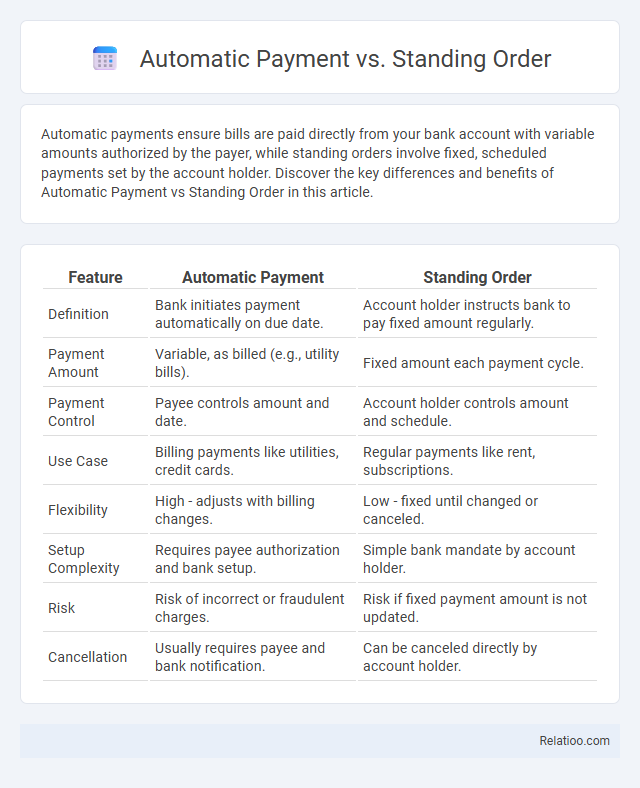

Automatic payments ensure bills are paid directly from your bank account with variable amounts authorized by the payer, while standing orders involve fixed, scheduled payments set by the account holder. Discover the key differences and benefits of Automatic Payment vs Standing Order in this article.

Table of Comparison

| Feature | Automatic Payment | Standing Order |

|---|---|---|

| Definition | Bank initiates payment automatically on due date. | Account holder instructs bank to pay fixed amount regularly. |

| Payment Amount | Variable, as billed (e.g., utility bills). | Fixed amount each payment cycle. |

| Payment Control | Payee controls amount and date. | Account holder controls amount and schedule. |

| Use Case | Billing payments like utilities, credit cards. | Regular payments like rent, subscriptions. |

| Flexibility | High - adjusts with billing changes. | Low - fixed until changed or canceled. |

| Setup Complexity | Requires payee authorization and bank setup. | Simple bank mandate by account holder. |

| Risk | Risk of incorrect or fraudulent charges. | Risk if fixed payment amount is not updated. |

| Cancellation | Usually requires payee and bank notification. | Can be canceled directly by account holder. |

Understanding Automatic Payments

Automatic payments enable seamless bill settlements by authorizing direct debits from a bank account, ensuring on-time transactions without manual intervention. Standing orders differ as they instruct banks to transfer fixed amounts regularly to a specified recipient, typically used for consistent payments like rent. Understanding automatic payments involves recognizing their flexibility in amount and frequency, ideal for variable bills such as utilities or subscriptions, enhancing financial management efficiency.

What is a Standing Order?

A standing order is a fixed instruction you give your bank to pay a specific amount regularly to another account, often used for rent or subscriptions. Unlike automatic payments, which can vary in amount based on bills or usage, standing orders remain consistent until you cancel or amend them. Understanding how standing orders work helps you manage your recurring payments efficiently and avoid missed deadlines.

Key Differences Between Automatic Payment and Standing Order

Automatic payments are electronically scheduled transactions where the payee initiates withdrawal for recurring bills, ensuring precise amounts are deducted on due dates, while standing orders are instructions from the payer to their bank to send a fixed amount regularly to a specified account. Key differences include control and variability: automatic payments provide payees with control to adjust the payment amount based on the bill, whereas standing orders maintain a constant payment amount fixed by the payer. Automatic payments are commonly used for utilities and credit card bills with fluctuating balances, while standing orders suit fixed, repetitive payments like rent or subscriptions.

Ease of Setup: Automatic Payments vs Standing Orders

Automatic Payments typically offer greater ease of setup by allowing users to link directly to billing accounts or credit cards, enabling seamless recurring transactions without manual intervention. Standing Orders require manual input of fixed payment details with banks and must be updated individually for changes, which adds complexity compared to automatic payments. The ability of Automatic Payments to adjust dynamically based on invoice amounts or services enhances flexibility and reduces setup time relative to the rigid, fixed-amount nature of Standing Orders.

Flexibility and Control for Users

Automatic payment allows users to schedule recurring transactions with fixed amounts, offering convenience but limited flexibility in adjusting payments. Standing orders give users greater control by enabling regular payments of a set amount but require manual changes for any updates. Compared to these, direct debit automatic payments provide higher flexibility by allowing payees to collect variable amounts, giving users both convenience and adaptability in managing their finances.

Cost Implications and Bank Fees

Automatic Payments often incur lower bank fees than Standing Orders because they allow precise control over individual transactions, reducing unnecessary charges. Standing Orders may involve fixed fees regardless of payment amounts, increasing your overall cost if payments are small or variable. Choosing Automatic Payments can optimize your banking costs by minimizing transaction fees and avoiding flat-rate charges common with Standing Orders.

Security Considerations

Automatic Payments use direct authorization for transferring funds, requiring strong encryption protocols to protect sensitive banking details from unauthorized access. Standing Orders initiate fixed-amount transfers on predetermined dates, posing lower cybersecurity risks but requiring vigilant monitoring to prevent outdated or incorrect payments. Unlike Automatic Payments and Standing Orders, Direct Debits offer more flexibility but demand robust authentication methods and frequent reconciliations to mitigate fraud and ensure transaction accuracy.

Use Cases: When to Choose Each Option

Automatic payments are ideal for recurring bills with variable amounts, such as utility bills, where exact charges fluctuate monthly, ensuring timely payments without manual intervention. Standing orders suit fixed regular payments like rent or subscriptions, where the payer authorizes a fixed amount to be transferred on set dates. Manual payments are preferred when control and flexibility are needed for irregular expenses or one-time charges, allowing the payer to authorize each transaction individually.

Managing and Cancelling Payments

Managing automatic payments often involves preset schedules where payments are deducted directly from an account, requiring users to navigate specific banking apps or online portals for modifications or cancellation. Standing orders allow consistent fixed amounts to be transferred regularly to a beneficiary, with cancellations needing direct requests to the bank before the next scheduled payment. Unlike standing orders and automatic payments, some recurring payments, such as subscription services, may require cancellation through the service provider rather than the bank, emphasizing the importance of understanding each payment method's management and cancellation protocols.

Which Is Best for You: A Comparative Summary

Automatic payments debit your account on a specific date to settle recurring bills, ensuring timely payment without manual intervention. Standing orders instruct your bank to transfer a fixed amount regularly to another account, ideal for consistent payments like rent or subscriptions. Comparing these options depends on your needs: automatic payments offer flexibility for varying amounts, standing orders suit fixed payments, and choosing the best depends on payment type, amount consistency, and convenience preferences.

Infographic: Automatic Payment vs Standing Order

relatioo.com

relatioo.com