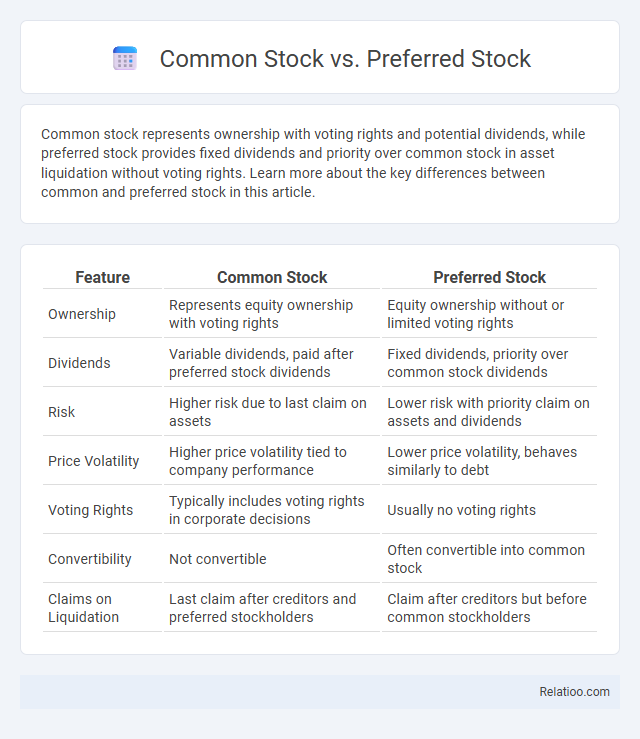

Common stock represents ownership with voting rights and potential dividends, while preferred stock provides fixed dividends and priority over common stock in asset liquidation without voting rights. Learn more about the key differences between common and preferred stock in this article.

Table of Comparison

| Feature | Common Stock | Preferred Stock |

|---|---|---|

| Ownership | Represents equity ownership with voting rights | Equity ownership without or limited voting rights |

| Dividends | Variable dividends, paid after preferred stock dividends | Fixed dividends, priority over common stock dividends |

| Risk | Higher risk due to last claim on assets | Lower risk with priority claim on assets and dividends |

| Price Volatility | Higher price volatility tied to company performance | Lower price volatility, behaves similarly to debt |

| Voting Rights | Typically includes voting rights in corporate decisions | Usually no voting rights |

| Convertibility | Not convertible | Often convertible into common stock |

| Claims on Liquidation | Last claim after creditors and preferred stockholders | Claim after creditors but before common stockholders |

Introduction to Stock Types

Common stock represents ownership in a corporation, granting shareholders voting rights and potential dividends, while preferred stock provides fixed dividends with priority over common stock in asset distribution but typically lacks voting power. Legal obligations in stock issuance require companies to comply with securities laws, disclose financial information transparently, and honor dividend payments to preferred shareholders as stipulated in corporate charters. Understanding these stock types and their associated legal duties is essential for investors assessing risk, control, and income potential within equity investments.

What is Common Stock?

Common stock represents ownership shares in a corporation, granting shareholders voting rights and potential dividends based on company performance. Unlike preferred stock, common stockholders have residual claims on assets during liquidation, making their investment risk higher but potentially more rewarding. Common stock is distinct from legal obligations such as bonds or loans, which require contractual repayment without granting ownership or voting privileges.

What is Preferred Stock?

Preferred stock is a class of ownership in a corporation that provides shareholders with fixed dividends before any dividends are paid to common stockholders. It combines features of both equity and debt, granting priority over common stock in asset liquidation but usually without voting rights. Understanding your preferred stock rights is crucial in evaluating its impact on your investment portfolio and legal claim in the company.

Key Differences Between Common and Preferred Stock

Common stock represents ownership with voting rights and potential dividends that vary based on company performance, while preferred stock provides fixed dividends and priority over common stockholders during liquidation but usually lacks voting rights. Your choice between common and preferred stock depends on whether you seek growth potential and influence in company decisions or stable income with lower risk. Legal obligations differ as common stockholders have residual claims after debt and preferred stock claims, reflecting the hierarchical nature of corporate financing.

Voting Rights: Common vs Preferred

Common stockholders possess voting rights enabling them to influence corporate decisions such as electing the board of directors and approving mergers, while preferred stockholders typically lack voting rights but receive fixed dividends and priority in asset liquidation. The legal obligation of a company requires balancing these rights to protect shareholder interests and comply with corporate governance regulations. Understanding the distinction between common and preferred stock voting rights is crucial for investors assessing control and income potential.

Dividend Structure Comparison

Common stockholders receive dividends that vary based on company profits and board decisions, often resulting in fluctuating income without guaranteed payments. Preferred stockholders benefit from fixed dividend rates, receiving priority payments over common stockholders and typically enjoying cumulative dividends if payments are missed. Legal obligations for dividend payments generally do not bind common or preferred stock dividends, except in rare cases where preferred dividends accumulate, but failure to pay dividends does not constitute a legal default like debt interest payments do.

Risk and Return Profiles

Common stock offers higher risk and potential return through capital appreciation and dividends, but it has lower claim priority in liquidation. Preferred stock provides more stable dividends with less risk, given its priority over common stock in asset claims but typically limited capital gain potential. Your investment choice hinges on balancing risk tolerance and expected return, as legal obligations favor preferred shareholders and creditors before common stockholders.

Convertibility and Redemption Features

Common stock typically does not have convertibility or redemption features, granting shareholders voting rights and residual claims without guaranteed returns. Preferred stock often includes convertibility options, allowing holders to convert shares into common stock, and redemption rights enabling the issuer to repurchase shares at specified terms. Legal obligations primarily affect preferred stock regarding mandated dividend payments and redemption schedules, whereas common stockholders bear less contractual obligation but face higher risk.

Suitability for Different Investors

Common stock offers voting rights and potential for capital appreciation, making it more suitable for investors seeking growth and willing to accept higher risk. Preferred stock provides fixed dividends and priority over common stock in dividends and asset liquidation, appealing to income-focused investors needing more stability. Understanding your risk tolerance and investment goals helps determine whether common stock, preferred stock, or adherence to legal obligations best fits your portfolio strategy.

Choosing Between Common and Preferred Stock

Choosing between common stock and preferred stock depends on your investment goals and risk tolerance; common stock offers voting rights and potential capital appreciation, while preferred stock provides fixed dividends and priority in asset distribution during liquidation. Understanding the legal obligations tied to each type is crucial, as preferred stockholders have a higher claim on company assets but often lack voting power, unlike common stockholders who assume more risk. Your decision should balance the desire for control and growth against the need for income stability and protection against company insolvency.

Infographic: Common Stock vs Preferred Stock

relatioo.com

relatioo.com