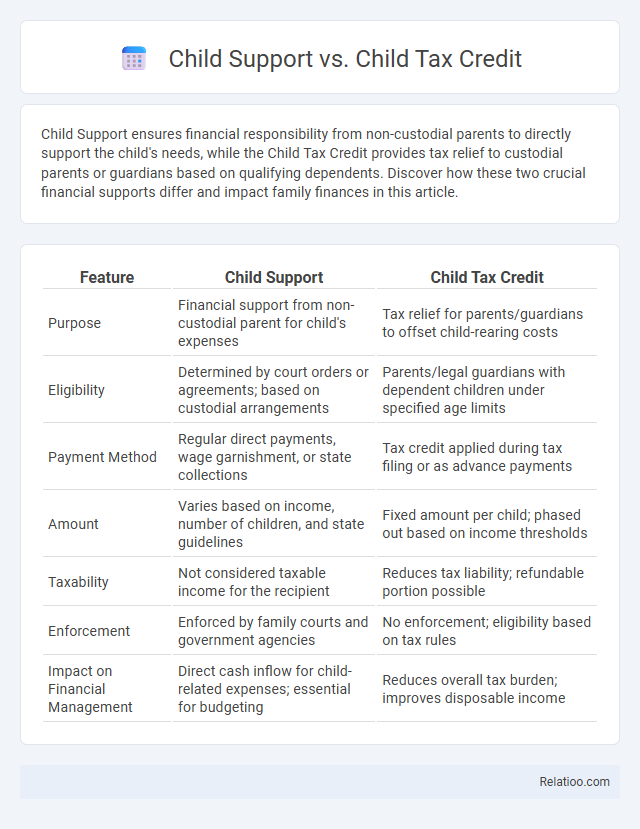

Child Support ensures financial responsibility from non-custodial parents to directly support the child's needs, while the Child Tax Credit provides tax relief to custodial parents or guardians based on qualifying dependents. Discover how these two crucial financial supports differ and impact family finances in this article.

Table of Comparison

| Feature | Child Support | Child Tax Credit |

|---|---|---|

| Purpose | Financial support from non-custodial parent for child's expenses | Tax relief for parents/guardians to offset child-rearing costs |

| Eligibility | Determined by court orders or agreements; based on custodial arrangements | Parents/legal guardians with dependent children under specified age limits |

| Payment Method | Regular direct payments, wage garnishment, or state collections | Tax credit applied during tax filing or as advance payments |

| Amount | Varies based on income, number of children, and state guidelines | Fixed amount per child; phased out based on income thresholds |

| Taxability | Not considered taxable income for the recipient | Reduces tax liability; refundable portion possible |

| Enforcement | Enforced by family courts and government agencies | No enforcement; eligibility based on tax rules |

| Impact on Financial Management | Direct cash inflow for child-related expenses; essential for budgeting | Reduces overall tax burden; improves disposable income |

Understanding Child Support: Definition and Purpose

Child Support is a legal obligation requiring a noncustodial parent to provide financial assistance for their child's living expenses, education, and healthcare, ensuring the child's well-being despite parental separation. Unlike the Child Tax Credit, which offers tax relief to eligible parents based on income and number of dependents, Child Support directly funds the child's daily needs through court-ordered payments. Understanding Your rights and responsibilities in Child Support helps secure consistent financial support, promoting stability and care for your child's development.

What is the Child Tax Credit?

The Child Tax Credit is a federal tax benefit designed to reduce the tax liability of eligible families with dependent children under 17 years old. Unlike child support, which is a court-ordered financial payment from a non-custodial parent to the custodial parent, the Child Tax Credit provides direct tax relief to families based on income and number of qualifying children. This credit can significantly offset the cost of raising children by lowering federal income taxes or providing a refundable amount for eligible taxpayers.

Key Differences Between Child Support and Child Tax Credit

Child support is a court-ordered payment made by a noncustodial parent to contribute to the expenses of raising a child, while the Child Tax Credit is a tax benefit provided by the government to eligible taxpayers to reduce their tax liability based on the number of qualifying children. Unlike child support, which directly funds a child's day-to-day needs, the Child Tax Credit offers financial relief through tax savings and may result in a refund. Child support obligations are legally enforceable and typically continue until the child reaches adulthood, whereas eligibility for the Child Tax Credit depends on income thresholds and filing status each tax year.

Eligibility Criteria for Child Support

Child support eligibility is typically determined by the court based on factors such as the parents' income, custody arrangements, and the child's needs. Unlike the Child Tax Credit, which requires you to meet specific income thresholds and have qualifying dependents, child support is a legal obligation primarily focused on ensuring financial support for the child's well-being. Your eligibility for child support depends on state laws, proof of paternity, and the establishment of custody or visitation rights.

Eligibility Requirements for Child Tax Credit

The Child Tax Credit eligibility requires that the child be under 17 at the end of the tax year, a U.S. citizen, national, or resident alien, and claimed as a dependent on the taxpayer's federal income tax return. Income limits apply: the credit begins to phase out for single filers with modified adjusted gross income (MAGI) above $200,000 and $400,000 for married couples filing jointly. In contrast, child support payments do not have income-based eligibility and are court-ordered financial obligations, while child tax credits directly reduce tax liability based on specific IRS criteria.

How Child Support Is Calculated

Child support is calculated based on factors such as the non-custodial parent's income, the custodial parent's income, the number of children, and the amount of time each parent spends with the children, with specific guidelines varying by state. The calculation often considers both parents' financial abilities to ensure fair contribution toward the child's expenses. This differs from the Child Tax Credit, which is a federal tax benefit designed to reduce tax liability for parents but does not affect the direct support payments determined in child support calculations.

Claiming the Child Tax Credit: Steps and Guidelines

Claiming the Child Tax Credit requires providing the child's Social Security number, ensuring the child is under 17 at the end of the tax year, and meeting income eligibility criteria, typically requiring earned income below specified IRS thresholds. Taxpayers must file Form 1040 or 1040-SR and complete Schedule 8812 to report and calculate the credit amount accurately. Unlike child support payments, which are received as regular financial assistance from a noncustodial parent, the Child Tax Credit directly reduces tax liability and is refundable up to the Additional Child Tax Credit limit, providing financial relief through annual tax filings.

Impact of Child Support Payments on Tax Credits

Child support payments do not affect eligibility for the Child Tax Credit, as these payments are considered private financial transactions between parents rather than taxable income or deductions. The Child Tax Credit is determined based on the custodial parent's income and number of qualifying children, independent of child support obligations. Noncustodial parents making child support payments cannot claim the Child Tax Credit, leaving the benefit solely with the custodial parent or guardian.

Frequently Asked Questions: Child Support vs Child Tax Credit

Child support and the child tax credit serve distinct purposes: child support ensures financial contributions from non-custodial parents for a child's living expenses, while the child tax credit provides tax relief to eligible families. Frequently asked questions often revolve around eligibility, with child support determined by court orders based on income and custody arrangements, whereas the child tax credit requires meeting specific IRS criteria such as income limits and filing status. Understanding that child support payments do not affect eligibility for the child tax credit helps clarify common misconceptions among parents and guardians.

Final Thoughts: Navigating Financial Support for Children

Child support ensures consistent monthly payments legally mandated to cover a child's basic needs, while the Child Tax Credit provides tax relief to eligible families, reducing their overall tax burden and increasing financial resources. Understanding the distinct roles of child support and child tax credits is crucial for maximizing financial assistance and securing a child's well-being. Effective navigation involves leveraging both child support enforcement mechanisms and tax benefits to optimize financial stability for children.

Infographic: Child Support vs Child Tax Credit

relatioo.com

relatioo.com