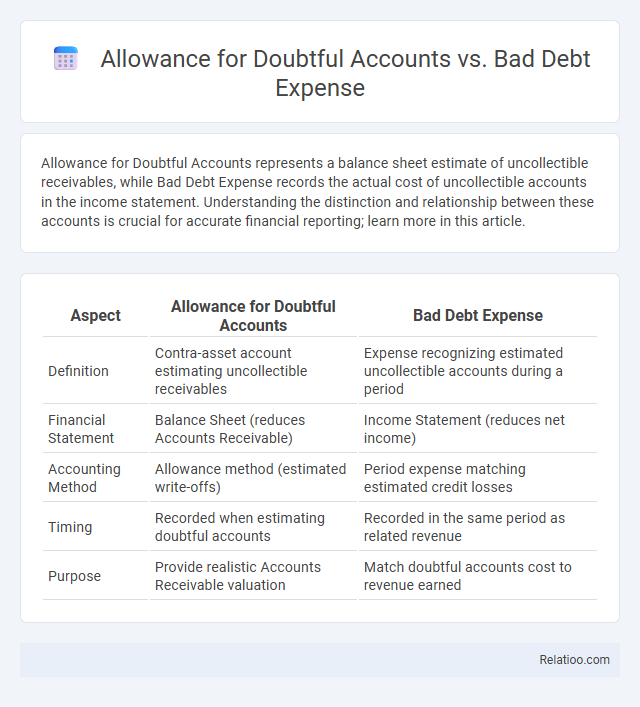

Allowance for Doubtful Accounts represents a balance sheet estimate of uncollectible receivables, while Bad Debt Expense records the actual cost of uncollectible accounts in the income statement. Understanding the distinction and relationship between these accounts is crucial for accurate financial reporting; learn more in this article.

Table of Comparison

| Aspect | Allowance for Doubtful Accounts | Bad Debt Expense |

|---|---|---|

| Definition | Contra-asset account estimating uncollectible receivables | Expense recognizing estimated uncollectible accounts during a period |

| Financial Statement | Balance Sheet (reduces Accounts Receivable) | Income Statement (reduces net income) |

| Accounting Method | Allowance method (estimated write-offs) | Period expense matching estimated credit losses |

| Timing | Recorded when estimating doubtful accounts | Recorded in the same period as related revenue |

| Purpose | Provide realistic Accounts Receivable valuation | Match doubtful accounts cost to revenue earned |

Understanding Allowance for Doubtful Accounts

Allowance for Doubtful Accounts is a critical contra-asset account that estimates the portion of receivables unlikely to be collected, ensuring your financial statements reflect more accurate asset values. Bad Debt Expense records the actual cost of uncollectible accounts during a period, directly impacting net income. Understanding the Allowance for Doubtful Accounts helps you manage credit risk by matching anticipated losses to the revenue generated in the same period, maintaining proper accounting principles.

What Is Bad Debt Expense?

Bad Debt Expense represents the estimated uncollectible amounts from credit sales, directly impacting Your company's income statement by reducing net income. The Allowance for Doubtful Accounts is a balance sheet contra-asset account that holds the cumulative estimated uncollectibles, adjusting accounts receivable to reflect realistic collectible value. While the Allowance represents the total reserve for potential losses, Bad Debt Expense records the current period's cost of uncollectible receivables, matching expenses to revenues under accrual accounting principles.

Key Differences: Allowance vs. Bad Debt Expense

The key difference between Allowance for Doubtful Accounts and Bad Debt Expense lies in their accounting roles; the Allowance is a balance sheet contra-asset account estimating uncollectible receivables, while Bad Debt Expense appears on the income statement reflecting the cost of estimated uncollectibles during a period. Allowance represents the cumulative provision for doubtful debts, updated each accounting cycle, whereas Bad Debt Expense captures the current period's adjustment based on new estimations. Understanding these distinctions helps You accurately assess the risk of receivables and properly match expenses to revenues.

How Allowance for Doubtful Accounts Works

Allowance for Doubtful Accounts is a contra-asset account that reduces your accounts receivable balance to reflect estimated uncollectible amounts based on historical data and current credit conditions. Bad Debt Expense records the estimated cost of uncollectible accounts on the income statement, impacting your net income. The Allowance maintains accurate financial reporting by anticipating losses before specific accounts are written off, ensuring your balance sheet reflects realistic asset values.

Methods for Estimating Doubtful Accounts

The Allowance for Doubtful Accounts is a contra-asset account used to estimate uncollectible receivables, with common methods including the percentage of sales and aging of accounts receivable approaches. Bad Debt Expense represents the estimated cost of uncollectible accounts recognized in the income statement, typically calculated using historical data and industry benchmarks. The Allowance method involves creating a reserve based on estimated doubtful accounts before specific debts are written off, ensuring that financial statements reflect more accurate accounts receivable values.

Recording Bad Debt Expense in Accounting

Recording Bad Debt Expense in accounting involves estimating uncollectible accounts receivable and recognizing this expense on the income statement to match revenues with related costs. The Allowance for Doubtful Accounts is a contra-asset account used to record the estimated uncollectible amounts, reducing accounts receivable on the balance sheet without immediately writing off specific debts. Your financial statements remain accurate by adjusting both Bad Debt Expense and the Allowance account, ensuring potential credit losses are properly reflected.

Direct Write-Off vs. Allowance Method

The Allowance for Doubtful Accounts represents an estimated reserve reflecting potential future uncollectible receivables, while Bad Debt Expense is the cost recognized on the income statement for uncollectible accounts during a period. Your choice between the Direct Write-Off Method, which records bad debt expense only when specific accounts are deemed uncollectible, and the Allowance Method, which estimates and matches bad debt expense to the period of sale, impacts accuracy in financial reporting. The Allowance Method provides a more consistent and GAAP-compliant approach by anticipating losses, whereas the Direct Write-Off Method may distort financial results due to delayed recognition.

Impact on Financial Statements

Allowance for Doubtful Accounts is a contra-asset account that reduces accounts receivable to reflect the estimated uncollectible amounts, directly impacting the balance sheet by presenting a more realistic net receivables value. Bad Debt Expense is recorded on the income statement, representing the cost of estimated credit losses during a period and reducing net income, which affects retained earnings on the balance sheet. Your understanding of these accounts ensures accurate financial reporting and decision-making by properly matching credit losses with revenues and presenting true financial health.

Examples in Real-World Accounting

Allowance for Doubtful Accounts represents a balance sheet contra-asset account estimating uncollectible receivables, such as a company recording $5,000 based on historical data to cover potential customer defaults. Bad Debt Expense is an income statement account reflecting the cost of uncollectible accounts during a period, for example, recognizing $3,000 in bad debt expense after identifying specific overdue invoices unlikely to be collected. The Allowance method involves estimating bad debts upfront and adjusting the Allowance for Doubtful Accounts, contrasting with the direct write-off method where bad debts are recorded only when deemed uncollectible.

Best Practices for Managing Bad Debts

Best practices for managing bad debts emphasize maintaining a robust Allowance for Doubtful Accounts to anticipate potential credit losses, ensuring accurate financial reporting. Regularly reviewing and adjusting the Bad Debt Expense based on historical data and current economic conditions improves the reliability of estimates. Implementing stringent credit policies and continuous monitoring of accounts receivable augments the effectiveness of the Allowance, minimizing write-offs and enhancing overall credit risk management.

Infographic: Allowance for Doubtful Accounts vs Bad Debt Expense

relatioo.com

relatioo.com