Return on Investment (ROI) measures the efficiency of an investment by comparing net profit to the total invested capital, while Return on Equity (ROE) indicates how effectively a company uses shareholders' equity to generate profits. Discover detailed insights on how balancing ROI and ROE can enhance financial decision-making in this article.

Table of Comparison

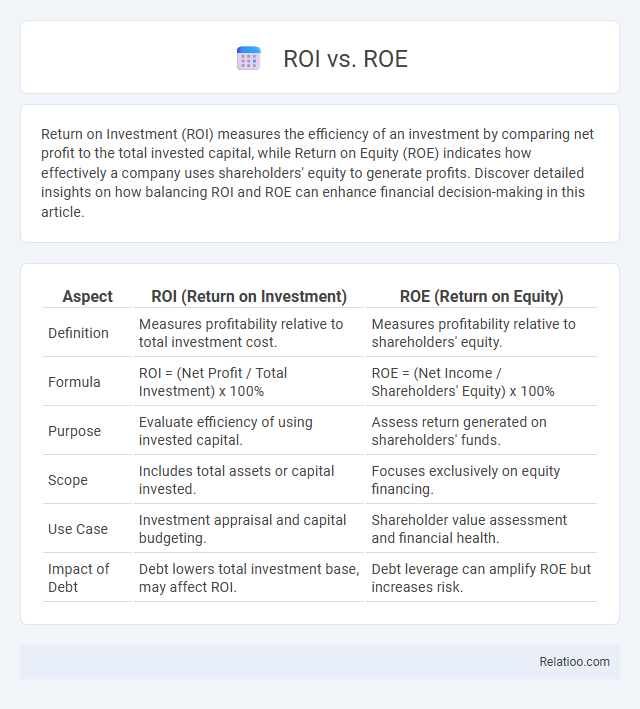

| Aspect | ROI (Return on Investment) | ROE (Return on Equity) |

|---|---|---|

| Definition | Measures profitability relative to total investment cost. | Measures profitability relative to shareholders' equity. |

| Formula | ROI = (Net Profit / Total Investment) x 100% | ROE = (Net Income / Shareholders' Equity) x 100% |

| Purpose | Evaluate efficiency of using invested capital. | Assess return generated on shareholders' funds. |

| Scope | Includes total assets or capital invested. | Focuses exclusively on equity financing. |

| Use Case | Investment appraisal and capital budgeting. | Shareholder value assessment and financial health. |

| Impact of Debt | Debt lowers total investment base, may affect ROI. | Debt leverage can amplify ROE but increases risk. |

Understanding ROI: Definition and Importance

Return on Investment (ROI) measures the efficiency of an investment by comparing net profit to the initial cost, providing a clear indicator of profitability. It is crucial for evaluating the potential return of various projects or assets, enabling informed decision-making and resource allocation. Unlike Return on Equity (ROE), which focuses specifically on shareholder returns, ROI offers a broader perspective applicable across different investment types.

What is ROE? Key Concepts Explained

Return on Equity (ROE) measures a company's profitability by revealing how much profit it generates with shareholders' equity, expressed as Net Income divided by Shareholders' Equity. Unlike Return on Investment (ROI), which assesses the efficiency of an investment regardless of financing, ROE focuses specifically on the returns earned on equity capital. Understanding ROE helps investors evaluate how effectively management uses equity financing to grow profits and create shareholder value.

ROI vs ROE: Core Differences

ROI (Return on Investment) measures the efficiency of an investment by comparing net profit to the total investment cost, highlighting the overall profitability of your capital expenditure. ROE (Return on Equity) specifically assesses how effectively a company utilizes shareholders' equity to generate profit, reflecting your equity holders' return rather than total invested capital. Understanding the core differences between ROI and ROE helps you evaluate financial performance from investment and ownership perspectives, ensuring informed decision-making.

Calculating ROI: Methods and Examples

Calculating ROI involves dividing net profit by the total investment cost and multiplying by 100 to express it as a percentage, which measures efficiency in generating returns from investments. Common methods include accounting ROI, which focuses on operating income, and cash flow ROI, which emphasizes net cash inflows; for example, if an investment of $50,000 yields a profit of $7,500, the ROI is 15%. Unlike ROE that measures return on shareholder equity, ROI directly assesses overall investment performance, providing clear metrics for comparing diverse projects or assets.

How to Determine ROE: Step-by-Step Guide

To determine Your Return on Equity (ROE), start by locating the net income on the company's income statement. Next, find the shareholders' equity from the balance sheet, which represents the owners' residual interest after liabilities. Finally, divide net income by shareholders' equity and multiply by 100 to express ROE as a percentage, reflecting how efficiently Your equity generates profit compared to broader Return or Return on Investment (ROI) metrics.

When to Use ROI vs ROE in Financial Analysis

ROI (Return on Investment) measures the efficiency of an investment relative to its cost, ideal for evaluating specific projects or capital expenditures. ROE (Return on Equity) assesses a company's profitability by revealing how effectively shareholder equity generates net income, making it crucial for analyzing overall company performance. Use ROI when comparing investment options or projects, while ROE is preferred for understanding management effectiveness and shareholder value creation.

Advantages of Measuring ROI

Measuring ROI (Return on Investment) provides a clear picture of the efficiency and profitability of your capital expenditures by directly comparing net gains to invested costs. Unlike ROE (Return on Equity), which only measures profitability relative to shareholders' equity, ROI evaluates the performance of all invested resources, giving a broader financial insight. Your ability to assess ROI enables smarter decisions, optimizing resource allocation and maximizing overall investment returns.

Benefits of Monitoring ROE

Monitoring ROE (Return on Equity) provides critical insights into how efficiently Your company is utilizing shareholders' equity to generate profits, directly impacting investor confidence and stock valuation. Unlike ROI, which measures overall investment efficiency, ROE highlights profitability relative to equity, making it essential for assessing management effectiveness and long-term financial health. Tracking ROE helps identify strengths and weaknesses in capital use, enabling more informed decisions that enhance shareholder value and sustainable growth.

Limitations of ROI and ROE Metrics

ROI and ROE provide valuable insights into profitability but have notable limitations. ROI often ignores the time value of money and can be manipulated by selecting different time periods or accounting methods, leading to misleading comparisons. ROE may be distorted by high debt levels, as leverage inflates equity returns, and it does not reflect the risk associated with the company's capital structure.

ROI vs ROE: Which Metric Should You Prioritize?

ROI (Return on Investment) measures the efficiency of an investment by comparing net profit to the initial cost, making it ideal for evaluating specific projects or asset purchases. ROE (Return on Equity) assesses a company's profitability relative to shareholders' equity, providing insights into overall financial performance and management effectiveness. Prioritize ROI for targeted investment decisions and short-term project evaluations, while ROE is essential for understanding long-term shareholder value and corporate health.

Infographic: ROI vs ROE

relatioo.com

relatioo.com