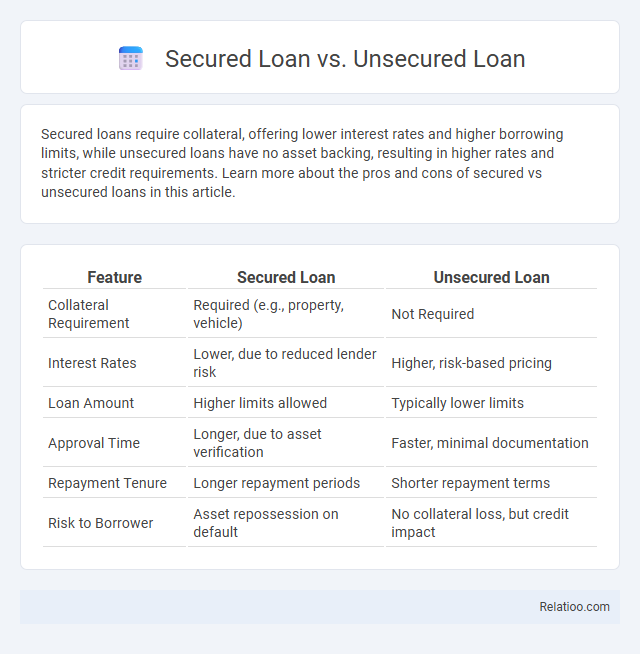

Secured loans require collateral, offering lower interest rates and higher borrowing limits, while unsecured loans have no asset backing, resulting in higher rates and stricter credit requirements. Learn more about the pros and cons of secured vs unsecured loans in this article.

Table of Comparison

| Feature | Secured Loan | Unsecured Loan |

|---|---|---|

| Collateral Requirement | Required (e.g., property, vehicle) | Not Required |

| Interest Rates | Lower, due to reduced lender risk | Higher, risk-based pricing |

| Loan Amount | Higher limits allowed | Typically lower limits |

| Approval Time | Longer, due to asset verification | Faster, minimal documentation |

| Repayment Tenure | Longer repayment periods | Shorter repayment terms |

| Risk to Borrower | Asset repossession on default | No collateral loss, but credit impact |

Introduction to Secured and Unsecured Loans

Secured loans require collateral such as property or assets, reducing lender risk and often resulting in lower interest rates. Unsecured loans do not require collateral, relying on the borrower's creditworthiness, which typically leads to higher interest rates and stricter eligibility criteria. Understanding the key differences between secured and unsecured loans helps borrowers choose the most suitable financing option for their financial needs.

Defining Secured Loans

Secured loans require borrowers to provide collateral, such as property or assets, which reduces the lender's risk and often results in lower interest rates compared to unsecured loans. Unsecured loans do not involve collateral, relying solely on the borrower's creditworthiness, leading to higher interest rates and stricter approval criteria. Understanding the distinction is crucial as secured loans offer more favorable terms but involve the risk of asset forfeiture in case of default.

Understanding Unsecured Loans

Unsecured loans do not require collateral, making them riskier for lenders and often resulting in higher interest rates compared to secured loans, which are backed by assets like property or vehicles. These loans rely primarily on your creditworthiness, income, and financial history to determine approval and terms. Understanding unsecured loans helps you evaluate borrowing options that balance flexibility with cost, especially when collateral is unavailable or undesirable.

Key Differences Between Secured and Unsecured Loans

Secured loans require collateral, such as property or assets, which reduces the lender's risk and often results in lower interest rates and higher borrowing limits. Unsecured loans do not require collateral, leading to higher interest rates and stricter eligibility criteria due to increased risk for the lender. The key differences revolve around risk, interest rates, loan amounts, and approval speed, impacting borrower eligibility and repayment terms.

Pros and Cons of Secured Loans

Secured loans require collateral, such as property or assets, which lowers the lender's risk and typically results in lower interest rates and higher borrowing limits. You benefit from easier approval and longer repayment terms, but risk losing your assets if you default on the loan. Unlike unsecured loans, secured loans provide better borrowing conditions but come with the critical downside of asset forfeiture.

Pros and Cons of Unsecured Loans

Unsecured loans offer the advantage of not requiring collateral, making them accessible to borrowers without assets to pledge, and typically faster to obtain than secured loans. However, unsecured loans often come with higher interest rates and stricter eligibility criteria due to the increased risk for lenders. You should weigh the convenience of unsecured loans against their potentially higher costs and the impact on your creditworthiness if repayment challenges arise.

Eligibility and Approval Process

Secured loans require collateral such as property or assets, making eligibility depend heavily on your ownership of valuable security, and they typically offer faster approval due to reduced lender risk. Unsecured loans do not require collateral, so eligibility is determined by your credit score, income stability, and debt-to-income ratio, often resulting in a more rigorous approval process. Understanding these differences helps you choose the best loan type based on your financial situation and the speed of approval you need.

Interest Rates and Fee Comparison

Secured loans typically offer lower interest rates because they are backed by collateral, reducing lender risk, whereas unsecured loans have higher rates due to increased default risk. Fees for secured loans often include appraisal and origination fees, while unsecured loans usually involve higher origination fees and sometimes prepayment penalties. Comparing general loans, secured options tend to be more cost-effective long-term, whereas unsecured loans provide faster access without asset risk but at a higher financial cost.

Which Type of Loan Should You Choose?

Secured loans require collateral, such as property or assets, offering lower interest rates and higher borrowing limits but posing a risk of asset loss upon default. Unsecured loans do not require collateral, typically have higher interest rates, and are suitable for borrowers with strong credit scores seeking smaller amounts. Choosing between secured and unsecured loans depends on your credit profile, risk tolerance, loan amount, and repayment capability, ensuring the loan type aligns with your financial goals and security needs.

Frequently Asked Questions (FAQs)

Secured loans require collateral, reducing lender risk and often resulting in lower interest rates, while unsecured loans lack collateral, typically leading to higher rates and stricter credit requirements. Frequently asked questions focus on eligibility criteria, repayment terms, interest rates, and the consequences of default for both secured and unsecured loans. Borrowers often seek clarity on which loan type best suits their financial goals, how credit scores impact approval, and the risks involved in pledging assets as security.

Infographic: Secured Loan vs Unsecured Loan

relatioo.com

relatioo.com