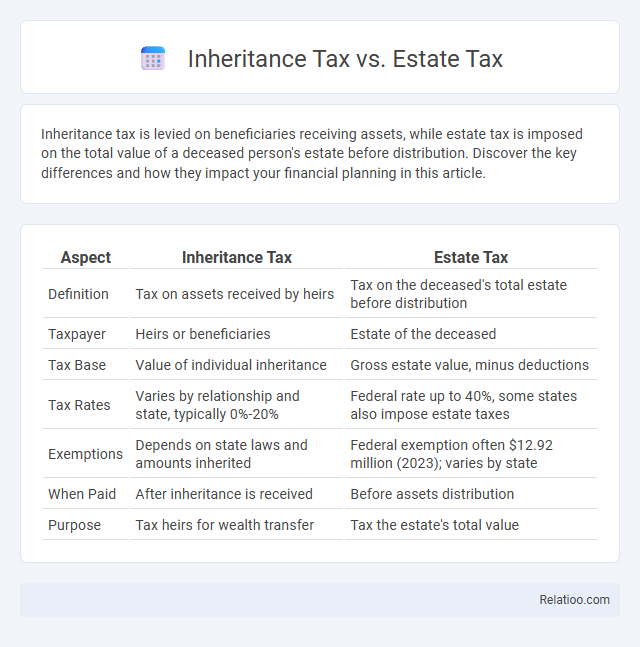

Inheritance tax is levied on beneficiaries receiving assets, while estate tax is imposed on the total value of a deceased person's estate before distribution. Discover the key differences and how they impact your financial planning in this article.

Table of Comparison

| Aspect | Inheritance Tax | Estate Tax |

|---|---|---|

| Definition | Tax on assets received by heirs | Tax on the deceased's total estate before distribution |

| Taxpayer | Heirs or beneficiaries | Estate of the deceased |

| Tax Base | Value of individual inheritance | Gross estate value, minus deductions |

| Tax Rates | Varies by relationship and state, typically 0%-20% | Federal rate up to 40%, some states also impose estate taxes |

| Exemptions | Depends on state laws and amounts inherited | Federal exemption often $12.92 million (2023); varies by state |

| When Paid | After inheritance is received | Before assets distribution |

| Purpose | Tax heirs for wealth transfer | Tax the estate's total value |

Understanding Inheritance Tax and Estate Tax

Inheritance tax is levied on the beneficiaries receiving assets from a deceased person's estate, varying by state and relationship to the decedent. Estate tax is imposed on the total value of the deceased's estate before distribution, often applied at the federal level with a high exemption threshold. Differentiating between inheritance tax and estate tax is crucial for effective estate planning and minimizing tax liabilities for heirs.

Key Differences Between Inheritance Tax and Estate Tax

Inheritance tax is paid by the beneficiary receiving assets from a deceased person, while estate tax is levied on the total value of the deceased person's estate before distribution. The key difference lies in who is responsible for the tax payment: estate tax reduces the overall estate value, and inheritance tax directly affects Your inheritance amount. Understanding these distinctions helps in effective estate planning and minimizing tax liabilities.

How Inheritance Tax Works

Inheritance tax is a state-imposed tax on the assets you receive from a deceased person's estate, varying significantly by jurisdiction and relationship to the decedent. Unlike estate tax, which is levied on the total value of the estate before distribution, inheritance tax is calculated based on the beneficiary's share and may exclude spouses or close relatives in some states. Understanding how inheritance tax works helps you plan effectively to minimize liabilities and ensure your heirs receive the maximum possible inheritance.

How Estate Tax Works

Estate tax is a federal tax imposed on the total value of a deceased person's estate before distribution to heirs. The estate must file an estate tax return if the estate value exceeds the federal exemption limit, currently $12.92 million as of 2023. Taxes are calculated on the net taxable estate after deductions such as debts, funeral expenses, and charitable donations, impacting the amount passed to beneficiaries.

States With Inheritance Tax vs Estate Tax

States with inheritance tax include Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania, each imposing varying rates based on the beneficiary's relationship to the decedent. Estate tax, levied on the total value of a deceased person's estate before distribution, is imposed by fewer states such as Oregon, Massachusetts, and Washington, with exclusion thresholds differing substantially. Understanding these differences is essential for estate planning since inheritance tax targets beneficiaries directly, whereas estate tax applies to the overall estate value.

Who Pays: Beneficiary vs Estate Responsibilities

Inheritance tax is paid by the beneficiary who receives assets, varying by state laws, while estate tax is levied on the deceased's estate before distribution and is handled by the estate executor. Your estate is responsible for settling any estate tax liabilities using the total value of the deceased's assets, which reduces the amount available for beneficiaries. Beneficiaries must pay inheritance tax only if their state imposes it, making it crucial to understand both tax types for effective estate planning.

Impact on Estate Planning Strategies

Inheritance tax, estate tax, and inheritance all influence your estate planning strategies by determining how assets are transferred and taxed across generations. Estate tax is levied on the total value of the deceased's estate before distribution, affecting the overall estate value and necessitating strategies like trusts and gifting to minimize tax liability. Inheritance tax is imposed on the beneficiaries receiving assets, requiring careful planning to manage tax burdens and ensure efficient wealth transfer based on jurisdiction-specific rules.

Tax Rates and Exemptions Comparison

Inheritance tax rates vary by beneficiary relationship and state, ranging from 0% to 20%, with close relatives often receiving higher exemptions or lower rates. Estate tax applies at the federal level with a flat rate of 40% on amounts exceeding the $12.92 million exemption in 2023, while some states impose separate estate taxes with varying thresholds. Inheritance refers to the assets received, which may be subject to either tax depending on jurisdiction and relationship to the decedent.

Ways to Minimize Inheritance and Estate Taxes

To minimize inheritance and estate taxes, consider strategies such as gifting assets during your lifetime, using trusts to transfer wealth efficiently, and taking advantage of the annual gift tax exclusion. Implementing the unlimited marital deduction allows you to transfer assets to your spouse tax-free, significantly reducing your taxable estate. You can also benefit from the lifetime estate and gift tax exemption by coordinating your estate plan with tax professionals to optimize tax savings.

Frequently Asked Questions About Death Taxes

Inheritance tax applies to assets received by beneficiaries and varies by state, whereas estate tax is levied on the deceased's total estate before distribution, often exceeding federal thresholds around $12.92 million in 2023. Frequently asked questions about death taxes include who is responsible for paying, how exemptions and deductions work, and whether any states impose both taxes simultaneously. Understanding distinctions between federal estate tax, state inheritance tax, and probate taxes helps heirs plan effective strategies to minimize tax liabilities after death.

Infographic: Inheritance Tax vs Estate Tax

relatioo.com

relatioo.com