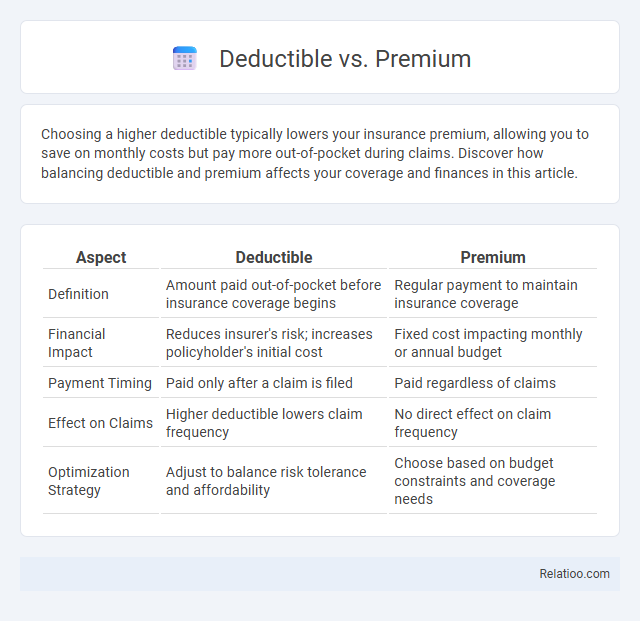

Choosing a higher deductible typically lowers your insurance premium, allowing you to save on monthly costs but pay more out-of-pocket during claims. Discover how balancing deductible and premium affects your coverage and finances in this article.

Table of Comparison

| Aspect | Deductible | Premium |

|---|---|---|

| Definition | Amount paid out-of-pocket before insurance coverage begins | Regular payment to maintain insurance coverage |

| Financial Impact | Reduces insurer's risk; increases policyholder's initial cost | Fixed cost impacting monthly or annual budget |

| Payment Timing | Paid only after a claim is filed | Paid regardless of claims |

| Effect on Claims | Higher deductible lowers claim frequency | No direct effect on claim frequency |

| Optimization Strategy | Adjust to balance risk tolerance and affordability | Choose based on budget constraints and coverage needs |

Understanding Deductibles and Premiums

Deductibles represent the out-of-pocket amount a policyholder must pay before insurance coverage begins, directly impacting their financial responsibility during a claim. Premiums are the recurring payments made to maintain active insurance coverage, influencing the overall cost of the policy regardless of claims made. Understanding the balance between deductible amounts and premium costs helps consumers optimize their insurance plans for affordability and risk management.

Key Differences Between Deductible and Premium

The key difference between a deductible and a premium lies in their roles within insurance policies: a premium is the amount you pay regularly, usually monthly or annually, to maintain your coverage, while a deductible is the out-of-pocket cost you must pay before your insurance starts to cover expenses. Premiums ensure your policy remains active regardless of claims, whereas the deductible impacts how much you pay when filing a claim. Understanding these distinctions helps you manage your insurance costs effectively and choose the best plan for your needs.

How Deductibles Affect Health Insurance Costs

Deductibles play a crucial role in determining your overall health insurance costs, as they represent the amount you pay out-of-pocket before your insurance coverage begins. Higher deductibles typically result in lower premiums, allowing you to save on monthly payments but increasing your initial expenses in case of medical care. Understanding the balance between deductible amounts and premium costs helps you select a plan that fits your budget and healthcare needs effectively.

The Role of Premiums in Insurance Coverage

Premiums are the regular payments policyholders make to maintain their insurance coverage, directly impacting the extent of protection provided. Higher premiums often correlate with lower deductibles, reducing out-of-pocket expenses when claims arise. Understanding the balance between premiums and deductibles is essential for optimizing insurance benefits and managing overall costs effectively.

Pros and Cons of High Deductible Plans

High deductible health plans (HDHPs) feature lower premiums but require higher out-of-pocket payments before coverage kicks in, benefiting You by reducing monthly costs yet increasing financial risk during medical emergencies. The main advantage of HDHPs lies in saving money on regular expenses, while the downside includes potential difficulty affording care if unexpected health issues arise. Evaluating your health needs and financial situation is crucial to determine whether a high deductible plan's lower premiums outweigh the potential burden of steep upfront costs.

Choosing Between Low Deductible and Low Premium

Choosing between a low deductible and a low premium depends on individual healthcare needs and financial stability. A low deductible means paying less out-of-pocket before insurance coverage begins, ideal for those anticipating frequent medical expenses. Conversely, a low premium reduces monthly costs but may lead to higher deductibles, suitable for individuals seeking budget-friendly upfront payments with less frequent healthcare use.

Impact on Out-of-Pocket Expenses

A higher deductible typically lowers your insurance premium but increases your out-of-pocket expenses before coverage begins, making it essential to balance immediate savings against potential future costs. Premiums are fixed monthly payments that must be paid regardless of whether you use your insurance, directly impacting your ongoing budget but not your upfront medical costs. Understanding the relationship between deductibles, premiums, and out-of-pocket maximums helps consumers minimize total healthcare expenses while maintaining adequate coverage.

Factors Influencing Deductibles and Premiums

Deductibles and premiums in insurance policies are influenced by factors such as the policyholder's age, health status, and claim history, which affect the risk profile and cost of coverage. Geographic location and the type of coverage also play critical roles in determining premium amounts and deductible levels. Insurers adjust premiums higher for lower deductibles because the company assumes more risk, while higher deductibles lower premiums but increase out-of-pocket expenses for claimants.

Strategies to Balance Deductible and Premium Costs

Balancing deductible and premium costs requires evaluating your financial capacity to manage out-of-pocket expenses versus monthly payments. Opting for a higher deductible typically lowers premium amounts, benefiting those with emergency savings who want to reduce upfront costs. Utilizing tools like cost-benefit analysis and insurance calculators can help tailor a plan that aligns deductible choices with budget and risk tolerance.

Frequently Asked Questions About Deductibles vs Premiums

Frequently asked questions about deductibles vs. premiums focus on understanding their roles in health insurance costs: the premium is the monthly amount paid to maintain coverage, while the deductible is the out-of-pocket sum required before insurance begins to pay. Consumers often ask how adjusting premiums affects deductible levels, with higher premiums typically resulting in lower deductibles and vice versa. Clarifying these distinctions helps policyholders balance upfront costs with potential long-term expenses for effective financial planning.

Infographic: Deductible vs Premium

relatioo.com

relatioo.com