Fraud involves intentionally deceiving individuals or organizations for financial gain, while money laundering is the process of concealing the origins of illegally obtained money through complex transactions. Explore this article to understand the key differences and connections between fraud and money laundering.

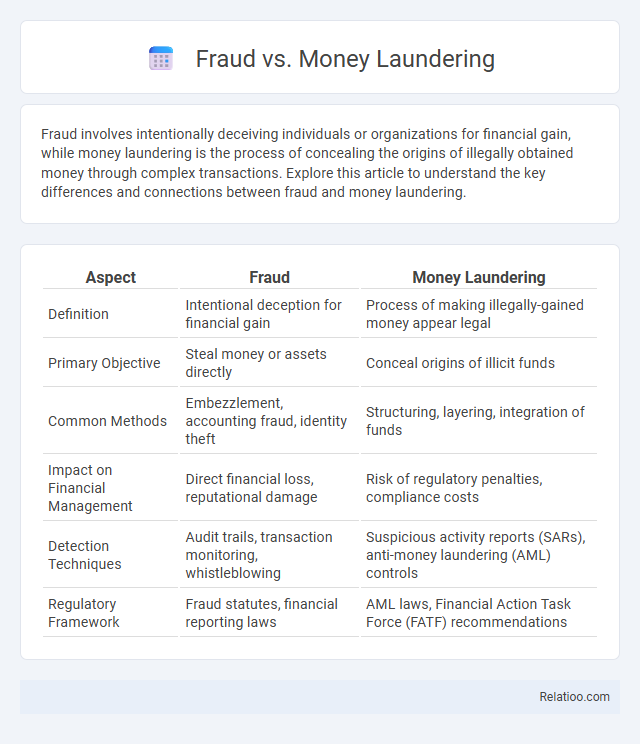

Table of Comparison

| Aspect | Fraud | Money Laundering |

|---|---|---|

| Definition | Intentional deception for financial gain | Process of making illegally-gained money appear legal |

| Primary Objective | Steal money or assets directly | Conceal origins of illicit funds |

| Common Methods | Embezzlement, accounting fraud, identity theft | Structuring, layering, integration of funds |

| Impact on Financial Management | Direct financial loss, reputational damage | Risk of regulatory penalties, compliance costs |

| Detection Techniques | Audit trails, transaction monitoring, whistleblowing | Suspicious activity reports (SARs), anti-money laundering (AML) controls |

| Regulatory Framework | Fraud statutes, financial reporting laws | AML laws, Financial Action Task Force (FATF) recommendations |

Understanding Fraud: Definition and Key Characteristics

Fraud involves intentional deception to secure unfair or unlawful financial gain, characterized by false representation, concealment of truth, or breach of trust. Unlike money laundering, which is the process of disguising illegally obtained money to make it appear legitimate, fraud directly targets victims through schemes like identity theft or financial statement fraud. Understanding fraud helps you recognize red flags such as misappropriation of assets, manipulation of financial data, and misrepresentation, crucial for protecting personal or business assets.

What is Money Laundering? An Overview

Money laundering is the process of disguising illegally obtained money to make it appear legitimate, often involving multiple complex financial transactions. Your understanding of money laundering is crucial for identifying how criminals integrate illicit funds into the legal economy, distinguishing it from fraud, which involves deceit to gain financial or personal benefits. Unlike fraud, money laundering primarily focuses on concealing the origins of criminal proceeds rather than the initial act of deception.

Types of Fraud: Common Schemes and Methods

Common schemes in fraud include identity theft, credit card fraud, and insurance fraud, where perpetrators manipulate personal information or documentation for illicit gain. Money laundering involves methods such as structuring, smurfing, and using shell companies to disguise the origins of illegally obtained funds. Both fraud and money laundering employ complex tactics, but fraud primarily aims to deceive victims for direct financial gain, whereas money laundering focuses on legitimizing illicit proceeds.

Stages of Money Laundering Explained

Money laundering involves three distinct stages: placement, where illicit funds enter the financial system; layering, which obscures the money's origins through complex transactions; and integration, where laundered funds re-enter the economy appearing legitimate. Fraud typically generates the illegal proceeds that are then laundered, whereas money laundering focuses on disguising the source of these criminally obtained assets. Understanding these stages helps you identify and prevent financial crimes by recognizing the methods used to conceal illicit activities.

Key Differences Between Fraud and Money Laundering

Fraud involves intentionally deceiving individuals or entities to gain financial or personal benefit, often through false representation or manipulation. Money laundering is the process of disguising the origins of illegally obtained money, typically by transferring it through complex financial transactions to make it appear legitimate. The key difference lies in fraud being the act of acquiring illicit funds, while money laundering focuses on concealing the source of those funds to integrate them into the legal economy.

Legal Consequences: Fraud vs Money Laundering

Fraud involves deceptive practices to unlawfully obtain money or property, typically resulting in criminal charges like fines, restitution, and imprisonment. Money laundering entails disguising the origins of illegally obtained funds, leading to severe penalties including asset forfeiture, heavy fines, and lengthy prison sentences. Legal consequences for money laundering are generally more severe due to its association with organized crime and efforts to conceal criminal proceeds.

Detection and Prevention Strategies for Fraud

Fraud involves intentional deception for financial gain, while money laundering disguises illegally obtained money as legitimate income, and corruption entails abuse of power for personal benefit. Effective detection and prevention strategies for fraud include implementing robust internal controls, continuous transaction monitoring using advanced analytics, and employee training on recognizing suspicious activities. You can enhance fraud prevention by adopting multi-factor authentication, conducting regular audits, and leveraging artificial intelligence to identify unusual patterns early.

Anti-Money Laundering (AML) Regulations and Compliance

Fraud involves deceit to gain financial or personal benefit, while money laundering conceals the origins of illegally obtained money, making it appear legitimate. Anti-Money Laundering (AML) regulations require financial institutions and businesses to implement rigorous compliance measures, including customer due diligence, transaction monitoring, and reporting suspicious activities to prevent illicit funds from entering the financial system. Your adherence to AML compliance not only mitigates legal risks but also strengthens overall financial integrity and trust.

Real-World Cases: Fraud and Money Laundering in Practice

Real-world cases highlight that fraud involves deceit to gain financial or personal benefits, while money laundering focuses on concealing the origins of illegally obtained money. You may encounter examples like the Enron scandal for fraud, exposing fraudulent accounting practices, and the HSBC case for money laundering, revealing how illicit funds were processed through global banking systems. Understanding these distinctions helps identify and prevent complex financial crimes effectively.

The Future of Financial Crime: Trends and Challenges

Emerging technologies like AI and blockchain are reshaping the future landscape of financial crime, intensifying the complexity of fraud and money laundering detection. Regulatory bodies are enhancing compliance measures with advanced analytics to stay ahead of sophisticated schemes targeting Your financial assets. Collaboration between institutions and continuous innovation in fraud prevention will be pivotal in addressing evolving threats and safeguarding the global financial system.

Infographic: Fraud vs Money Laundering

relatioo.com

relatioo.com