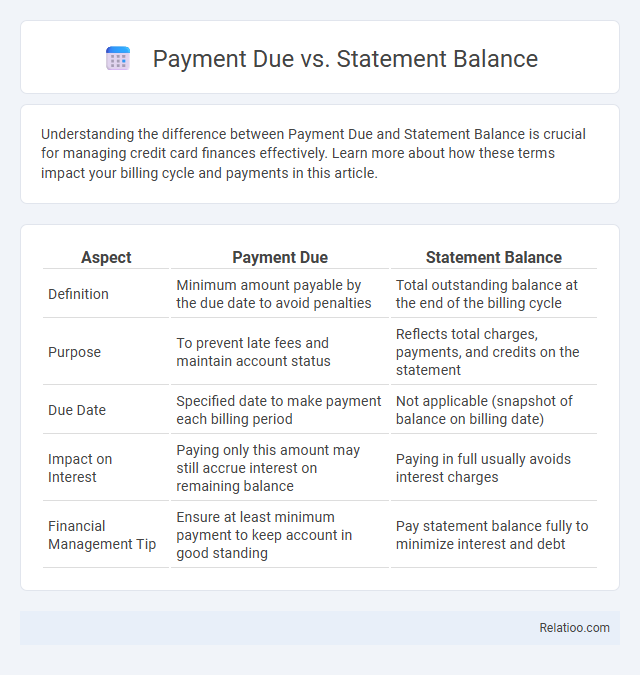

Understanding the difference between Payment Due and Statement Balance is crucial for managing credit card finances effectively. Learn more about how these terms impact your billing cycle and payments in this article.

Table of Comparison

| Aspect | Payment Due | Statement Balance |

|---|---|---|

| Definition | Minimum amount payable by the due date to avoid penalties | Total outstanding balance at the end of the billing cycle |

| Purpose | To prevent late fees and maintain account status | Reflects total charges, payments, and credits on the statement |

| Due Date | Specified date to make payment each billing period | Not applicable (snapshot of balance on billing date) |

| Impact on Interest | Paying only this amount may still accrue interest on remaining balance | Paying in full usually avoids interest charges |

| Financial Management Tip | Ensure at least minimum payment to keep account in good standing | Pay statement balance fully to minimize interest and debt |

Understanding Payment Due vs Statement Balance

Understanding the difference between Payment Due and Statement Balance is crucial for effective credit card management. Payment Due is the minimum amount you must pay by the due date to avoid late fees, while the Statement Balance reflects the total amount owed from all transactions during the billing cycle. Paying the Statement Balance in full helps avoid interest charges, whereas paying only the Payment Due keeps your account in good standing but may accrue interest on the remaining balance.

What Is a Statement Balance?

A statement balance is the total amount you owe on your credit card at the end of a billing cycle, including all purchases, fees, and interest charges. It differs from the payment due, which is the minimum amount required to avoid late fees and penalties. Understanding your statement balance helps you manage your credit utilization and avoid interest charges by paying the full amount by the due date.

What Does Payment Due Mean?

Payment Due refers to the minimum amount you must pay by the due date to avoid late fees and penalties on your credit card or loan account. It is distinct from the Statement Balance, which is the total amount you owe as of the billing cycle's end, including all charges and fees. Understanding the difference helps you manage your payments effectively and maintain a healthy credit score.

Key Differences Between Payment Due and Statement Balance

Payment due is the exact amount you must pay by the due date to avoid late fees and maintain good credit standing, while the statement balance reflects the total charges on your account during the billing cycle, including any unpaid previous balances. Your payment due often includes minimum payment requirements, which can be less than the statement balance if you choose to pay partially. Understanding the key differences between payment due and statement balance helps you manage your credit card effectively and avoid unnecessary interest charges.

Why the Statement Balance Matters

The statement balance represents the total amount owed on your credit card at the end of the billing cycle, reflecting all transactions and fees accrued. Understanding the statement balance is crucial because paying it in full by the payment due date helps you avoid interest charges and maintain a healthy credit score. Your payment due only indicates the minimum amount required, which if paid alone, can lead to accumulating interest on the remaining balance.

How Payment Due Impacts Your Credit Card Usage

Payment Due is the minimum amount you must pay by the due date to avoid late fees and negative credit impacts, while Statement Balance represents the total charges on your credit card statement. Paying only the Payment Due ensures on-time payments but carrying a balance may accrue interest and affect your credit utilization ratio, which can lower your credit score. Managing Payment Due effectively helps maintain a positive payment history and optimal credit utilization, both crucial factors in credit card usage and credit health.

Paying the Minimum vs Paying the Statement Balance

Paying the minimum amount on a credit card helps avoid late fees but accrues interest on the remaining balance, increasing overall debt. Settling the statement balance in full each month prevents interest charges, maintaining your credit health and reducing costs. Understanding the difference between payment due and statement balance enables smarter financial decisions and improves credit score management.

Tips to Manage Payment Due and Statement Balances

Effectively managing your payment due and statement balances involves prioritizing full statement balance payments to avoid interest charges, while ensuring on-time payment of at least the minimum due to maintain good credit standing. Regularly monitoring statement balances helps track spending and prevent unexpected debt accumulation, enabling better budgeting and financial control. Utilizing automatic payments or calendar reminders can prevent missed due dates and optimize credit card usage for improved credit scores.

Common Myths About Payment Due vs Statement Balance

Common myths about payment due versus statement balance often confuse credit card users, leading to unnecessary fees or interest charges. The payment due is the minimum amount required to avoid late fees, while the statement balance reflects the total amount owed on the billing cycle. Misunderstanding these terms may result in paying only the minimum and accruing interest, or assuming paying the statement balance is optional when it directly impacts credit utilization and scores.

Choosing the Best Payment Strategy for Your Finances

Understanding the differences between Payment Due, Statement Balance, and Minimum Payment Due is crucial for managing credit card payments effectively. Paying the Statement Balance in full each month avoids interest charges, while paying only the Minimum Payment Due keeps your account current but accrues interest on the remaining balance. To optimize your finances, prioritize paying the full Statement Balance or as much above the minimum as possible, minimizing debt and improving credit scores.

Infographic: Payment Due vs Statement Balance

relatioo.com

relatioo.com