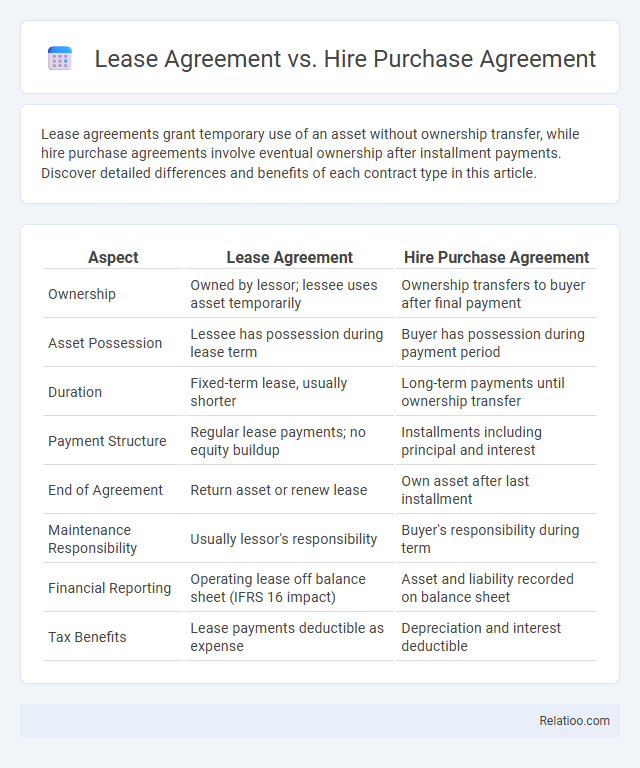

Lease agreements grant temporary use of an asset without ownership transfer, while hire purchase agreements involve eventual ownership after installment payments. Discover detailed differences and benefits of each contract type in this article.

Table of Comparison

| Aspect | Lease Agreement | Hire Purchase Agreement |

|---|---|---|

| Ownership | Owned by lessor; lessee uses asset temporarily | Ownership transfers to buyer after final payment |

| Asset Possession | Lessee has possession during lease term | Buyer has possession during payment period |

| Duration | Fixed-term lease, usually shorter | Long-term payments until ownership transfer |

| Payment Structure | Regular lease payments; no equity buildup | Installments including principal and interest |

| End of Agreement | Return asset or renew lease | Own asset after last installment |

| Maintenance Responsibility | Usually lessor's responsibility | Buyer's responsibility during term |

| Financial Reporting | Operating lease off balance sheet (IFRS 16 impact) | Asset and liability recorded on balance sheet |

| Tax Benefits | Lease payments deductible as expense | Depreciation and interest deductible |

Introduction to Lease and Hire Purchase Agreements

Lease agreements allow you to use an asset for a fixed period while paying regular rental installments without ownership transfer. Hire purchase agreements enable you to gradually own the asset by making installment payments, with ownership transferring after the final payment. Both agreements differ significantly in terms of ownership, payment structure, and asset control.

Definition of Lease Agreement

A Lease Agreement is a legally binding contract where the lessor grants the lessee the right to use an asset, such as property or equipment, for a specified period in exchange for periodic payments. Unlike Hire Purchase Agreements, which include eventual ownership transfer after installment payments, Lease Agreements typically do not transfer ownership rights to the lessee. Financial Agreements cover a broader range of contracts related to funding or credit arrangements, but a Lease Agreement specifically details asset usage terms without creating immediate ownership.

Definition of Hire Purchase Agreement

A Hire Purchase Agreement is a financial contract where you hire an asset by paying installments, with ownership transferring only after the final payment. Unlike a Lease Agreement, which allows the use of an asset without ownership, and a Financial Agreement that covers broader financial terms and lending conditions, Hire Purchase specifically combines credit and ownership acquisition. Your rights and obligations hinge on completing the payment schedule outlined in the Hire Purchase contract.

Key Differences Between Lease and Hire Purchase

Lease agreements grant the lessee the right to use an asset for a specified period without ownership, whereas hire purchase agreements involve incremental payments leading to eventual ownership of the asset. Lease payments are considered rental expenses and do not build equity, while hire purchase payments contribute toward ownership transfer after the final installment. Financial agreements may include broader credit arrangements but differ from leases and hire purchase by focusing on funding terms rather than asset use or ownership acquisition.

Ownership and Title Transfer

In a Lease Agreement, you obtain the right to use the asset for a specified period without ownership or title transfer, which remains with the lessor; Lease payments are considered rental fees. A Hire Purchase Agreement allows you to use the asset while making installment payments, with ownership and title transferring only after the final payment is completed. A Financial Agreement, often structured as a loan or credit arrangement, provides funds to purchase the asset outright, granting immediate ownership and title transfer upon acquisition.

Payment Structure Comparison

Lease agreements require regular rental payments without ownership transfer, while hire purchase agreements involve installment payments leading to asset ownership after the final payment. Financial agreements typically outline structured repayments including principal and interest over a fixed term, often used for loans or credit facilities. Understanding your payment obligations in each contract helps you manage cash flow and determine the best financing option for your needs.

Tax Implications of Each Agreement

Lease agreements typically allow businesses to deduct lease payments as operating expenses, reducing taxable income without acquiring asset ownership. Hire purchase agreements enable gradual asset ownership transfer, with interest and capital repayments treated distinctly for tax purposes--interest is often deductible, while capital payments are not. Financial agreements, such as loans secured against assets, generally require interest expense claims, with asset depreciation allowable for tax relief, impacting corporate tax calculations differently than leasing or hire purchase structures.

Advantages of Lease Agreements

Lease agreements offer the advantage of preserving capital since lessees do not need to make large upfront payments; this improves cash flow management for businesses. They provide flexibility by allowing lessees to upgrade or change assets at the end of the lease term, keeping technology and equipment current without ownership risks. Furthermore, lease payments are often considered operating expenses, providing potential tax benefits and simplifying accounting processes compared to hire purchase or financial agreements.

Advantages of Hire Purchase Agreements

Hire Purchase Agreements allow businesses to acquire assets while spreading payments over time, preserving cash flow and improving budget management. Ownership of the asset transfers only after the final payment, reducing initial financial burden and risk associated with immediate full payment. This arrangement often includes fixed interest rates and predictable costs, facilitating easier financial planning compared to lease agreements or traditional financial loans.

Which Agreement Is Best for You?

Choosing between a lease agreement, hire purchase agreement, and financial agreement depends on your financial goals and asset ownership preferences. Lease agreements offer lower monthly payments without ownership, ideal for short-term use or business assets needing regular upgrades. Hire purchase agreements lead to ownership after payments, suitable for those who want to keep the asset long-term, while financial agreements or loans provide flexibility for purchasing various assets with full ownership upfront.

Infographic: Lease Agreement vs Hire Purchase Agreement

relatioo.com

relatioo.com