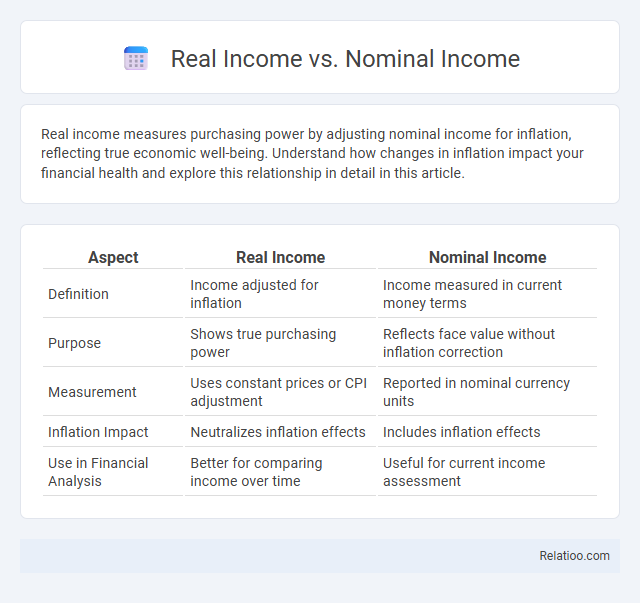

Real income measures purchasing power by adjusting nominal income for inflation, reflecting true economic well-being. Understand how changes in inflation impact your financial health and explore this relationship in detail in this article.

Table of Comparison

| Aspect | Real Income | Nominal Income |

|---|---|---|

| Definition | Income adjusted for inflation | Income measured in current money terms |

| Purpose | Shows true purchasing power | Reflects face value without inflation correction |

| Measurement | Uses constant prices or CPI adjustment | Reported in nominal currency units |

| Inflation Impact | Neutralizes inflation effects | Includes inflation effects |

| Use in Financial Analysis | Better for comparing income over time | Useful for current income assessment |

Introduction to Real Income and Nominal Income

Real income measures the purchasing power of income by adjusting nominal income for inflation, reflecting the true value of earnings over time. Nominal income represents the amount of money earned in current dollars without considering changes in prices or inflation. Understanding the distinction between real income and nominal income is crucial for accurately assessing economic well-being and comparing income levels across different time periods.

Defining Nominal Income

Nominal income refers to the total income earned by an individual or entity without adjusting for inflation, reflecting the face value of wages, salaries, or earnings during a specific period. Real income adjusts nominal income by accounting for changes in purchasing power, providing a more accurate measure of the actual value of your earnings over time. Differentiating these income types helps you understand the true financial impact of economic fluctuations on your budget and living standards.

Understanding Real Income

Real income measures the purchasing power of your earnings by accounting for inflation, unlike nominal income which reflects the face value without adjusting for price changes. Understanding real income helps you evaluate the true value of your salary over time and how much goods and services you can afford. Tracking real income is crucial for making informed financial decisions and maintaining your standard of living despite economic fluctuations.

Key Differences Between Real and Nominal Income

Real income accounts for inflation and reflects the true purchasing power of earnings, while nominal income represents the face value of income without adjusting for price changes. Income generally refers to the total earnings received before taxes and adjustments. The key difference is that real income provides a more accurate measure of financial well-being by showing how much goods and services can be bought, unlike nominal income which can be misleading during periods of inflation.

The Role of Inflation in Income Measurement

Real income adjusts nominal income by accounting for inflation, reflecting the true purchasing power of earnings over time. Nominal income represents the amount of money earned without considering changes in price levels, often leading to misleading comparisons across different periods. Inflation erodes the value of nominal income, making real income a more accurate indicator for measuring economic wellbeing and living standards.

Calculating Real Income: Step-by-Step

Calculating real income involves adjusting nominal income to account for inflation, providing a more accurate measure of purchasing power over time. The formula for real income is: Real Income = Nominal Income / (Consumer Price Index/100). By using the Consumer Price Index (CPI) as a deflator, individuals can compare income across different periods, ensuring a clear understanding of economic well-being beyond nominal earnings.

Why Real Income Matters for Financial Wellbeing

Real income reflects purchasing power by adjusting nominal income for inflation, providing a clear measure of true financial capability. Understanding real income is essential for evaluating the actual growth or decline in earnings over time, influencing budgeting, saving, and investment decisions. Focusing on real income helps individuals maintain financial wellbeing by ensuring their income keeps pace with cost of living changes.

Common Misconceptions about Income Figures

Nominal income refers to the total earnings before adjusting for inflation, often leading to overestimations of purchasing power, while real income accounts for inflation, reflecting your actual buying ability. A common misconception is assuming nominal income increases always improve financial well-being without considering inflation's impact on real income. Understanding the distinction helps you make more informed decisions by focusing on income figures that truly represent economic value over time.

Real-World Examples: Real vs Nominal Income

Real income reflects your purchasing power by adjusting nominal income for inflation, while nominal income represents the raw salary figure without considering price changes. For instance, if your nominal income rises from $50,000 to $52,000 but inflation is 5%, your real income effectively decreases because prices have increased faster than your earnings. Understanding this difference helps you evaluate whether your financial situation truly improves in real-world scenarios.

Conclusion: Choosing the Right Income Indicator

Selecting the appropriate income indicator depends on the analysis objective; real income provides a more accurate measure of purchasing power by adjusting for inflation, while nominal income reflects the face value of earnings without such adjustments. For economic comparisons over time, real income is preferred to account for changes in price levels, whereas nominal income may suffice for short-term or non-inflation-adjusted assessments. Understanding the distinction ensures precise financial analysis and informed decision-making in economic planning and policy evaluation.

Infographic: Real Income vs Nominal Income

relatioo.com

relatioo.com