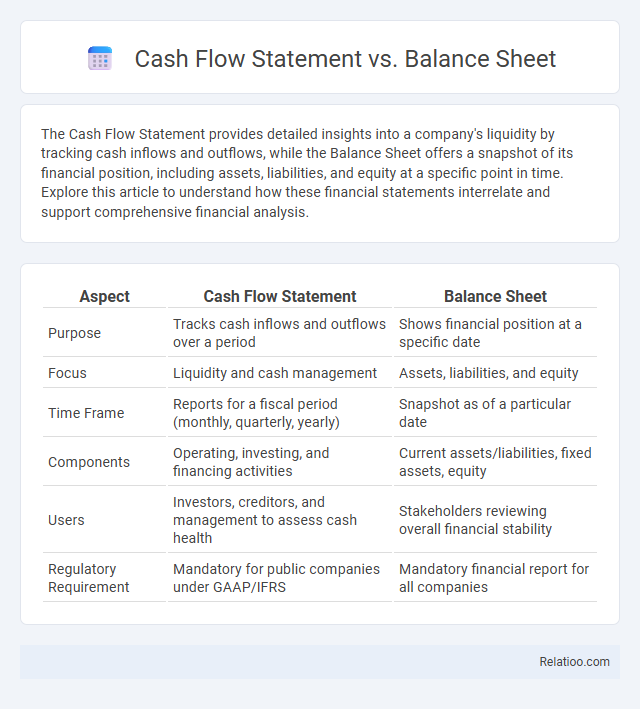

The Cash Flow Statement provides detailed insights into a company's liquidity by tracking cash inflows and outflows, while the Balance Sheet offers a snapshot of its financial position, including assets, liabilities, and equity at a specific point in time. Explore this article to understand how these financial statements interrelate and support comprehensive financial analysis.

Table of Comparison

| Aspect | Cash Flow Statement | Balance Sheet |

|---|---|---|

| Purpose | Tracks cash inflows and outflows over a period | Shows financial position at a specific date |

| Focus | Liquidity and cash management | Assets, liabilities, and equity |

| Time Frame | Reports for a fiscal period (monthly, quarterly, yearly) | Snapshot as of a particular date |

| Components | Operating, investing, and financing activities | Current assets/liabilities, fixed assets, equity |

| Users | Investors, creditors, and management to assess cash health | Stakeholders reviewing overall financial stability |

| Regulatory Requirement | Mandatory for public companies under GAAP/IFRS | Mandatory financial report for all companies |

Introduction to Financial Statements

Cash Flow Statement, Balance Sheet, and Income Statement each provide distinct insights into a company's financial health. The Cash Flow Statement tracks the movement of cash in and out, highlighting operational efficiency and liquidity. Your understanding of these financial statements helps in making informed decisions by revealing profitability, asset management, and cash availability.

What is a Cash Flow Statement?

A Cash Flow Statement details the inflows and outflows of cash within a company over a specific period, highlighting operational, investing, and financing activities. It provides insights into liquidity and cash management, which are not fully reflected in the Balance Sheet that records assets, liabilities, and equity at a fixed point in time. Unlike the Income Statement that shows profitability, the Cash Flow Statement reveals the actual cash generated or used, essential for assessing financial health and sustainability.

What is a Balance Sheet?

A balance sheet provides a snapshot of a company's financial position at a specific point in time, detailing assets, liabilities, and shareholders' equity. It helps investors and management assess the company's liquidity, solvency, and capital structure. Unlike the cash flow statement, which shows cash inflows and outflows over a period, the balance sheet reflects cumulative balances of resources and obligations.

Key Components of a Cash Flow Statement

The key components of a Cash Flow Statement include operating activities, investing activities, and financing activities, each detailing cash inflows and outflows in these areas. Unlike the Balance Sheet, which provides a snapshot of assets, liabilities, and equity at a specific point in time, the Cash Flow Statement highlights actual cash movements, offering insights into Your liquidity and financial flexibility. Understanding these components helps You assess how well a company generates cash to fund operations and growth.

Key Components of a Balance Sheet

A balance sheet provides a snapshot of Your company's financial position, detailing assets, liabilities, and shareholders' equity at a specific point in time. Key components include current assets such as cash and inventory, long-term assets like property and equipment, current liabilities including accounts payable, and long-term liabilities such as loans or bonds payable. Unlike the cash flow statement, which tracks cash inflows and outflows, and the income statement that shows profitability over time, the balance sheet emphasizes financial stability and resource allocation.

Purpose and Importance of Cash Flow Statements

The Cash Flow Statement provides critical insight into Your company's liquidity and cash management by detailing the inflows and outflows from operating, investing, and financing activities. Unlike the Balance Sheet, which presents a snapshot of assets, liabilities, and equity at a specific point in time, the Cash Flow Statement focuses on actual cash movements, highlighting Your ability to sustain operations and meet financial obligations. Understanding the importance of the Cash Flow Statement empowers informed decisions on budgeting, investing, and ensuring financial stability.

Purpose and Importance of Balance Sheets

The Cash Flow Statement tracks the inflows and outflows of cash, revealing your company's liquidity and financial health over a period. The Balance Sheet provides a snapshot of your assets, liabilities, and equity at a specific point in time, offering crucial insights into your financial stability and ability to meet obligations. Understanding the purpose and importance of the Balance Sheet is essential, as it helps you evaluate your company's net worth, solvency, and overall financial position for informed decision-making.

Differences Between Cash Flow Statement and Balance Sheet

The Cash Flow Statement provides detailed insights into your company's liquidity by tracking cash inflows and outflows from operating, investing, and financing activities over a specific period. The Balance Sheet offers a snapshot of your business's financial position at a single point in time, detailing assets, liabilities, and equity. Unlike the Balance Sheet, which focuses on what your company owns and owes, the Cash Flow Statement emphasizes how cash moves through your business, affecting your ability to meet short-term obligations.

When to Use Cash Flow Statement vs Balance Sheet

The cash flow statement is essential for assessing a company's liquidity by detailing cash inflows and outflows over a period, making it ideal for short-term financial planning and operational decisions. The balance sheet provides a snapshot of a company's financial position at a specific date, showing assets, liabilities, and equity, which is crucial for evaluating overall financial stability and long-term solvency. Use the cash flow statement to monitor cash management and operational efficiency, while the balance sheet is best for assessing capital structure and financial health at a point in time.

Conclusion: Choosing the Right Financial Report

Selecting the appropriate financial report depends on the information needed: the Cash Flow Statement provides detailed insights into cash inflows and outflows, essential for liquidity analysis; the Balance Sheet offers a snapshot of a company's assets, liabilities, and equity, critical for assessing financial stability; the Income Statement summarizes revenues and expenses, highlighting profitability. Businesses analyzing operational efficiency prioritize the Income Statement, while those managing liquidity focus on the Cash Flow Statement. Investors and creditors use the Balance Sheet to evaluate solvency and long-term financial health, making each report indispensable for specific financial decisions.

Infographic: Cash Flow Statement vs Balance Sheet

relatioo.com

relatioo.com