate new loan terms to avoid default. Lenders assess factors like credit history, current income, and ability to pay the modified loan to determine qualification for a loan modification compared to the stricter criteria triggering foreclosure.

Impact on Credit Score: Foreclosure vs Loan Modification

Foreclosure drastically lowers your credit score, often by 85 to 160 points, and remains on your credit report for up to seven years, severely affecting your ability to secure future loans. Loan modification, while it may cause a temporary dip in your credit score, typically has a less damaging impact because it shows the lender agreed to new terms rather than a default or repossession. Your financial recovery prospects improve significantly with a loan modification compared to foreclosure, as it demonstrates an effort to manage debt responsibly.

Financial Consequences and Long-Term Effects

Foreclosure results in significant credit score damage, making it difficult for you to obtain future loans and often leading to the loss of your home equity. Loan modification can reduce monthly payments and help you avoid foreclosure, preserving your credit score and allowing more time to rebuild financial stability. Foreclosure typically causes long-term financial setbacks, while loan modification offers a chance for recovery without the severe impact on your credit history.

Legal Considerations and Homeowner Rights

Foreclosure involves the legal process where lenders reclaim property due to mortgage default, often resulting in the homeowner losing ownership rights. Loan modification legally alters the original loan terms to make payments affordable, requiring homeowners to negotiate with lenders and understand contract changes to protect their rights. Homeowners retain specific protections under state and federal laws during both foreclosure and loan modification processes, including the right to timely notices, opportunities for dispute resolution, and, in some cases, access to foreclosure prevention programs.

Choosing the Best Option: Factors to Consider

Evaluating foreclosure, loan modification, and short sale requires analyzing factors such as current financial stability, credit impact, and long-term housing goals. Loan modification can preserve homeownership but may involve stricter payment terms, while foreclosure severely damages credit history and leads to asset loss. Choosing the best option depends on assessing income consistency, loan terms, and the potential to rehabilitate financial standing without losing the property.

Infographic: Foreclosure vs Loan Modification

relatioo.com

relatioo.com