Understanding the Annual Gift Exclusion lets you give up to $17,000 per recipient in 2024 without affecting your Lifetime Gift Exemption, which currently allows transfers exceeding $12.92 million tax-free. Explore this article to learn how to strategically combine both to maximize your gifting benefits.

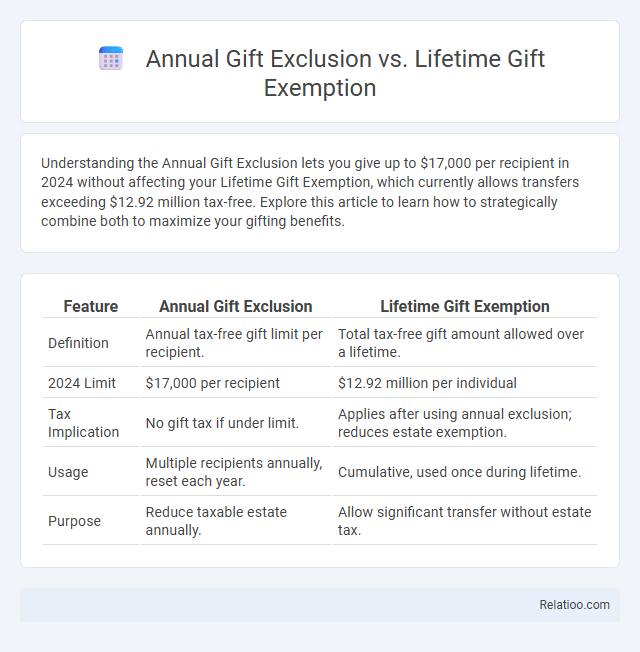

Table of Comparison

| Feature | Annual Gift Exclusion | Lifetime Gift Exemption |

|---|---|---|

| Definition | Annual tax-free gift limit per recipient. | Total tax-free gift amount allowed over a lifetime. |

| 2024 Limit | $17,000 per recipient | $12.92 million per individual |

| Tax Implication | No gift tax if under limit. | Applies after using annual exclusion; reduces estate exemption. |

| Usage | Multiple recipients annually, reset each year. | Cumulative, used once during lifetime. |

| Purpose | Reduce taxable estate annually. | Allow significant transfer without estate tax. |

Introduction to Gift Taxation

Understanding Annual Gift Exclusion, Lifetime Gift Exemption, and general Gifting is crucial for effective gift tax planning. The Annual Gift Exclusion allows you to give up to a specified amount per recipient each year without triggering gift tax, while the Lifetime Gift Exemption covers cumulative gifts exceeding the annual limit, exempting them from taxation up to a certain threshold. Your strategic use of these provisions can minimize tax liability and maximize wealth transfer efficiency.

What Is the Annual Gift Exclusion?

The Annual Gift Exclusion allows you to give up to $17,000 per recipient each year without incurring gift tax or reducing your lifetime estate and gift tax exemption. Unlike the Lifetime Gift Exemption, which covers cumulative gifts exceeding $12.92 million (as of 2024) over your lifetime, the Annual Gift Exclusion resets every year, enabling strategic tax-free wealth transfer. Understanding this distinction helps you optimize gifting strategies while preserving your estate's value for heirs.

Understanding the Lifetime Gift Exemption

The Lifetime Gift Exemption allows you to transfer a significant amount of assets tax-free over your lifetime, unlike the Annual Gift Exclusion which limits tax-free gifts to a set amount per recipient each year. Understanding this exemption is crucial for effective estate planning, as it can reduce your taxable estate and potentially minimize estate taxes for your heirs. Proper use of the Lifetime Gift Exemption, combined with strategic gifting, can optimize wealth transfer and preserve your assets for future generations.

Key Differences: Annual Exclusion vs. Lifetime Exemption

The Annual Gift Exclusion allows you to give up to a specific amount per recipient each year without incurring gift tax, currently set at $17,000 per individual in 2024. The Lifetime Gift Exemption, however, covers total gifts given over your lifetime above the annual exclusions, with a limit of $12.92 million as of 2024, which can reduce your estate tax liability. Understanding these key differences helps optimize gifting strategies, ensuring you maximize tax benefits while efficiently transferring wealth.

How the Annual Gift Exclusion Works

The Annual Gift Exclusion allows individuals to give up to a specified amount--$17,000 per recipient in 2024--without incurring gift tax or reducing their Lifetime Gift Exemption. This exclusion applies per donor to each donee annually, enabling substantial tax-efficient wealth transfer during a lifetime. Unlike the Lifetime Gift Exemption, which is a cumulative amount (over $12 million in 2024) used once annual exclusions are exceeded, the Annual Gift Exclusion provides recurring, yearly relief from gift taxation.

Applying the Lifetime Gift Exemption

Applying the Lifetime Gift Exemption allows individuals to transfer assets exceeding the Annual Gift Exclusion limit without immediate gift tax consequences, effectively reducing the taxable estate upon death. Unlike the Annual Gift Exclusion, which permits gifts up to $17,000 per recipient annually (as of 2024) tax-free, the Lifetime Gift Exemption currently stands at $12.92 million per individual, enabling larger transfers combined across a lifetime. Properly utilizing the Lifetime Gift Exemption involves filing IRS Form 709 to report taxable gifts, ensuring these transfers count against the exemption and minimize estate tax liability.

Tax Implications for Donors and Recipients

The Annual Gift Exclusion allows donors to give up to a specific amount per recipient each year tax-free, currently set at $17,000 in 2024, minimizing immediate gift tax liability. The Lifetime Gift Exemption, totaling $12.92 million per individual in 2024, enables donors to transfer larger sums without incurring gift tax but reduces the estate tax exemption upon death. Recipients typically do not incur income tax on received gifts, but donors must track gifted amounts to avoid exceeding exemption limits and triggering gift tax payments.

Strategies for Maximizing Gift Tax Benefits

Utilizing the Annual Gift Exclusion allows you to transfer up to $17,000 per recipient in 2024 without incurring gift tax, effectively reducing your taxable estate year by year. The Lifetime Gift Exemption, set at $12.92 million per individual in 2024, provides a cumulative amount you can gift beyond the annual exclusion threshold before triggering gift tax. Strategically combining both allows your estate plan to maximize tax benefits by leveraging annual exclusions for smaller, ongoing gifts while applying the lifetime exemption for larger, one-time transfers, minimizing overall tax liability.

Common Mistakes to Avoid with Gift Taxes

When managing gift taxes, You must distinguish between the Annual Gift Exclusion and the Lifetime Gift Exemption to avoid costly errors. Common mistakes include exceeding the $17,000 (2024) annual gift exclusion without filing a gift tax return and mistakenly assuming lifetime gifts are free of tax consequences until death. Proper documentation and understanding IRS limits are essential to prevent unintended gift tax liabilities and maximize your gifting strategy.

Frequently Asked Questions: Gift Tax Rules

The annual gift exclusion allows individuals to give up to $17,000 per recipient in 2024 without incurring gift tax or using the lifetime gift exemption. The lifetime gift exemption in 2024 stands at $12.92 million, enabling taxpayers to gift amounts exceeding the annual exclusion over their lifetime before owing federal gift tax. Gifting strategies often involve understanding these limits to minimize estate taxes while complying with IRS gift tax rules, which require filing Form 709 for gifts surpassing the annual exclusion.

Infographic: Annual Gift Exclusion vs Lifetime Gift Exemption

relatioo.com

relatioo.com