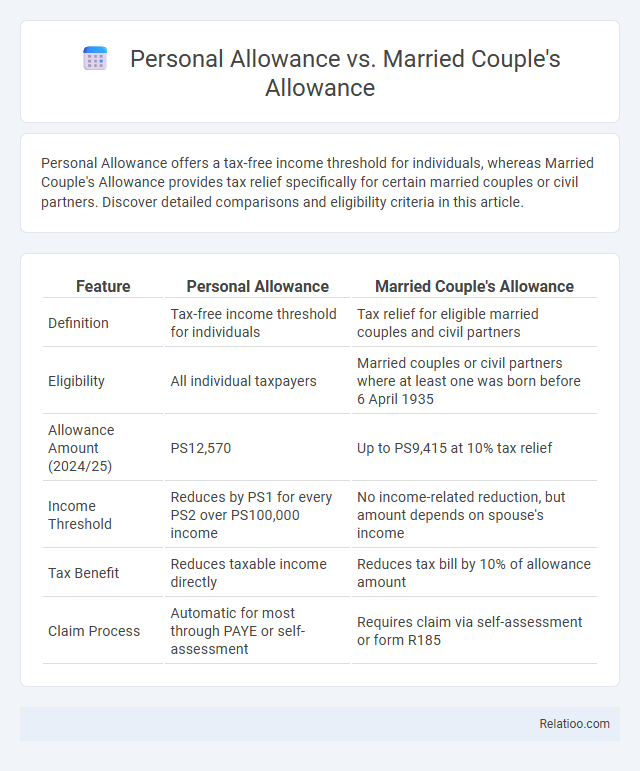

Personal Allowance offers a tax-free income threshold for individuals, whereas Married Couple's Allowance provides tax relief specifically for certain married couples or civil partners. Discover detailed comparisons and eligibility criteria in this article.

Table of Comparison

| Feature | Personal Allowance | Married Couple's Allowance |

|---|---|---|

| Definition | Tax-free income threshold for individuals | Tax relief for eligible married couples and civil partners |

| Eligibility | All individual taxpayers | Married couples or civil partners where at least one was born before 6 April 1935 |

| Allowance Amount (2024/25) | PS12,570 | Up to PS9,415 at 10% tax relief |

| Income Threshold | Reduces by PS1 for every PS2 over PS100,000 income | No income-related reduction, but amount depends on spouse's income |

| Tax Benefit | Reduces taxable income directly | Reduces tax bill by 10% of allowance amount |

| Claim Process | Automatic for most through PAYE or self-assessment | Requires claim via self-assessment or form R185 |

Understanding Personal Allowance

Personal Allowance is the amount of income you can earn tax-free each year, currently set at PS12,570 for most individuals. Married Couple's Allowance differs by providing tax relief to couples where at least one spouse was born before April 6, 1935, with a minimum allowance of PS9,415. Understanding Personal Allowance helps you maximize your tax efficiency by accurately assessing your tax-free income threshold.

What Is Married Couple’s Allowance?

Married Couple's Allowance is a tax relief available in the UK for couples where at least one partner was born before April 6, 1935, reducing their overall tax liability by allowing a portion of income to be tax-free. Unlike the standard Personal Allowance, which applies universally to taxpayers, Married Couple's Allowance specifically benefits eligible older couples by sharing tax relief based on their combined incomes. This allowance can reduce income tax by up to PS906 annually, depending on income levels and spouse status.

Key Differences Between Personal and Married Couple’s Allowance

Personal Allowance is the amount of income you can earn tax-free each year, while Married Couple's Allowance offers tax relief specifically for couples where one spouse was born before April 6, 1935. The key differences lie in eligibility criteria, with Personal Allowance available to most individuals regardless of marital status, and Married Couple's Allowance dependent on age and marital status, providing a tax reduction as a percentage of the allowance rather than a fixed tax-free amount. Understanding these distinctions helps you optimize your tax planning based on your personal circumstances and eligibility.

Eligibility Criteria for Each Allowance

Personal Allowance is available to all UK taxpayers, providing a tax-free income threshold up to a specific limit, usually dependent on age and earnings. Married Couple's Allowance applies only to couples where at least one partner was born before April 6, 1935, and they must be married or in a civil partnership, with one spouse paying tax at the higher or additional rate. Eligibility for Marriage Allowance, often confused with Personal Allowance, requires the lower-earning partner to transfer part of their tax-free Personal Allowance to their spouse, who must be a basic-rate taxpayer.

How Allowances Affect Your Tax Bill

Personal Allowance reduces the amount of income on which you pay tax, lowering your overall tax bill by allowing a certain portion of your income to be tax-free. Married Couple's Allowance provides a tax reduction specifically for married couples or civil partners where one earns below a certain threshold, offering additional relief that can significantly decrease your tax liability. Your tax bill is directly impacted by which allowances apply, as Personal Allowance benefits most individuals, while Married Couple's Allowance offers extra savings to eligible couples, ensuring you pay less tax overall.

Claiming the Right Allowance: Step-by-Step

Claiming the right allowance starts with identifying eligibility criteria for Personal Allowance, Married Couple's Allowance, or Blind Person's Allowance based on individual circumstances such as marital status and income thresholds. Checking HMRC guidelines and using the online tax calculator helps determine which allowance maximizes tax relief, especially considering that Married Couple's Allowance applies to couples where at least one was born before April 6, 1935. Submitting accurate claims through the Self Assessment tax return or contacting HMRC directly ensures the correct allowance is applied, reducing the risk of overpayment or underpayment of tax.

Impact of Marriage and Civil Partnership on Tax Allowances

Marriage and civil partnership impact your tax allowances by potentially increasing the amount you can earn tax-free through the Married Couple's Allowance, which is available if you or your spouse were born before April 6, 1935. Personal Allowance applies to individuals regardless of marital status, offering a baseline tax-free income threshold. You can benefit from transferring a portion of your partner's Personal Allowance via the Marriage Allowance, reducing your combined tax liabilities if one spouse earns less than the personal allowance threshold.

Common Mistakes When Claiming Allowances

Common mistakes when claiming Personal Allowance, Married Couple's Allowance, and Blind Person's Allowance include misunderstanding eligibility criteria and failing to notify HMRC of changes in circumstances, such as marital status or blindness certification. Taxpayers often overlook that Married Couple's Allowance is only available if one spouse was born before April 6, 1935, leading to incorrect claims. Incorrectly claiming multiple allowances simultaneously or not adjusting claims after income changes can result in underpayment or overpayment of tax, triggering penalties or refunds.

Maximizing Tax Efficiency as a Couple

Maximizing tax efficiency as a couple involves understanding the differences between Personal Allowance, Married Couple's Allowance, and transferable tax allowances. Personal Allowance provides a tax-free income threshold for each individual, while Married Couple's Allowance offers a valuable tax reduction for eligible couples, particularly those where one partner was born before April 6, 1935. Couples can optimize tax savings by transferring unused Personal Allowance or claiming Married Couple's Allowance where applicable, ensuring the highest possible combined tax efficiency.

Frequently Asked Questions on Tax Allowances

Personal Allowance is the amount of income you can earn tax-free, typically set at a standard rate for most individuals. Married Couple's Allowance offers additional tax relief for certain married couples or civil partners, usually those born before a specific date, and can reduce the overall tax bill more significantly than the standard Personal Allowance. Understanding how these allowances apply to your situation is crucial for maximizing your tax efficiency and ensuring you claim the correct entitlements.

Infographic: Personal Allowance vs Married Couple’s Allowance

relatioo.com

relatioo.com