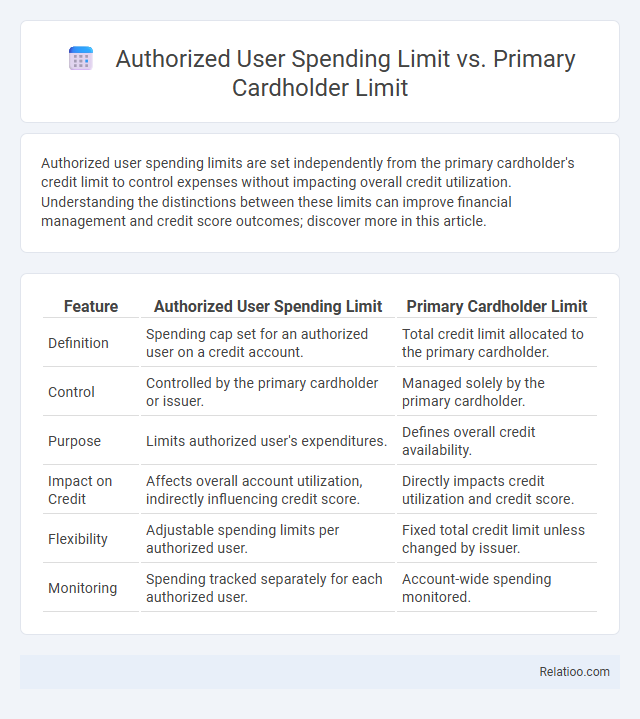

Authorized user spending limits are set independently from the primary cardholder's credit limit to control expenses without impacting overall credit utilization. Understanding the distinctions between these limits can improve financial management and credit score outcomes; discover more in this article.

Table of Comparison

| Feature | Authorized User Spending Limit | Primary Cardholder Limit |

|---|---|---|

| Definition | Spending cap set for an authorized user on a credit account. | Total credit limit allocated to the primary cardholder. |

| Control | Controlled by the primary cardholder or issuer. | Managed solely by the primary cardholder. |

| Purpose | Limits authorized user's expenditures. | Defines overall credit availability. |

| Impact on Credit | Affects overall account utilization, indirectly influencing credit score. | Directly impacts credit utilization and credit score. |

| Flexibility | Adjustable spending limits per authorized user. | Fixed total credit limit unless changed by issuer. |

| Monitoring | Spending tracked separately for each authorized user. | Account-wide spending monitored. |

Understanding Credit Card Spending Limits

Your credit card spending limits include the primary cardholder limit, which is the maximum amount set for the entire account, encompassing all authorized users. Authorized user spending limits are often sub-limits assigned by the primary cardholder to control how much each additional cardholder can spend, providing tailored budget management. Understanding these distinctions helps you monitor and regulate spending effectively to avoid exceeding the overall credit limit and potential fees.

Who Is an Authorized User?

An authorized user is someone granted permission by the primary cardholder to use a credit card account without being legally responsible for the debt. Your spending limit as an authorized user is typically set by the primary cardholder, allowing control over authorized user spending separate from the overall primary cardholder limit. This distinction helps manage and monitor spending while maintaining the primary cardholder's credit responsibility.

Defining the Primary Cardholder Limit

The Primary Cardholder Limit defines the maximum credit available to the main account holder, setting the overall spending capacity for the credit card. Authorized User Spending Limit is a subset of this limit, assigned to secondary users by the primary cardholder to control their individual expenditures. Your understanding of these distinctions is crucial for managing credit responsibly and preventing overspending across different users on the same account.

How Authorized User Spending Limits Work

Authorized user spending limits are distinct controls set by the primary cardholder to manage the expenditure of additional cardholders on the account, ensuring that each authorized user operates within a specified budget. These limits function independently from the overall primary cardholder limit, providing a tailored cap that prevents unauthorized overspending while maintaining the convenience of shared access. Your ability to set and monitor these authorized user limits enhances financial oversight and helps maintain responsible credit use across all cardholders.

Key Differences Between Authorized User and Primary limits

Authorized user spending limits are set by the primary cardholder or issuer, restricting how much an authorized user can charge, while the primary cardholder's limit represents the total credit line for the entire account. Spending limits for authorized users help control individual expenditures without affecting the overall credit limit assigned to the primary cardholder. Key differences include the primary cardholder's ability to manage the full credit line and make payments, whereas authorized users have limited control and are subject to specific sub-limits imposed within the primary account.

Financial Responsibility: Authorized User vs Primary Cardholder

Financial responsibility differs significantly between authorized users and primary cardholders; the primary cardholder holds full liability for all charges on the account, including those made by authorized users. Spending limits for authorized users are often set by the primary cardholder to control expenditures and mitigate risk, ensuring that your authorized users cannot exceed predetermined credit thresholds. Understanding these distinctions helps you maintain effective financial oversight and prevent unexpected debt accumulation on your credit card account.

Impact on Credit Scores

Authorized user spending limits reflect the maximum amount an authorized user can charge, directly influencing their reported utilization ratio and potentially impacting their credit score. The primary cardholder limit defines the overall credit limit on the account, determining the total available credit and impacting both the primary and authorized users' credit utilization rates. Your responsible management of these limits helps maintain a healthy credit utilization ratio, which is crucial for positive credit score performance.

Setting and Managing Spending Limits

Setting and managing spending limits for your credit cards involves understanding the differences between Authorized User Spending Limits, Primary Cardholder Limits, and overall Spending Limits. The Primary Cardholder Limit represents the maximum credit available on your account, while Authorized User Spending Limits are specific caps you assign to each additional user to control their expenditures independently. Effective management of these limits ensures you maintain financial control, prevent overspending, and tailor access privileges according to your budget and security preferences.

Pros and Cons for Cardholders and Authorized Users

Authorized User Spending Limit allows authorized users to make purchases up to a set amount, providing controlled access without impacting the primary cardholder's overall credit line. Primary Cardholder Limit represents the total credit available on the account, giving full flexibility but requiring careful management to avoid overspending and credit score damage. Spending Limits distribute risk and budget control more effectively but may restrict authorized users' flexibility, while benefiting primary cardholders by minimizing unauthorized debt accumulation.

Choosing the Right Spending Limit Strategy

Choosing the right spending limit strategy involves understanding the differences between authorized user spending limits, primary cardholder limits, and overall spending limits. Authorized user spending limits are set by the primary cardholder to control individual user expenses, while the primary cardholder limit represents the total credit available on the account. Your optimal strategy balances these limits to monitor and manage expenses effectively, preventing overspending and maintaining healthy credit utilization.

Infographic: Authorized User Spending Limit vs Primary Cardholder Limit

relatioo.com

relatioo.com